New report confirms Europe’s tech investment doldrums, but there are signs of life

Europe finds itself in the midst of a tech investment hangover, following the boom of 2020-2021. Despite this, there are glimpses of hope as VC investment in European startups has reached record levels, surpassing pre-pandemic figures with a total of $60 billion, according to a recent report. However, the surge in investment during the pandemic has created some challenges, though there are indications of potential growth.

Global law firm Orrick conducted a study on over 350 VC and growth equity investments made by their clients in Europe last year.

The report reveals that a total of $61.8 billion was raised in Europe in 2023. While this marked a major correction in global investment levels, it also signaled a reset. In comparison to the top three regions for VC – Europe, Asia, and North America – Europe is the only one to have exceeded 2019 investment levels in 2023.

Record Levels of Dry Powder: According to the report, Europe currently boasts “record levels of dry powder” and is producing more new founders than the United States. However, the funding process remains slow.

Lack of Unicorns: Only 11 new unicorns emerged in Europe last year, the lowest number in a decade. Additionally, a growing number of unicorns lost their coveted status.

Climate Tech Takes the Lead: In Europe, Climate Tech has overtaken FinTech as the most popular sector for investment.

AI Dominates Investment: The report also shows that AI’s share of total investment in Europe reached a record high of 17%.

Investors Tighten Control: As a result of the downturn in funding, investors are exercising greater control over their investments, with founders being required to adhere to strict warranties in 39% of venture deals.

Shift in Strategies: Due to the decline in later-stage financing, deal volume has dropped, and founders are now exploring alternative methods, racing towards revenue and profits.

New Investors Enter the Scene: The report also notes an “unprecedented spike” in the number of new investors entering the tech industry, as founders seek new lead investors. There has also been an increase in the use of convertible debt, SAFEs, and ASAs, with convertible financing accounting for 23% of all rounds in 2023.

Focused on Existing Portfolios: Investors seem to be prioritizing the management of their existing portfolios, leading to an increase in secondary transactions. SaaS and AI remained popular, while FinTech investments declined.

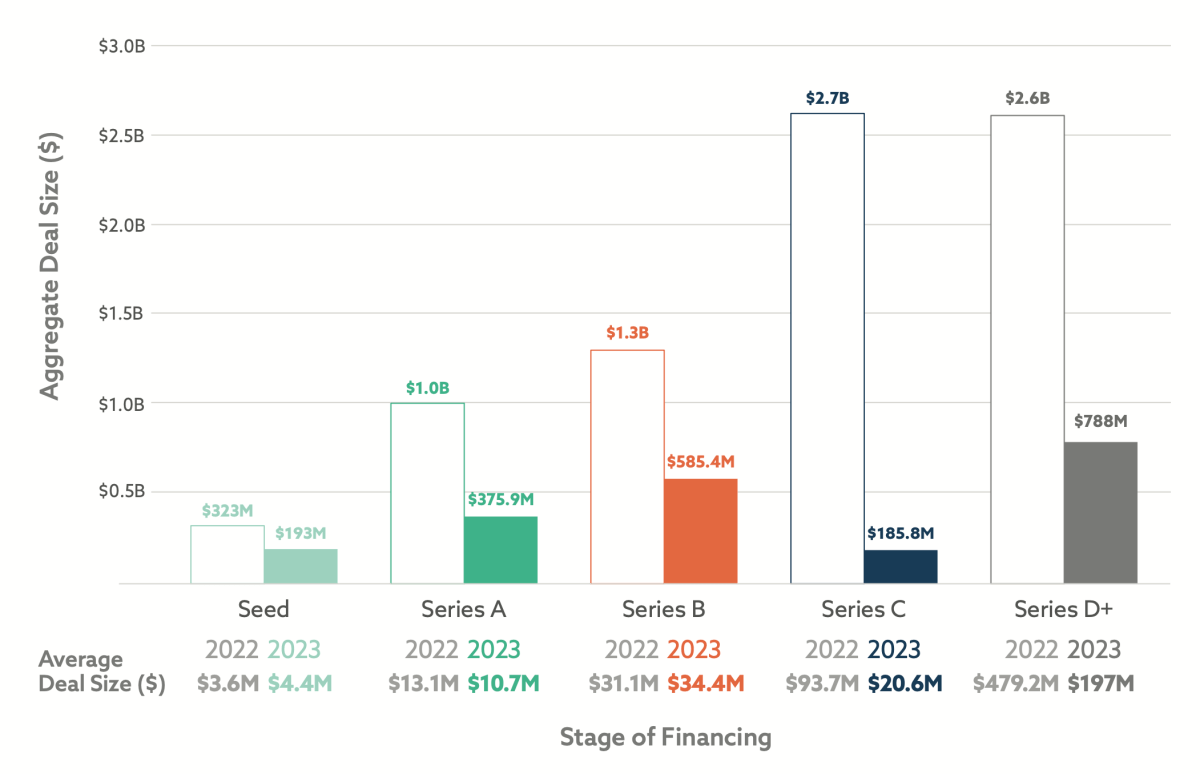

Decline in Deal Value: At each stage, the value of deals has declined, with the most significant decrease seen in later-stage deals.

Active Early-Stage Investors: Despite the decline in early-stage deal value, early-stage investors remain the most active in the market.

Rise of IPOs and M&A Activity: The report also highlights “signs of life” in the IPO landscape, with ARM’s $55 billion IPO, and an increase in M&A activity.

Pressure in the UK: In the UK, VCs are under pressure to deliver returns, which is likely to lead to an increase in demand for secondary transactions, and a rise in M&A activity and consolidation.

Shifting Terms in France and Germany: In France, there has been a shift from “founder-friendly” terms to more investor-friendly terms, while in the UK, the opposite is true. In Germany, there is a growing demand from LPs for liquidity, which is expected to energize the tech M&A pipeline.