Hyperexponential, a London-based insurance technology (insurtech) startup that serves the property-casualty (P&C) insurance industry with “decision intelligence” for pricing, has skyrocketed with a whopping $73 million in Series B funding.

Boston-based venture capital (VC) firm Battery Ventures led the round, which also saw participation from existing investor Highland Europe and Andreessen Horowitz (A16z).

Founded in 2017, Hyperexponential revolutionizes the insurance market by providing predictive data and critical insights from a wide range of sources, even those which may be niche, sparse, and fragmented.

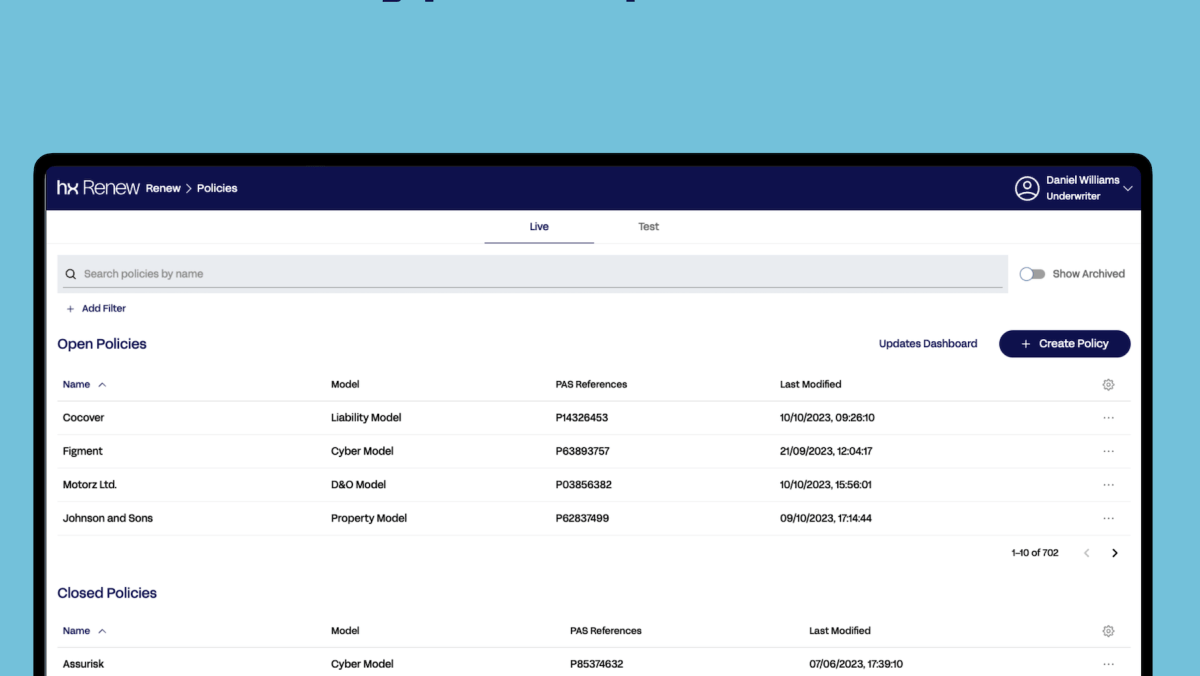

Through their innovative HX Renew software, insurers and reinsurers can access APIs and build predictive models to streamline their data sources and workflows between systems. With the help of automation and machine learning, they can assess risks and gain valuable insights from constantly changing data.

Prior to this massive funding, Hyperexponential had already raised $18 million in funding in 2021, and has been profitable with a ten-fold increase in sales. It proudly boasts of top-tier clients like the insurance giant Aviva.

Such a significant investment in this economic climate can only mean one thing – that Hyperexponential has a strong financial foundation and a promising growth trajectory, making it a highly attractive investment opportunity.

Moreover, the involvement of well-known U.S. VC firms indicates an international expansion roadmap for Hyperexponential. The company has confirmed its plans to expand beyond its current operations in the U.K. and Poland, and enter the lucrative U.S. market.

“From the very beginning, we have focused on building an independent and capital-efficient business that offers both high-growth and sustainability,” said Amrit Santhirasenan, co-founder and CEO of Hyperexponential, in a recent statement. “Even though we have more cash on hand than what we have raised, we decided to bring in expertise from our target markets as we continue to expand into new verticals and geographies.”

Europe is calling out to investors

Recently, when both OMERS and Coatue pulled out of the U.K. venture capital landscape, it raised concerns about the attractiveness of Europe for early-stage investors. However, two well-established VC firms have done the opposite by setting up their first international hubs in London last year – one of them being IVP, and the other being Andreessen Horowitz, which opened its U.K. office in November.

A16z has always been bullish about crypto, blockchain, and the associated “web3” technologies, and it continues to invest in this sector, such as in London-based company Pimlico a few months back. However, it has also been directing significant investments towards AI, healthcare, and enterprise – as can be seen through its recent investments in Databricks and Motherduck.

While crypto remains on A16z’s radar, it seems to be veering towards bigger investments in tried-and-tested technology that addresses real industry challenges today. Last year, the P&C insurance market was estimated to be worth $1.8 trillion, and with Hyperexponential’s impressive growth and profitability, it’s understandable why any VC firm would be drawn to investing in this market.

With an additional $73 million in its war chest from two of the most prominent VC firms in the U.S., Hyperexponential is now well-positioned to embark on its global expansion plans this year. The company intends to double its current workforce to over 200 and open a New York office. It also aims to enter adjacent markets, including SME insurance, as part of its expansion strategy.