Midas, a fintech startup that allows people in Turkey to invest in U.S. and Turkish equities, says it has raised $45 million in a funding round led by Portage Ventures of Canada.

The startup is aimed at Turkey’s retail investor market and claims to have more than 2 million users.

That’s in a country of 80 million,” Egem Eraslan, CEO and founder of Midas, told TechCrunch.

The company has plans to expand beyond Turkey, and aims to target countries in the MENA region.

Globally, Portage invests in transformational financial technology and Midas is poised to lead that initiative in a region of early adopters.”

It’s been more than a minute since Tesla went public, but the EV company was inescapable on TechCrunch this week.

From layoffs to pricing changes and more, it was a week dyed deeply in Tesla colors so we had to chat through the latest.

But that was just one element of what we got into on Equity this week.

We also dug into Mary Ann’s reporting about Ramp’s latest round — and up valuation — that fit neatly next to Rippling’s own impending fundraise.

Equity is back tomorrow with a special interview between Mary Ann and Notable Capital’s Hans Tung, so stay tuned!

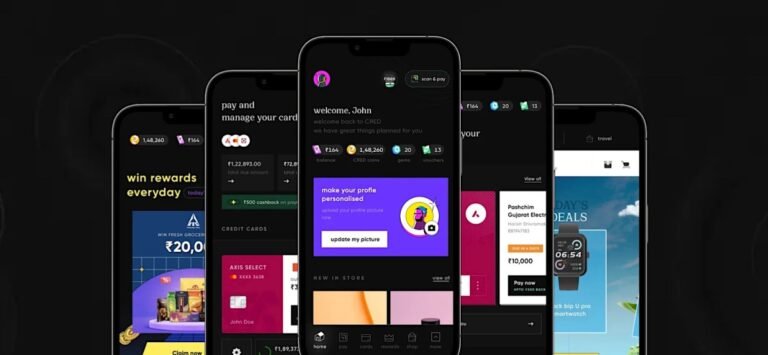

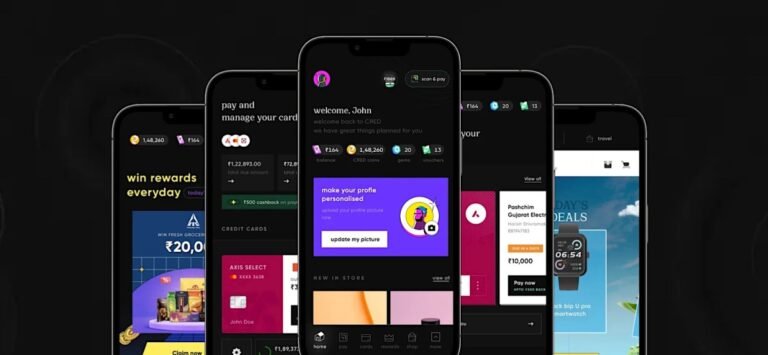

CRED has received the in-principle approval for payment aggregator license in a boost to the Indian fintech startup that could help it better serve its customers and launch new products and experiment with ideas faster.

The RBI has granted in-principle approval for payment aggregator licenses to several companies, including Reliance Payment and Pine Labs, over the past year.

Typically, the central bank takes nine months to a year to issue full approval following the in-principle approval.

Without a license, fintech startups must rely on third-party payment processors to handle transactions, and these players may not prioritize such mandates.

Obtaining a license allows fintech companies to process payments directly, reduce costs, gain greater control over payment flow, and onboard merchants directly.

Business banking startup Mercury, founded in 2020, is now launching a consumer banking product.

“We already have a few hundred thousand users of our business banking product, and a lot of people have expressed that they want a personal banking product,” he told TechCrunch in an interview.

The person also said the fintech partner banking market as a whole has been the target of more regulatory scrutiny.

Crossing overBut success in B2B banking doesn’t automatically queue up Mercury to handle consumer banking.

Sign up for TechCrunch Fintech here.

Inside LemFi’s play to be fintech to the Global South diaspora First, the Nigerian startup focused on migrants from Africa.

These events spotlight the company’s growing influence in Africa’s remittance market, fuelled by a $33 million Series A funding round and the launch of services in the U.S. corridor, both announced last August.

LemFi later expanded to serve other African diaspora communities in the country before entering the U.K. market in 2021 by acquiring RightCard for $2.5 million.

Additionally, Daiyaan Alam, formerly leading partnerships at Delivery Hero subsidiary Foodpanda in Pakistan, is spearheading LemFi’s expansion efforts into Pakistan and South Asia.

They join Allen Qu, former COO at Chinese-backed African fintech OPay, who leads the fintech’s growth among the Chinese diaspora.

Welcome to TechCrunch Fintech!

This week, we’re looking at how two fintech companies serving the underserved are faring, and more!

The big storyPayJoy is an example of a company with positive unit economics and a mission to help the underserved.

It last raised a $50 million Series C funding round in 2021.

And with fintech funding on the decline, this could perhaps partly explain YC’s lack of LatAm interest.

When it comes to news items that we love at TechCrunch, IPOs rank pretty darn high.

Another great newsy bit that comes along less frequently than we’d like is a startup buying another startup.

These deals are often very interesting as they either bring a gob of talent, or technology to an already growing company, potentially accelerating it.

So it was with joy that the Equity Podcast crew dug into Automattic buying Beeper for $125 million.

But certainly we are an ocean or two away from the heady days we saw back in 2021.

Welcome to TechCrunch Fintech!

One thing that stood out to me was just how much fintech representation in their cohorts is shrinking.

So there was one-third the percentage of fintech companies this year compared to two years ago.

Analysis of the weekFintech funding slid by 16% quarter-over-quarter during the three-month period ended March 31, according to CB Insights’ Q1 2024 State of Venture Report.

During the three-month period, 904 investments were made into fintech startups, which was higher than 786 in the previous quarter, signaling smaller deal sizes.

The cross-border payments market is forecasted to reach over $250 trillion by 2027, according to the Bank of England.

So it’s no surprise that one of the trends among Y Combinator’s Winter 2024 batch of nearly 30 fintech startups is how to more easily move money globally.

Users get a U.S. bank account and access to low-cost local payment rails.

InfinityWhat it does: Cross-border banking for small businesses in IndiaWe heard from a lot of childhood friends during the past two days, so it was refreshing to see two siblings form a company.

Businesses in India account for $700 billion in cross-border trades per year, and Infinity makes 1% from those transactions.

When it comes to funding, the fintech sector didn’t have a very good start to the year.

Fintech funding slid by 16% quarter-over-quarter during the three-month period, according to CB Insights’ Q1 2024 State of Venture Report.

But even more troubling than the double-digit dip was the fact that the $7.3 billion raised globally by fintech startups in the three-month period marked the lowest level the sector has seen since early 2017, according to the report.

During the three-month period, 904 investments were made into fintech startups.

Dollars raised and deal count is also down compared to the fourth quarter of 2023, when 786 fintech startups raised $8.7 billion.