Late stage HRtech startup Rippling is currently in discussions to raise new capital at a $13.4 billion valuation. This amount is a significant increase from the $11.25 billion valuation it received during its previous round of funding, which was only a year ago. The new round is expected to bring in a total of $870 million, with $670 million coming from the sale of secondary shares.

This will mark Rippling’s Series F fundraising round, as the company has already raised $1.2 billion in total prior to this new round. Sources familiar with the deal have revealed that the round has not yet closed, and that $200 million will be injected directly into Rippling, while existing stockholders will sell off the remaining $670 million worth of shares.

When reached for comment, a Rippling spokesperson declined to provide any further information.

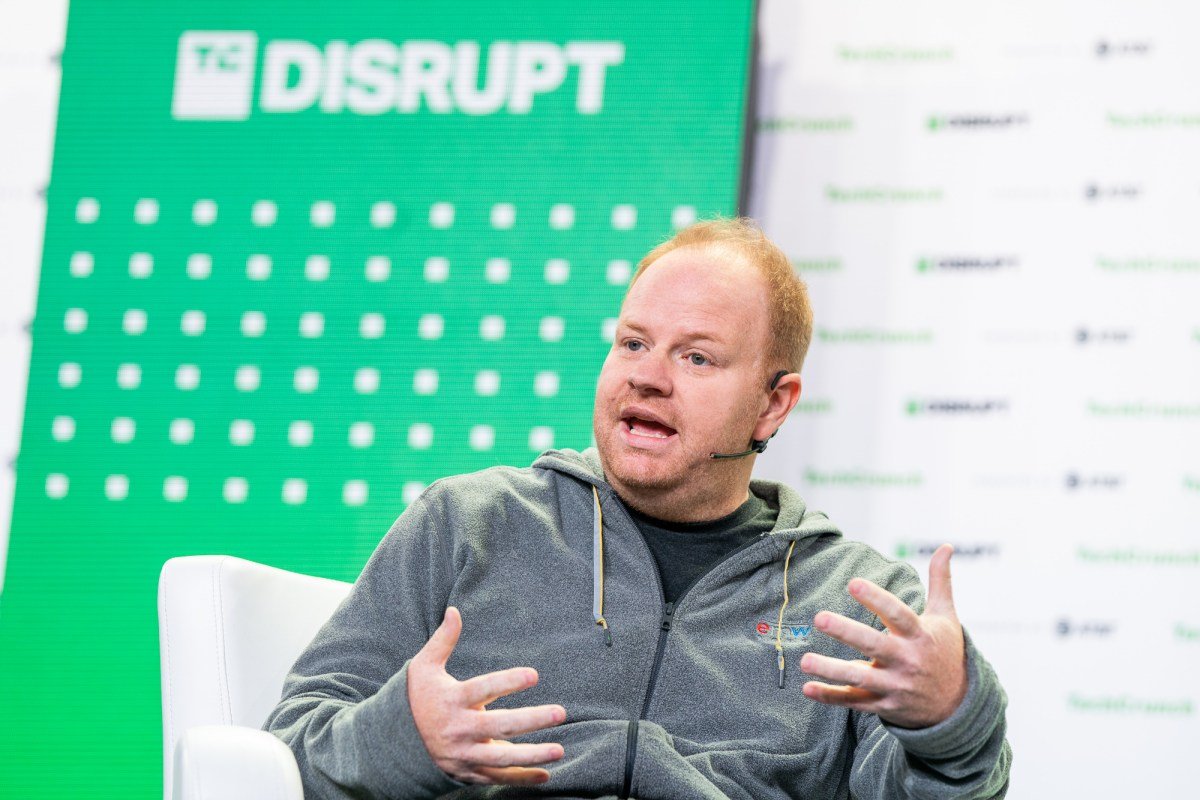

Interestingly, Rippling’s last round of funding took place during the Silicon Valley Bank crisis, when their funds were unexpectedly frozen. At the time, founder and CEO Parker Conrad had to work diligently on the phone with banks, investors, and customers to raise enough cash to cover everyone’s payrolls.

In this current round, existing investor Napolean Ta from Founders Fund is said to be willing to invest $310 million, which would be the largest check the fund has ever written for a single company. It is unclear how much of this investment will go towards the Series F shares, or if it will be used to buy shares from other investors. The round is being led by existing investor Coatue, with participation from Greenoaks as well.

It comes as no surprise that Rippling is raising more capital, as the market for HRtech services such as payroll and remote labor management continues to grow. Gusto, one of Rippling’s main competitors, shared that it brought in $500 million in revenue last year and achieved positive cash flow. Similarly, Deel, which specializes in payroll for international teams, reported $500 million in annual recurring revenue earlier this year.

The HRtech industry is booming, with companies like Gusto valued at $9.5 billion, Deel at $12 billion, Remote at $3 billion, and Rippling now at $13.5 billion. There is a substantial amount of venture capital and equity being invested in HRtech, with new companies emerging as well. Just recently, Remofirst raised $25 million to continue developing its cost-effective hiring solution, competing against many of the aforementioned companies.

With the IPO market remaining sluggish, shareholders of private companies, including employees and existing investors, are also looking for ways to cash out. Large secondary transactions have become increasingly popular as a result.

[…] markets like Africa, Asia, and the Caribbean. In 2018, she brought that vision to life through her startup, The Folklore. The Folklore aimed to connect these brands with the global market. Four years later, […]

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.