As governments and organizations around the world continue to invest in deep tech solutions to tackle pressing global issues such as climate change, an increasing number of PhD entrepreneurs from top European universities and labs are utilizing their research to build successful startups.

“Diamonds are no longer a laboratory subject: They have become an industrial reality, with startups, with manufacturers interested in this field, and with the partners we have around us.”

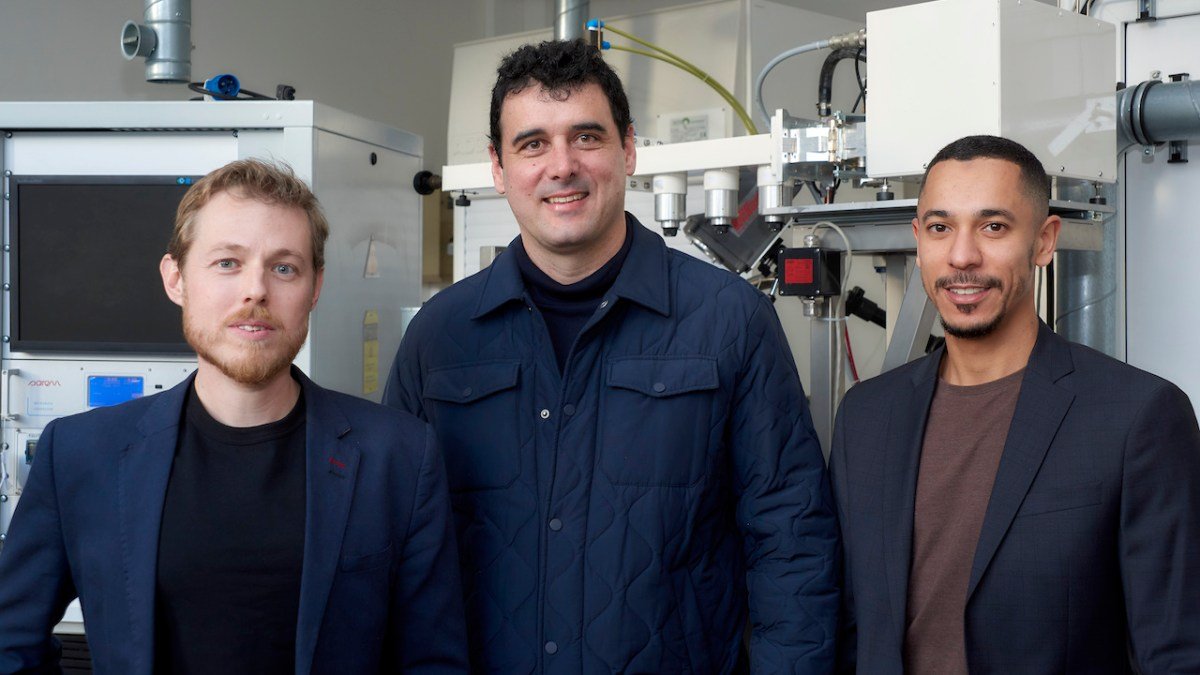

Take French spinout Diamfab, for example. Founded in 2019, the company was born out of the pioneering work of co-founders CEO Gauthier Chicot and CTO Khaled Driche. Both PhDs in nanoelectronics and highly regarded researchers in the realm of semiconducting diamond, the pair left Institut Néel, a laboratory of the French National Center for Scientific Research (CNRS), with two licensed patents.

Since then, Chicot and Driche have continued to develop their technology, earning several more patents and bringing on a third co-founder, Ivan Llaurado, as their chief revenue officer and partnership director. They have also secured an €8.7 million round of funding from investors such as Asterion Ventures, Bpifrance’s French Tech Seed fund, Kreaxi, Better Angle, Hello Tomorrow, and Grenoble Alpes Métropole.

This growing interest in Diamfab is due in part to the shifting perception of semiconducting diamonds over the past few years. As Chicot explains, “Diamonds are no longer a laboratory subject: They have become an industrial reality.”

- With increased attention from startups and manufacturers in the field, semiconducting diamonds are now emerging as a viable alternative to traditional materials like silicon.

- By utilizing natural diamond’s innate temperature resistance and energy efficiency, Diamfab envisions a future where they can create smaller, more affordable components compared to silicon carbide.

- Their ultimate goal? To create more efficient and environmentally-friendly semiconductors that support the “electrification of society,” starting with transportation.

But the potential of diamond-based electronics doesn’t stop there. In fact, Diamfab sees opportunities for their technology in power electronics, nuclear batteries, space tech, and even quantum computing.

“We wanted to be useful pioneers.”

Of course, Diamfab’s success is rooted in their partnership with Institut Néel, where over 30 years of research into synthetic diamond growth laid the foundation for their technology. However, Chicot and his team were determined to take this technology out of the lab and into the real world. As Chicot puts it, “We wanted to be useful pioneers.”

In 2019, Diamfab was recognized for their groundbreaking work, winning the Jury’s Grand Prize of i-Lab, a prestigious award program co-organized by French institutions. This major accomplishment not only brought in essential funding, but also served as a much-needed validation for the startup.

- “We wanted to be useful pioneers,” Chicot said.

- The award gave the team the confidence and recognition they needed both internally and externally.

“Even if you don’t generate any sales, banks trust you.”

One notable investor that has showed confidence in Diamfab is French public sector investment bank Bpifrance. In fact, the bank is doubling down on Diamfab with funding from the French Tech Seed fund, a strategic investment fund managed by Bpifrance on behalf of the French government as part of the France 2030 plan.

With the rise of silicon being used as a commodity, Diamfab’s high-value-added diamond wafers could potentially be manufactured and sold in Europe at a premium due to their higher efficiency, supporting efforts to decarbonize the economy. This aligns with one of the key goals of the France 2030 plan, and Chicot believes that diamonds could play a crucial role in achieving this objective.

In addition, Diamfab has also found ways to reduce their own carbon footprint in the production process. By synthesizing diamonds from methane, they have the potential to use biomethane in the future, creating a commercial outlet for this recycled byproduct.

While Diamfab’s future looks bright, they are still a few years away from their goals. According to Chicot, it will take approximately five more years of development before their technology is commercially viable for mass production on four-inch wafers. This means scaling up from the one-inch wafers they currently work with, requiring significant funding and time.

Despite this five-year timeline, Chicot successfully secured €8.7 million in funding for Diamfab’s pre-industrialization phase. However, some VCs may have been hesitant to invest due to the longer timeframe and their liquidity cycles, which make these types of investments more challenging. Ultimately, a balanced group of investors including public players, evergreen fund Asterion Labs, and regional supporters like Auvergne-Rhône-Alpes and Grenoble, came together to support the startup’s growth.

Speaking of Grenoble, the Alpine city has emerged as a deep tech hub in Europe, often compared to Silicon Valley. Known for its focus on electronics, the city has seen a surge in startups like Verkor and Renaissance Fusion, securing billions of euros in funding for cutting-edge projects. Diamfab is also well-connected in Grenoble, collaborating with key players like CEA, Schneider Electric, Soitec, and STMicroelectronics.

As Europe and the United States look to decrease their dependency on Asia with initiatives like the Chip Acts, French investments in the semiconductor industry have grown. Recently, it was announced that France will provide €2.9 billion in aid for a joint factory between STMicroelectronics and GlobalFoundries, and Soitec has opened a fourth factory nearby. With support from their investors and their strong presence in Grenoble’s deep tech ecosystem, Diamfab hopes to play a key role in France’s efforts to lead the way in semiconductor innovation.