Uber has slyly been testing out a fresh pricing feature in over a dozen cities in India, a strategic move that could potentially broaden its customer base in the South Asian nation and put pressure on competing ride-hailing platforms, including Ola and InDrive.

The new service, coined Uber Flex, made its debut in India last year in October and has since expanded to more than 12 cities such as Aurangabad, Ajmer, Bareilly, Chandigarh, Coimbatore, Dehradun, Gwalior, Indore, Jodhpur and Surat, among others, according to an exclusive report from TechCrunch. A Uber spokesperson has verified that the flexible pricing service has indeed expanded.

“We are currently running a pilot of this feature in select Tier 2 and 3 markets in India,” said the Uber spokesperson in an email response to TechCrunch.

The new service, initially introduced for cabs but later extended to auto-rickshaw rides, enables riders to offer a bid for a specific fare for their ride. This is starkly different from Uber’s conventional dynamic pricing model, which fluctuates based on the supply and demand and traffic in a particular region.

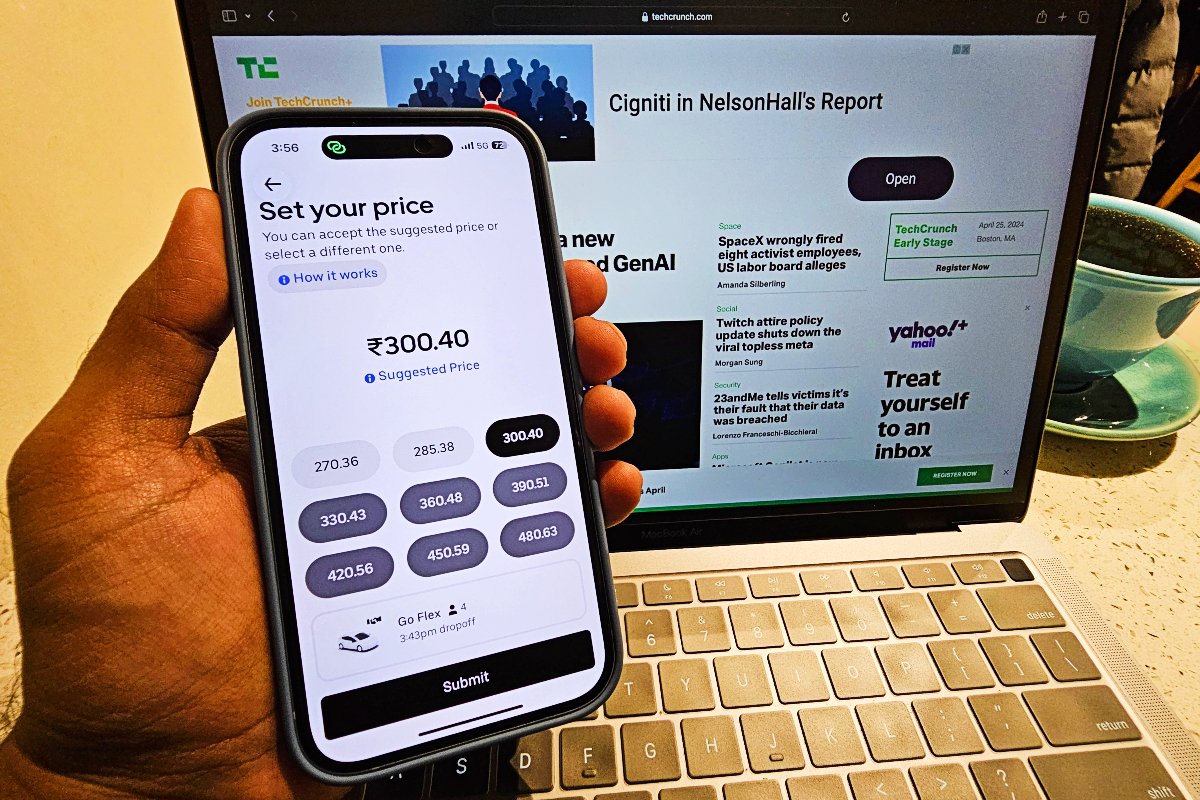

Uber Flex utilizes nine pricing points with a default fare already selected, providing riders with the option to pick a fare of their choice that will later be shared with nearby drivers. Based on this fare, the drivers can either accept or decline the ride.

- Flexible pricing service is called Uber Flex

- Launched in India in October last year

- Currently available in over 12 cities

- Drivers can bid for specific fare

- Utilizes nine pricing points

- Offered for different modes of transportation

In contrast, Uber’s rival, InDrive, which operates in multiple Indian cities, allows riders to negotiate the fare by manually entering a particular price for their ride. However, many InDrive drivers have expressed dissatisfaction with passengers offering extremely low fares for their rides. InDrive has yet to address this issue and has instead highlighted its “unique approach” that allegedly guarantees fair compensation for drivers while still providing affordable and high-quality ride-hailing services to passengers.

“By offering drivers the option to make counterbids to passengers’ prices, InDrive provides a platform for drivers to increase the fare if they deem it necessary,” explained InDrive APAC director Roman Ermoshin in an interview with TechCrunch, when questioned about the company’s response to driver concerns regarding low compensation.

“Drivers are often dissatisfied with the pricing on ride-hailing platforms as they strive for fair compensation for their services. With a focus on transparency and fairness, InDrive displays a recommended fare in the app, usually slightly lower than other apps, thanks to our significantly lower fees for drivers (roughly half as much as our competition), ensuring drivers earn the same, if not more than the higher fares on other apps.”

However, Uber seems to have found a solution to this low-fare problem faced by some InDrive drivers. In their flex pricing model, Uber does not allow passengers to manually enter a specific fare, and there is also a minimum fare limit in place.

The service is currently available for affordable Uber Go rides and Intercity cabs in certain cities, and in some, it is even offered for Premier cabs and auto-rickshaw rides. Payment can be made through either cash or digital methods. However, the flex pricing model is not available for all types of transportation in every city where Uber operates.

Uber is currently testing Flex in other markets, including Lebanon, Kenya, and Latin America. TechCrunch has also learned that the company is looking to expand this service to major cities in India, such as Delhi and Mumbai.

In addition to Uber Flex, the San Francisco-based company is testing various other services in India to cater to the local demand. This includes Uber Taxis in Mumbai, where traditional taxi drivers can also offer their services and a Wait & Save model in cities like Mumbai, Guwahati, and Chandigarh, where riders can beat surge pricing by pre-booking a taxi at a lower price when available.

India’s app-based cab market has seen significant growth in recent years, with new players entering the urban transportation space in the past few months. Companies like BluSmart and Evera now offer electric taxis, while major players like Ola, Uber, and InDrive have a large fleet of gasoline cabs. Last year, bike taxi startup Rapido also joined the market, introducing its unique cab service to cater to different customers and expand its revenue streams.

Despite this growth, cab drivers in India, regardless of the platform they operate on, face challenges with low compensation and concerns about safety. With no clear policies in place, many drivers are uncertain about their future and potential job loss once their vehicles become outdated and no longer allowed on the roads.