“Big tech companies have ‘mis-set’ expectations when it comes to AI,” Heltewig told TechCrunch.

According to one survey, over half of businesses have already invested in AI capabilities to support their customer service operations.

Per market research firm Markets and Markets, revenue in the market for call center AI alone is set to climb from $1.6 billion in 2022 to $4.1 billion by year-end 2027.

And it’s scalable; Cognigy manages AI agents that can handle up to tens of thousands of customer conversations at once.

Image Credits: Cognigy“Cognigy provides a platform to build, operate and analyze AI agents for customer experiences in the contact center,” Heltewig said.

ISAs are a technical spec at the foundation of every chip, describing how software controls the chip’s hardware.

In addition to building the chip, Rivos is working on self-contained data center hardware based on the Open Compute Project modular standard, which will effectively serve as plug-and-play chip housing.

Startups by the dozens, meanwhile, are angling for a slice of a custom data center chip market that could reach $10 billion this year and double by 2025.

Habana Labs, the Intel-owned AI chip company, laid off an estimated 10% of its workforce last year.

Kumar wouldn’t talk about customers, and Rivos’ chip isn’t anticipated to reach mass production until sometime next year.

Google Cloud on Tuesday joined AWS and Azure in announcing its first custom-built Arm processor, dubbed Axion.

Based on Arm’s Neoverse 2 designs, Google says its Axion instances offer 30% better performance than other Arm-based instances from competitors like AWS and Microsoft and up to 50% better performance and 60% better energy efficiency than comparable X86-based instances.

To be fair, though, Microsoft only announced its Cobalt Arm chips late last year, too, and those chips aren’t yet available to customers, either.

In a press briefing ahead of Tuesday’s announcement, Google stressed that since Axion is built on an open foundation, Google Cloud customers will be able to bring their existing Arm workloads to Google Cloud without any modifications.

“Through this collaboration, we’re accessing a broad ecosystem of cloud customers who have already deployed ARM-based workloads across hundreds of ISVs and open-source projects.”More later this year.

“And the product was electricity.”He was comparing this — turning raw material into something else that have value — to the notion of data centers, which are purely money pits.

“There’s a new Industrial Revolution happening in these [server] rooms: I call them AI factories,” Huang said.

“The raw material that goes in is data and electricity.

It’s very valuable.”The distinction makes a lot of sense in a world where Nvidia benefits tremendously if it can persuade companies to think of data centers and AI tools in a different way.

“The last time, data centers went into your company’s cost centers and capital expenditure.

Jonathan Winer, the co-founder and co-CEO of SIP, said that the first three data centers designed using Verrus’ architecture will be located in Arizona, California and Massachusetts.

(Alongside the new business, SIP is also launching the Data Center Flexibility Initiative to bring stakeholders like energy companies, tech giants and regulators together in the meantime.)

Observing the strain that data centers in particular have on the electrical grid, SIP turned its attention to those data centers themselves.

Simply building more data centers, whether run by third-party data center operators or by the hyperscalers themselves, will not keep up with demand.

As SIP sees it, simply adding more data centers — which has been the approach up to now — is not a sustainable approach longer term.

That’s where Codified, an early stage startup that was nurtured last year inside venture capital firm Madrona Ventures, comes into the picture.

The company was built from the ground up from a data veteran with an eye toward solving the data compliance problem, and today it announced a $4 million seed round.

Company founder and CEO Yatharth Gupta sees that data is at the center of today’s technology, yet companies struggle to control access to it.

Both jobs, he says, were heavily involved in data and he saw the kinds of problems he’s trying to solve with Codified.

Investors in today’s round include Vine Ventures, Soma Capital and Madrona Venture Labs where Codified incubated last year.

When the large cloud providers have excess compute capacity, they tend to discount it through programs like AWS’s and Azure’s spot instances.

While in the recovery room, Surkov shared his idea for a company that would make this excess data center capacity available to developers.

Because of his experience with networking at Cisco and decentralized systems in crypto, Surkov had become interested in why there is so much friction in using decentralized compute.

In addition to these decentralized projects, NodeShift has also set up deals with independent data center operators.

