Recently, Steve Burns, the ousted founder, chairman, and CEO of the bankrupt EV startup Lordstown Motors came to a settlement with the U.S. Securities and Exchange Commission (SEC). This settlement was made following accusations that Burns misled investors regarding the demand for the company’s all-electric Endurance pickup truck, which was their flagship product.

According to the agreement filed with the U.S. District Court for the District of Columbia, Burns has been ordered to pay a civil fine of $175,000 and is now prohibited from serving as an officer or director of a public company for a period of two years. Despite not admitting or denying the SEC’s allegations, Burns has consented to a permanent injunction, the fine, and other conditions outlined in the agreement.

The SEC had initially charged Lordstown Motors in February 2024 with intentionally deceiving investors about the sales potential of their Endurance electric pickup truck. As part of an earlier settlement, the company had agreed to pay $25.5 million. At the time, it was not made clear that the SEC was also targeting Burns.

Lordstown Motors was originally established in April 2019 as a spinoff of Burns’ other company, Workhorse Group. The following year, the company went public through a merger with a special purpose acquisition company called DiamondPeak Holdings Corp., which had a market value of $1.6 billion. During and after the merger, Lordstown was able to raise $780 million from investors, as reported by the SEC.

Similar to other electric vehicle startups, Lordstown Motors also went public in 2020 through mergers with blank-check companies. However, after experiencing a surge in share prices, these companies soon faced the challenge of producing and selling electric vehicles, which caused their share prices to plummet. Despite these challenges, Lordstown Motors was able to attract the attention and investment of major companies such as GM. They also acquired a massive 6.2 million-square-foot assembly plant in Lordstown, Ohio from GM.

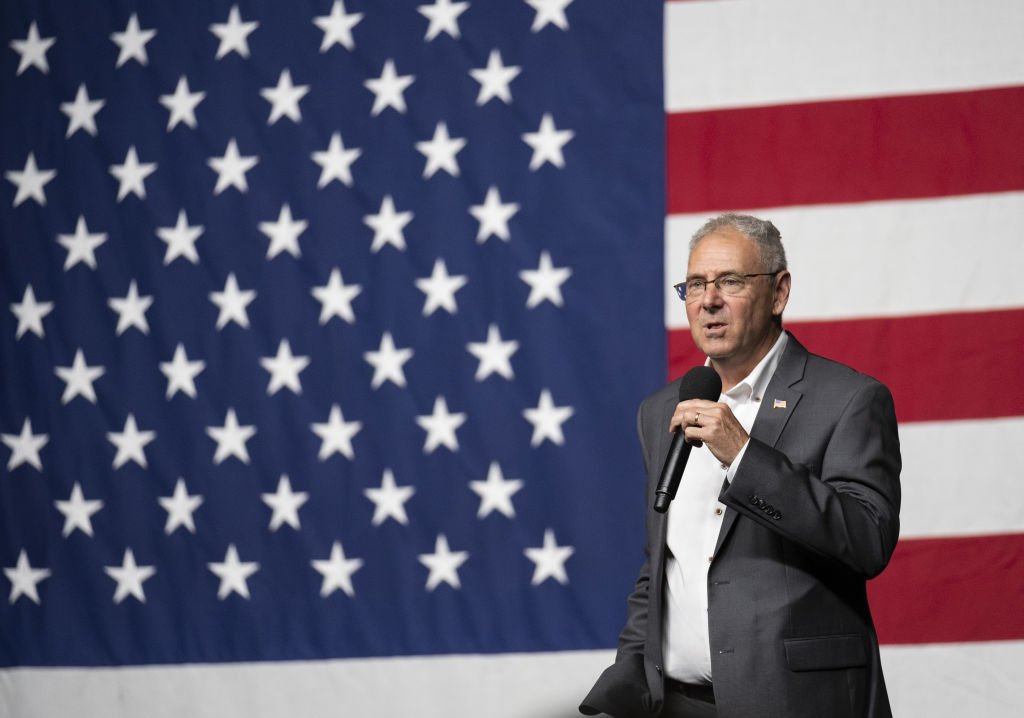

June 2020 marked an important milestone for Lordstown Motors, as they proudly revealed their Endurance electric pickup truck in a grand and politically-charged ceremony. This event featured former Vice President Mike Pence, who spoke for 25 minutes about former President Trump’s policies on jobs, manufacturing, China, and the COVID-19 response.

During the ceremony, Burns announced that the company had received an impressive 20,000 pre-orders. If all of these customers followed through with their orders, it would have secured the entire first year of production for Lordstown Motors. Later on, Burns also stated that they had received a whopping 100,000 nonbinding pre-orders from commercial fleet customers.

However, these claims were later disputed by the short-seller research firm Hindenburg Research. Eventually, both Burns and other executives resigned from their positions in June 2021. Following their resignations, the SEC launched an investigation and revealed that Lordstown Motors and Burns had made misleading statements about the business. This was due to the fact that most of the pre-orders were not made by commercial fleet customers, but rather by companies that did not operate fleets or intend to purchase the trucks for their own use. As a result, the SEC stated that this created false and inaccurate expectations of demand from commercial fleet customers.

Facing numerous challenges, Lordstown Motors continued to experience a turbulent journey even after Burns’ departure. Eventually, in March, the company declared bankruptcy and filed for Chapter 11 protection. After emerging from bankruptcy proceedings, Lordstown Motors rebranded itself as Nu Ride Inc. and shifted its focus to pursuing legal action against the popular iPhone-maker, Foxconn. The lawsuit alleges that Foxconn “destroyed the business of an American startup.”

Meanwhile, Burns has also moved forward after his resignation from Lordstown Motors. In January, he launched a new venture called LandX Motors.

charlsey laghrib