Oakland-based Silvergate Capital Corp. announced Wednesday its intent to wind down operations and voluntarily liquidate the banking unit, which was one of the first banks to offer services related to cryptocurrency. The decision comes as the company sees slow growth in deposits and an increase in delinquent loans, signaling that cryptocurrencies are not a viable long-term investment. Despite these challenges, Silvergate remains committed to helping its clients find innovative ways to use cryptocurrencies and blockchain technology.

With crypto prices continuing to plummet and institutions shunning the space, it is clear that this fledgling industry is still struggling to find its feet. However, some stalwart institutions are still working hard to provide innovative services for their clients, even if it comes at a cost.

The bank’s sudden decline in deposits could be linked to the overall cryptocurrency market crash of 2022. With prices falling, most people may have been less willing to risk their money in a relatively new and volatile field.

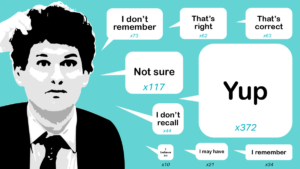

Silvergate executives staunchly maintained that their company’s investment in FTX was only small, and its exposure to the exchange was negligible. However, the company’s collapse would ultimately prove them wrong. Silvergate was heavily exposed to FTX – after investing $30 million in the digital asset exchange – and as a result of its collapse, investors lost an estimated $175 million.

While Silvergate has no outstanding loans to or investments in FTX, the company does have a relationship with FTX when it comes to deposits. This is likely due to the fact that FTX is a digital asset custodian, which helps protect Silvergate’s bitcoin-collateralized SEN Leverage loans.

It appeared that Silvergate was caught up in a government crackdown on fraudulent companies. However, the government looked elsewhere and left Silvergate to fail. This left the company with debt and little hope of recovering from its previous mistakes.

The shut down of Silvergate will have a significant impact on how money moves in and out of the crypto world. On March 3, the bank announced it would discontinue the Silvergate Exchange Network (SEN), its crypto payments network that enabled dollar transfers between investors and crypto exchanges 24/7. This makes it very difficult for financial institutions to touch cryptocurrencies; most are not comfortable with their volatility. Consequently, this will severely limit the growth of this budding industry.

Silvergate’s customers are getting their deposits back, but the company is still facing financial difficulties. The company has been struggling to keep up with its payment obligations and has even had to suspend some of its services.

Silvergate believes the best path forward for the Bank is a voluntary liquidation and repayment of all deposits. This will ensure that its customers are satisfied, while preserving the residual value of its assets.