Stock-trading platform Robinhood is diving deeper into the cryptocurrency realm with the acquisition of crypto exchange Bitstamp.

With Bitstamp under its wing, Robinhood says that it will be better positioned to target retail and institutional crypto investors across Europe, Asia, and the U.S., with Bitstamp currently holding more than 50 licenses and registrations to operate in these markets.

“The acquisition of Bitstamp is a major step in growing our crypto business,” Robinhood’s crypto general manager Johann Kerbrat said in a statement.

“The Bitstamp team has established one of the strongest reputations across retail and institutional crypto investors.

Through this strategic combination, we are better positioned to expand our footprint outside of the U.S. and welcome institutional customers to Robinhood.”

A crypto wallet maker claimed this week that hackers may be targeting people with an iMessage “zero-day” exploit — but all signs point to an exaggerated threat, if not a downright scam.

Trust Wallet’s official X (previously Twitter) account wrote that “we have credible intel regarding a high-risk zero-day exploit targeting iMessage on the Dark Web.

According to Apple, there is no evidence anyone has successfully hacked someone’s Apple device while using Lockdown Mode.

For its part, CodeBreach Lab appears to be a new website with no track record.

TechCrunch could not reach CodeBreach Lab for comment because there is no way to contact the alleged company.

Shakeeb Ahmed, a cybersecurity engineer convicted of stealing around $12 million in crypto, was sentenced on Friday to three years in prison.

In a press release, the U.S. Attorney for the Southern District of New York announced the sentence.

Ahmed was accused of hacking into two cryptocurrency exchanges, and stealing around $12 million in crypto, according to prosecutors.

While the name of one of his victims was never disclosed, Ahmed reportedly hacked into Crema Finance, a Solana-based crypto exchange, in early July 2022.

In the case of Nirvana Finance, the stolen funds “represented approximately all the funds possessed by Nirvana,” which led Nirvana Finance to shut down, according to the press release.

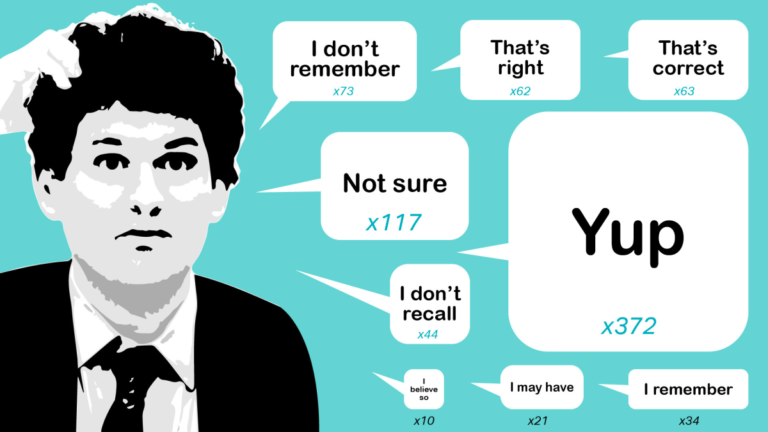

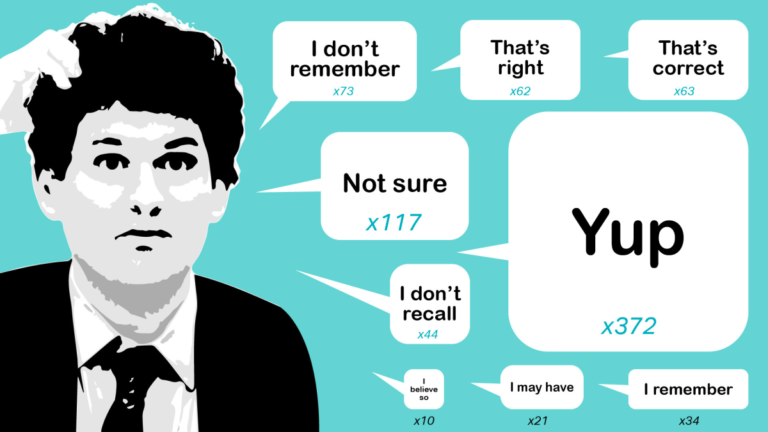

After a lengthy trial and conviction, we finally learned how long former crypto baron Sam Bankman-Fried will be behind bars: up to 25 years.

