TravelPerk, the go-to business travel management platform for small and medium enterprises, has just secured $105 million in fresh equity-based funding. The investment round was led by SoftBank’s Vision Fund 2, with participation from existing investors Kinnevik and Felix Capital.

This new round of funding brings TravelPerk’s valuation to $1.4 billion, slightly surpassing the $1.3 billion valuation revealed during the company’s Series D round two years ago. Despite this marginal increase, it appears that the post-money valuation has remained steady. However, co-founder and CEO Avi Meir believes that in today’s unpredictable market, a flat valuation is actually a positive outcome.

“In today’s climate, where startup funding and valuations have taken a major hit, this is a healthy and realistic valuation,” Meir explained to TechCrunch.

With the travel industry slowly bouncing back from the pandemic, companies like TravelPerk are seeing an uptick in investor interest. Last year alone, travel tech startups raised a total of $3.7 billion in funding. This trend has continued into 2024, with B2B travel app Tumodo recently announcing a $35 million raise last week.

Well-Traveled

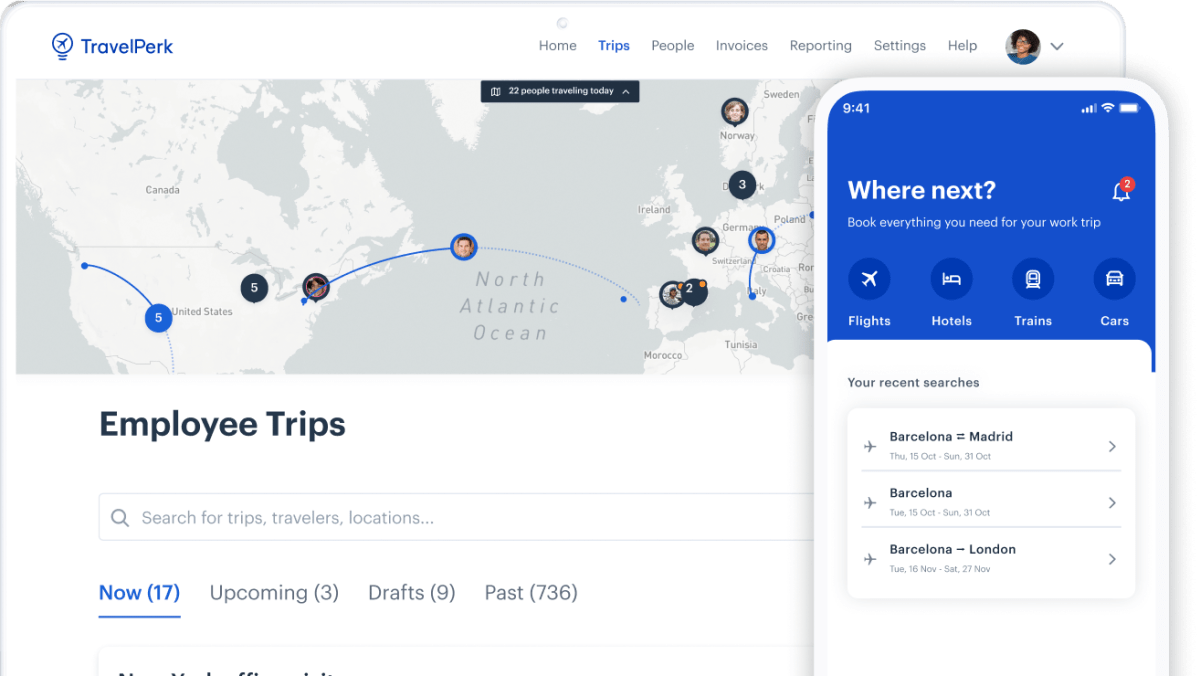

Since its founding in 2015, TravelPerk has been offering a comprehensive platform for companies to book, manage, and track all their domestic and international travel. The platform also integrates with popular expense management and HR software, such as Spendesk and HiBob.

Prior to this latest financing, TravelPerk had already raised around $427 million. The $105 million investment is the fourth part of its ongoing Series D round, which was initially launched in 2021 and comprised of a mix of debt and equity. In 2022, the company added an additional $115 million to the Series D-1 round, followed by a smaller $18.5 million extension from Kinnevik six months ago. This extension may have appeared to be an emergency infusion to outsiders, but Meir clarified that it was not.

“It was far from an emergency infusion – even without this round, we were already fully funded to break even,” Meir explained. “Last summer’s tranche was actually part of this latest investment.”

So in total, TravelPerk has now raised nearly $400 million for its Series D round. The decision to call it an extension of the ongoing round was based on the fact that it was raised on the same terms as the initial round in 2022.

It’s also worth noting that previously, TravelPerk did not disclose how much of its Series D round was composed of debt versus equity. Meir has now confirmed that roughly $80 million was in debt, leaving the remaining amount in equity.

Follow-On Funding

In an industry where many startups are struggling to secure follow-on capital, TravelPerk seems to be bucking the trend. However, there are also signs that the company has been burning through a significant amount of cash. Meir, however, insists that this is not the case, but acknowledges that the company has been investing heavily in its core product.

“We have a significant cash position and were already fully funded to break even prior to this round,” Meir stated. “The single largest investment is in our product and technology. Travel is a complex category, requiring us to aggregate a vast number of inventory providers, payment methods, and premium customer care services. This requires a considerable investment in product and engineering resources.”

All of this brings us to TravelPerk’s newest major investor – the powerful SoftBank. The Japanese conglomerate announced its second Vision Fund in 2019, with investors like Microsoft, Apple, and Foxconn. Despite significant losses from its previous fund, SoftBank has continued to invest in various technology verticals. In the second half of 2023, there were signs that the company was regaining steam, which could explain this most recent investment in TravelPerk. In addition to the funding, SoftBank investor Stephen Thorne will also join TravelPerk’s board of directors.

“We were drawn to TravelPerk for a variety of reasons, including its market size and growth potential,” Thorne commented. “But more importantly, we were impressed by the company’s response to the global pandemic. They avoided major layoffs and continued to innovate and expand their product offerings – a testament to the strong company culture built by Meir.”

As for what’s next for TravelPerk, only time will tell. Meir has one successful exit under his belt with the sale of Hotel Ninjas to Booking.com’s parent company in 2014. The company also hired its first Chief Financial Officer in 2022, who has experience leading two other tech companies through IPOs. Ultimately, whether it’s through a public or private route, Meir’s goal is to build a company that will last for the next hundred years.