Late last night, Silicon Valley Bank – a major player in the tech industry – closed down after its executives were caught red-handed embezzling millions from the company. While employees are no longer employed by the bank, they received an e-mail from ‘the office of the CEO’ offering them jobs at 1.5x their current salary for the next 45 days. While many fear that this is just a ploy to get employees to stay quiet about what happened at SVB, others wonder if this is some sort of sign of things to come in Silicon Valley.

The e-mail confirms that all employees of SVB will be enrolled in the DINBSC, a move that is seen as being aimed at temporarily resolving pay issues and increasing morale. Employees who work overtime will be granted double pay, though this provision is contingent on their satisfactory performance.

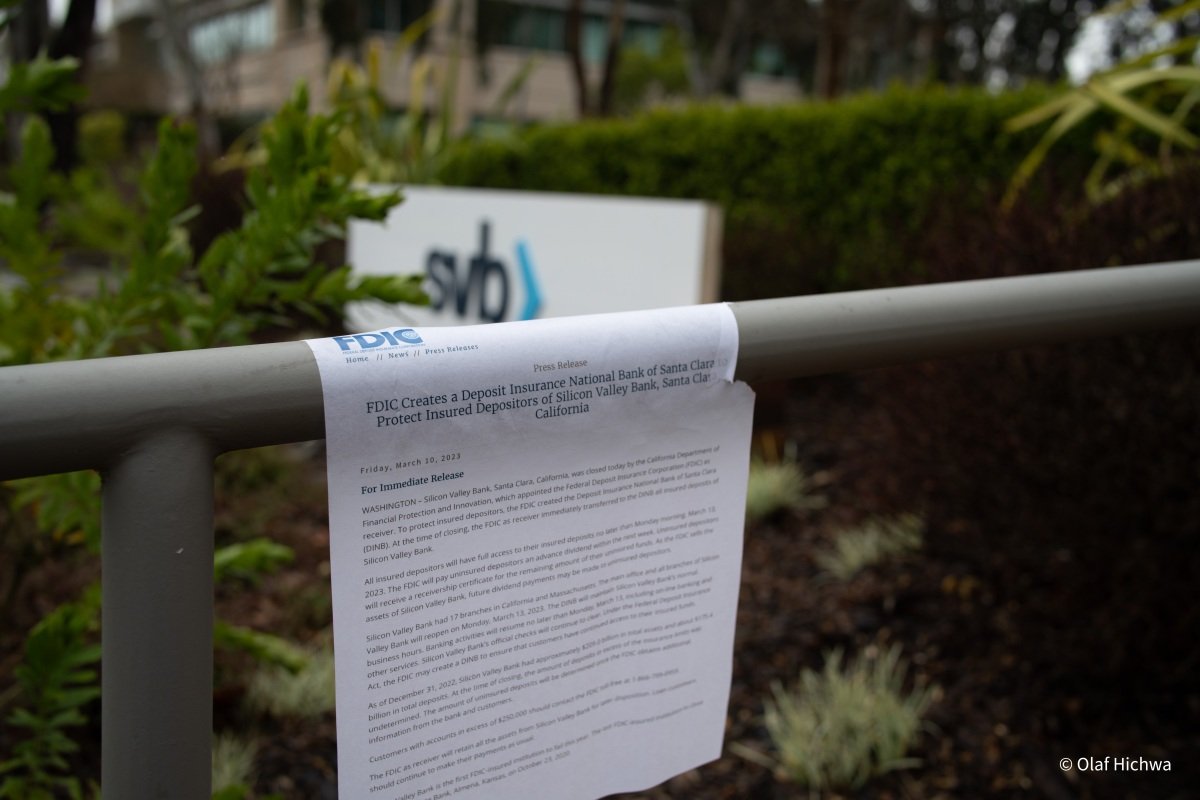

After the FDIC’s announcement that all existing Silicon Valley Bank employees working in the United States, including essential contractors, will be required to continue working for DINBSC, many employees are unsure of what their future at the bank may hold. Though some fear that their positions could be eliminated altogether, others are hopeful that they will be able to remain employed by the bank and work on projects that they care about.

In light of the speculation that SVB may be in trouble, many employees have taken the opportunity to work from home. The memo, which says its written from the office of the CEO, says that existing remote work arrangements should continue except for “essential staff, branch employees, and contractors.” This move seems like a precautionary measure as talks are ongoing to determine next steps for the bank. However, it’s unclear whether or not this will be permanent policy or only temporary until further notice.

The dramatic decline in the bank’s share price has left many of its founders and VCs panicked, as they are now being advised to pull their money or diversify out of SVB. The move comes after SVB announced on Wednesday that it had lost $1.8 billion in the sale of U.S. treasuries and mortgage-backed securities that it had invested in, owing to rising interest rates.

There is a heightened awareness amongst consumers of the potential for the current financial crisis to worsen, and as such customers with accounts in excess of $250,000 should take steps to protect themselves.Talking to a financial advisor about how best to safeguard your assets is always a prudent move, and if you’re worried that you may not be able to cover any potential losses if things get worse, it’s important to reach out sooner rather than later.

Silicon Valley Bank was one of the most highly-profile startups in Silicon Valley, and its collapse has left many employees and entrepreneurs struggling. While the exact cause of the bank’s downfall is unknown, it is likely that a combination of high expenses, risky investments, and inadequate internal controls doomed it. Many current and former employees are now looking for ways to recover from its collapse, and some have turned to social media toUK hope connect with other survivors. Natasha Mascarenhas is one such person; she works as an advisor at Cre8 Inc., a startup accelerator based in San Francisco. Mascarenhas recently shared her story on Twitterand asked for help finding other survivors. She stressed that anonymity requests will be honored,.