It’s a lengthy sentence, but one that given the scale of the crimes he was convicted of, doesn’t come as a shock.

For the crypto industry, it’s also the final page in a chapter that many may want firmly behind them.

After all, we’re out of the last crypto winter and are back in a period of rising token prices, growing trading volume, and hints of the prior excitement that web3 commanded during the last asset bubble.

Still, before we fully wrap up our coverage of SBF and his erstwhile empire, it’s worth taking one last trip down memory lane to cement in our minds how we wound up with a former venture and political darling not in the dock, but behind bars.

Nearly everything else that’s being built on or enabled by blockchains replaces something that’s already being done fairly well.

Yes, there are companies that facilitate crypto trades like Coinbase and Block (formerly Square).

But there’s no actual company that’s developed economic value by doing something brand new or better on a blockchain.

Energy drives the real-world economy, and unless Sam Altman or somebody successfully unlocks fusion and delivers energy that’s truly “too cheap to meter,” it’s going to remain a real asset with real value for some time.

In fact, it wouldn’t surprise me in the least if Satoshi had some kind of connection to the energy industry.

SBF sentenced, Worldcoin hit with another ban order and big web3 pre-seed rounds are backWelcome to TechCrunch Crypto, formerly known as Chain Reaction.

This week in web3Crunching numbersThis week the crypto market prices were a bit more chipper, with the top cryptocurrencies being green on the week.

The second-largest crypto, ether, increased 2.6% on the week to $3,550, according to CoinMarketCap data.

Zero-knowledge proofs are a cryptographic action used to prove something about a piece of data, without revealing the origin data itself.

Scott and I discuss Space and Time’s origin story, how data warehouses work in Web 2.0 versus web3 and the importance of data transparency.

Earlier this month, U.S. prosecutors from the Department of Justice called for a “necessary” 40 to 50-year sentence for him.

Prior to its collapse, FTX was one of the top crypto exchanges by volume, behind Coinbase and Binance.

Bankman-Fried testified that he didn’t defraud FTX customers or use their funds, but that Alameda “borrowed” that capital from the exchange.

Prosecutors strongly argued Bankman-Fried made a number of false promises internally and externally and was responsible for the loss of billions of dollars for thousands of FTX investors.

And as a result, Bankman-Fried will be spending quite some time behind bars.

Hello, and welcome back to Equity, a podcast about the business of startups, where we unpack the numbers and nuance behind the headlines.

This is our Monday show, in which we look back at the weekend what’s ahead in the week before us.

Over in the EU, a number of U.S.-based tech companies are under inquiry thanks to the new Digital Markets Act.

At some point, you have to wonder if tech giants are going to find a better working relationship with the bloc.

Equity drops at 7 a.m. PT every Monday, Wednesday and Friday, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts.

Welcome to TechCrunch Crypto, formerly known as Chain Reaction.

Hello and welcome back to the TechCrunch Crypto newsletter.

This week in web3Crunching numbersThis week the crypto market prices were lower, but still relatively strong compared to previous months.

Bitcoin was down 6.5% on the week at $67,300 and 32% higher on the month, at the time of publication.

This kickstarted her career in web3, data and AI solutions.

Rails, a decentralized crypto exchange, has raised $6.2 million in attempts to fill the void FTX left behind after crashing in 2022, the startup’s co-founder and CEO Satraj Bambra exclusively told TechCrunch.

The crypto community is watching Rails because it’s attempting to straddle the divide in crypto exchanges by building out both centralized and decentralized underlying technology.

The capital is earmarked for engineering team hiring and expanding its licensing and regulatory strategy to make the exchange “fully compliant,” Bambra said.

That centralized computing was something Rails saw with FTX as “being really, really good,” but when it came to decentralized exchanges like dYdX that exist today it wasn’t as solid, Bambra thinks.

But being a hybrid of decentralized and centralized is better than being fully one side or another, he added.