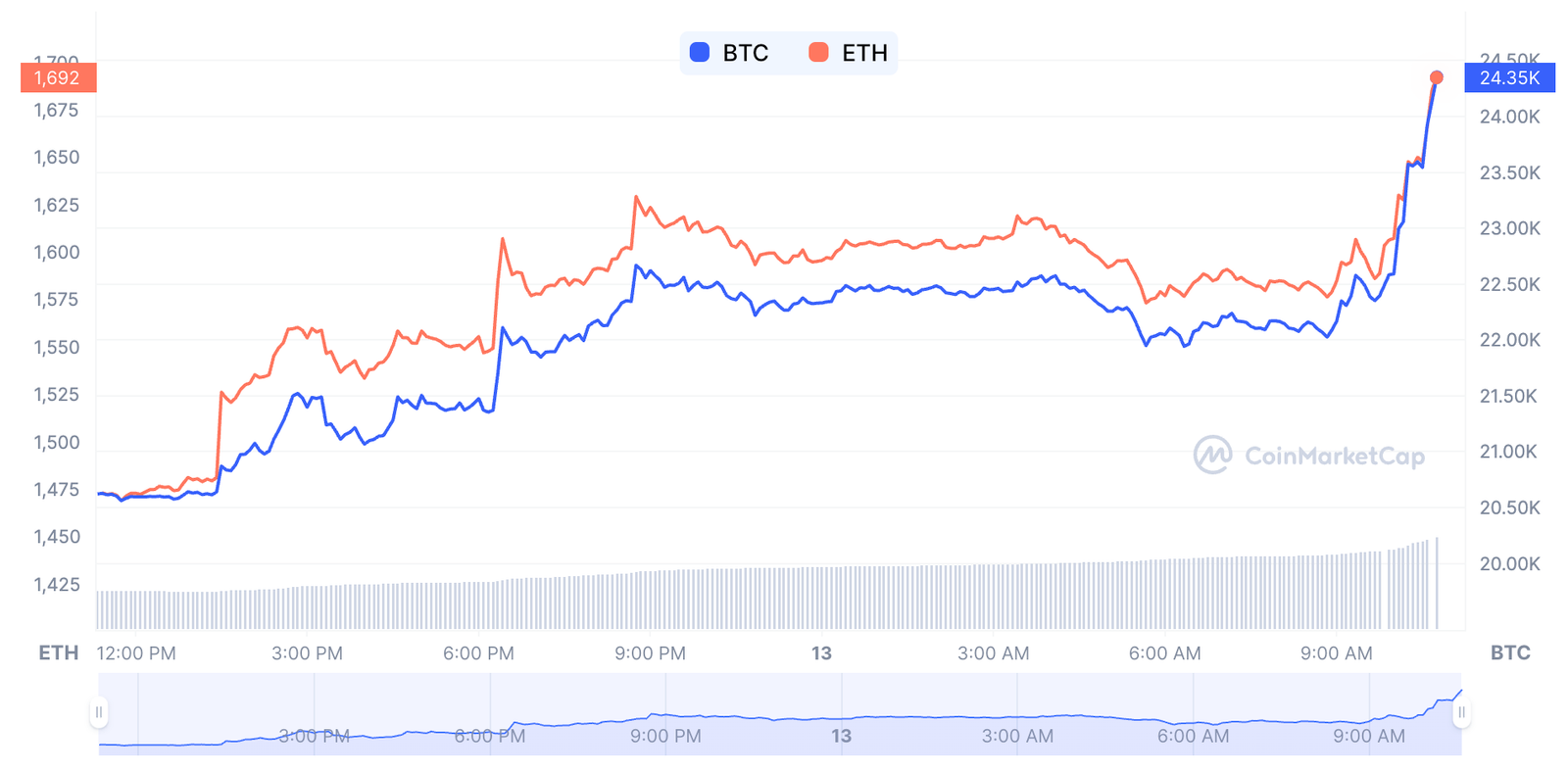

Over the weekend, it was reported that the U.S. government planned to protect Silicon Valley Bank and Signature Bank depositors from any financial losses in the event of a failure by the banks. As a result, major cryptocurrencies like Bitcoin and Ethereum rose in value Monday morning.

The Federal Reserve issued statements on Sunday stating that Silicon Valley Bank’s depositors, both insured and uninsured, will receive help in a manner that will “fully protect” their deposits. The bank has been closed since September 17 due to a financial crisis and numerous complaints from customers about the poor condition of their accounts. The Fed stated that all depositors would be treated equally, regardless of whether or not they were insured by the Federal Deposit Insurance Corporation (FDIC).

Although there is still a risk of a banking contagion, it is not zero as the start of the week was lower than last Friday. This means that some banks have started to recover from their issues, but others may still need time to get back on their feet.

Bitcoin and other crypto assets continue to surge in value as global market participation continues to grow. The overall crypto market now stands at over $1 trillion, with bitcoin alone worth over $280 billion. This news has sparked renewed optimism among investors, who seem to be betting on the long-term potential of cryptocurrencies. While there are still plenty of unknowns surrounding the space, investors are sticking around despite the heightened volatility.

Bitcoin and ether prices are rising due to increasing worldwide demand for digital tokens. Bitcoin has been gaining popularity as a preferred payment method for online transactions, while ether is becoming more commonly used to purchase cryptocurrencies and other digital assets.

Cryptocurrencies are becoming more and more popular, with each new coin being released into the market. No one knows for certain how long this trend will continue, but for now, investors are eager to get in on the action.

The cryptocurrency USDC, which is the second largest stablecoin, appears to be recovering after its announcement that deposits would be protected.

The collapse in the price of USDC raises questions about the trustworthiness of its issuer, which has already been struggling to maintain credibility. The depegging experiment shows that there is a demand for a stablecoin that is independent from the fiat currency markets, indicating that there is an issue with current Fiat-based stablecoins.

Monday morning, Circle announced that the reserve risk had been “removed” and that their newly available funds would be used to build new products. This news comes as a major relief to investors who were concerned about the company’s viability. With this new influx of capital, Circle is now in a much stronger position to continue growing its business and innovating in the cryptocurrency space.

Circle is taking a proactive approach to mitigating risk by ensuring that all USDC in circulation are 1:1 redeemable for fiat currency. This is important given the current bank contagion affecting cryptocurrency markets.

USDC, the cryptocurrency designed to serve as a enabling instrument for global liquidity and settlement, is seeing modest volume growth in the wake of sanctions relief being announced by the US. The market cap of USDC remains relatively small at $40.5 billion but with daily traded volume of $10.9 billion it is seeing some healthy movement overall.

The crypto market had a volatile week as one of the largest banks to provide services to crypto companies, Silvergate Capital, shared that it was winding down operations and liquidating its banking division. This caused several cryptocurrency prices, such as Bitcoin and Ethereum, to drop significantly. However, this may not be the end for cryptocurrencies as other large companies are beginning to understand the potential of these digital assets.

Shortly after, Silicon Valley Bank collapsed on Friday, and Signature Bank, a major crypto lender, was shut down by regulators on Sunday. As a result of these closures, many traders and investors lost their money as well as their trust in the crypto market. This news has significant implications for the future of crypto lending and cryptocurrency investment.

Many traders are evidently bullish on cryptocurrencies in the wake of the market turmoil, as the overall market cap rose by 1.3% on Monday. With China’s crackdown and ongoing investigation into bitcoin and other virtual currencies, some believe that this news has propped up prices and may continue to do so for a while.