The news of Circle Holdings joining the ranks of crypto-centric firms that have filed for Chapter 11 bankruptcy casts a pall over the burgeoning digital currency marketplace. The company, which facilitated trades between bitcoin and other digital currencies, reported losses of $40 million in its most recent fiscal year. Its collapse raises questions about whether the bulk of cryptoassets are backed by anything resembling real value and leads some to assert that more firms will likely follow suit in the near future.

The announcement from Silvergate Capital comes as a surprise to many in the crypto community, as the bank had been doing well by providing services such as digital asset custody and lending to crypto businesses. This decision may signal that the industry is still in its early stages and that there are too few reliable financial institutions available for investors.

The reports of a massive crypto meltdown have caused many investors to lose faith in the $137 billion market, with some firms botching attempts at liquidating assets and exiting the industry altogether. The California-based firm, which had sold off assets at a huge loss just two months ago in an effort to cover over $8 billion in withdrawals, has now lost even more money.

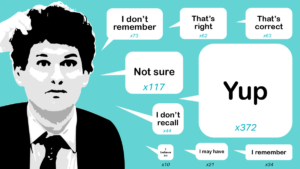

The abrupt closure of UK-based cryptocurrency exchange, FTX, has thrown the cryptocurrency industry into a state of uncertainty. The exchange was accused of money laundering and fraud and its closure has raised concerns about the safety of transactions conducted in bitcoin and other cryptocurrencies. Banks have been reluctant to get involved in the cryptocurrency market, fearing that they will become targets for criminals. However, some banks are starting to explore opportunities in the cryptocurrency market. Coincover is one such company that is developing products to help banks store their digital assets securely.

The exodus of institutional investors from the crypto space marks the end of an experiment for many in the industry. While it may have been a short-lived success for those who participated, it is clear that the infrastructure necessary to accommodate these investors simply does not exist yet. As a result, this trend only confirms the need for greater regulation and oversight in an attempt to protect misguided investors fromopotentially losing huge sums of money.

The state of the crypto ecosystem seems to be shaky, with more providers disappearing. This could have serious consequences if it continues, as the market would become much less diverse and efficient.

Very interesting information!Perfect just what I was

looking for!Raise blog range