Just on the data center side, the company says, it currently has access to about 400,000 CPUs and 28 million terabytes of storage.

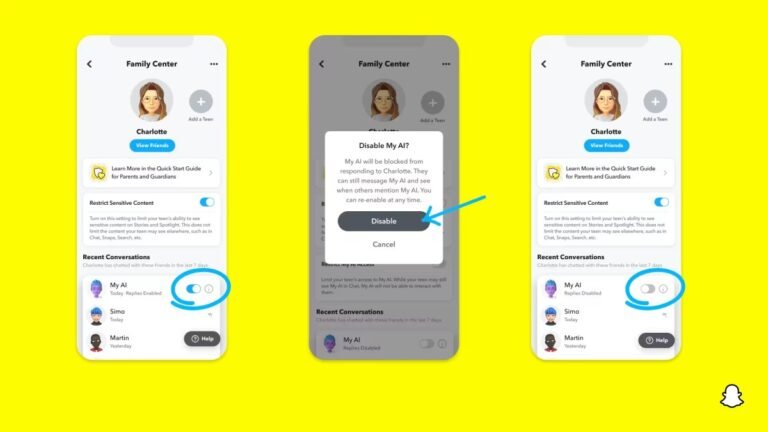

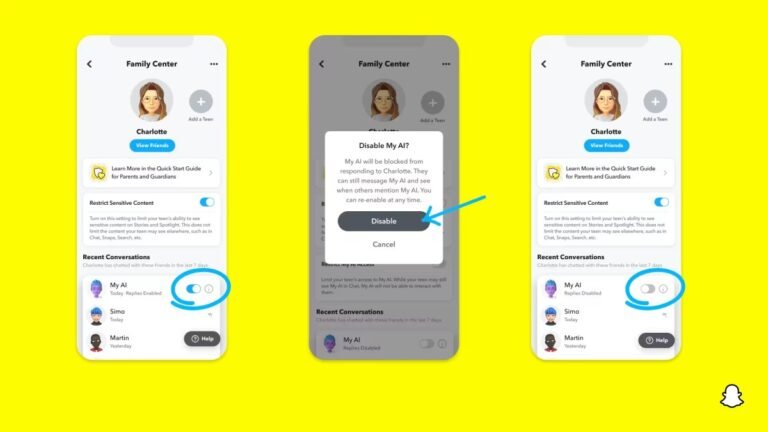

Snapchat is introducing new parental controls that will allow parents to restrict their teens from interacting with the app’s AI chatbot.

The changes will also allow parents to view their teens’ privacy settings, and get easier access to Family Center, which is the app’s dedicated place for parental controls.

Parents can now restrict My AI, Snapchat’s AI-powered chatbot, from responding to chats from their teen.

As for parents who may be unaware about the app’s parental controls, Snapchat is making Family Center easier to find.

Parents can now find Family Center right from their profile, or by heading to their settings.

Arkon Energy, a data center infrastructure company, closed a $110 million private funding round to expand its operations, the company’s CEO Josh Payne shared exclusively with TechCrunch.

“These sites appeal to both bitcoin miners and AI [or] machine learning clients who have very high power computing demands,” Payne said.

“We are essentially a landlord who owns the underlying infrastructure assets.”Arkon’s business model focuses on strategically acquiring distressed data center assets across the globe.

“The current and future demand for data center capacity of all types that we are seeing globally, but especially in the U.S., is unprecedented and monumental.

Arkon aims to fill that gap by providing the underlying infrastructure layer that the AI sector relies on.

Akron Energy, a data center infrastructure company, closed a $110 million private funding round to expand its operations, the company’s CEO Josh Payne shared exclusively with TechCrunch.

“These sites appeal to both bitcoin miners and AI [or] machine learning clients who have very high power computing demands,” Payne said.

“We are essentially a landlord who owns the underlying infrastructure assets.”Akron’s business model focuses on strategically acquiring distressed data center assets across the globe.

“The current and future demand for data center capacity of all types that we are seeing globally, but especially in the U.S., is unprecedented and monumental.

Akron aims to fill that gap by providing the underlying infrastructure layer that the AI sector relies on.