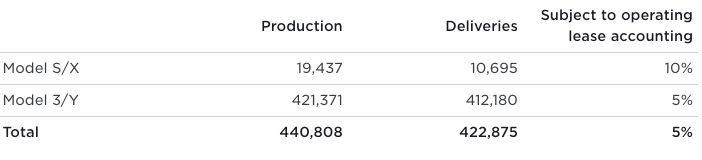

Tesla’s deliveries for the first quarter of 2023 were much higher than Wall Street expectations, with the company producing 440,808 vehicles in comparison to 420,000 units delivered. Tesla has been neck and neck with competitors Mercedes-Benz and General Motors in terms of electric vehicle sales; however, it is still far behind its biggest competitor – Ford. Tesla’s delivery total for the first quarter was a significant increase from the fourth quarter of 2021 when it delivered 320,881 vehicles. Despite this increase in production and sales numbers, Wall Street experts are doubtful that Tesla will be able to maintain this level of performance over time given their high expenses.

Tesla’s production numbers in the fourth quarter of 2022 were not meeting Wall Street’s expectations, but Tesla still delivered 405,278 units. Tesla is still dominating the market when it comes to electric vehicle production.

The Tesla Model 3 is a popular car for delivery in China, as it offers competitive prices and attractive features. This has contributed to an increase of deliveries from the automaker in China this year, despite price cuts being issued elsewhere in the world. This suggests that growing demand for Teslas in China is helping to bolster global sales numbers.

Tesla’s latest deliveries from China are more than 50% of Q1 deliveries. This could be largely due to the fact that Tesla only sells its cars in China through its own stores, but it could also be a sign that Tesla is gaining ground in the Chinese market.

Tesla’s Q1 delivery and production numbers show continued momentum in the company’s overall growth trajectory. Delivery figures topped 2,000 cars for the first time ever, and production reached 52,600 vehicles -an all-time quarterly high. In addition to strong sales results, Tesla also announced that it is investing $2 billion in its solar roof product line and

Notably, Tesla is not the only carmaker looking to take advantage of the cheaper Chinese yuan. Rivals like Xpeng and Nio have also begun discounting their prices in order to compete with Tesla’s cars, which are now up to 14% cheaper than last year. The Chinese market is crucial for Tesla due to its large population and growing consumer base. If the company can continue to reduce prices while also improving its bottom line, it could position itself as a major player in China’s automotive market.

Tesla has been engaged in a price war with its key rivals over the past several months. The automaker slashed prices for Model Y and Model 3 vehicles in the U.S., Mexico, and Europe by up to 20%, and Model X and Model S vehicles by up to 9%. Tesla also relaunched its European referral program last week in an attempt to increase sales before the end of this quarter.

Tesla’s successful quarterly production and delivery results had investors wondering what the company could do next to ensure sustained growth. CEO Elon Musk has already mentioned plans to increase production of the Model 3, which has been a challenge for Tesla.

Echoing the concerns of many investors, CEO Elon Musk overhauled Twitter last month, posting a series of incendiary messages regarding production goals for Tesla’s Model 3. For some shareholders this signaled that demand for the electric car might be weakening and contributed to Tesla’s share price decline at the end of 2022. However, discounts offered to consumers across markets could still indicate healthy demand, despite increased scrutiny by Wall Street.

Elon Musk’s assurances to investors at the start of 2018 that Tesla’s production and demand were still outpacing each other led to skepticism among some analysts. Even though the company acknowledged that price decreases and general inflationary environment might affect its short-term automotive margins, it said its higher goal was operating margin. In Q4 2022, Tesla reported an operating margin of 31%. This suggests that while product demand may drop from time to time, Tesla is still able to maintain profitability through cost-savings measures like automation and economies of scale.

Tesla’s stock price has been decreasing significantly in the past few months, most likely due to concerns over the cost of production and future sales. The company is stillexpected to remain ahead of the long-term 50% compound annual growth rate, but investors are concerned about Tesla’s ability to maintain this pace.