Fresh off the triumph of its inaugural mission, satellite manufacturer Apex has secured a hefty sum of $95 million in new capital to fuel its growth.

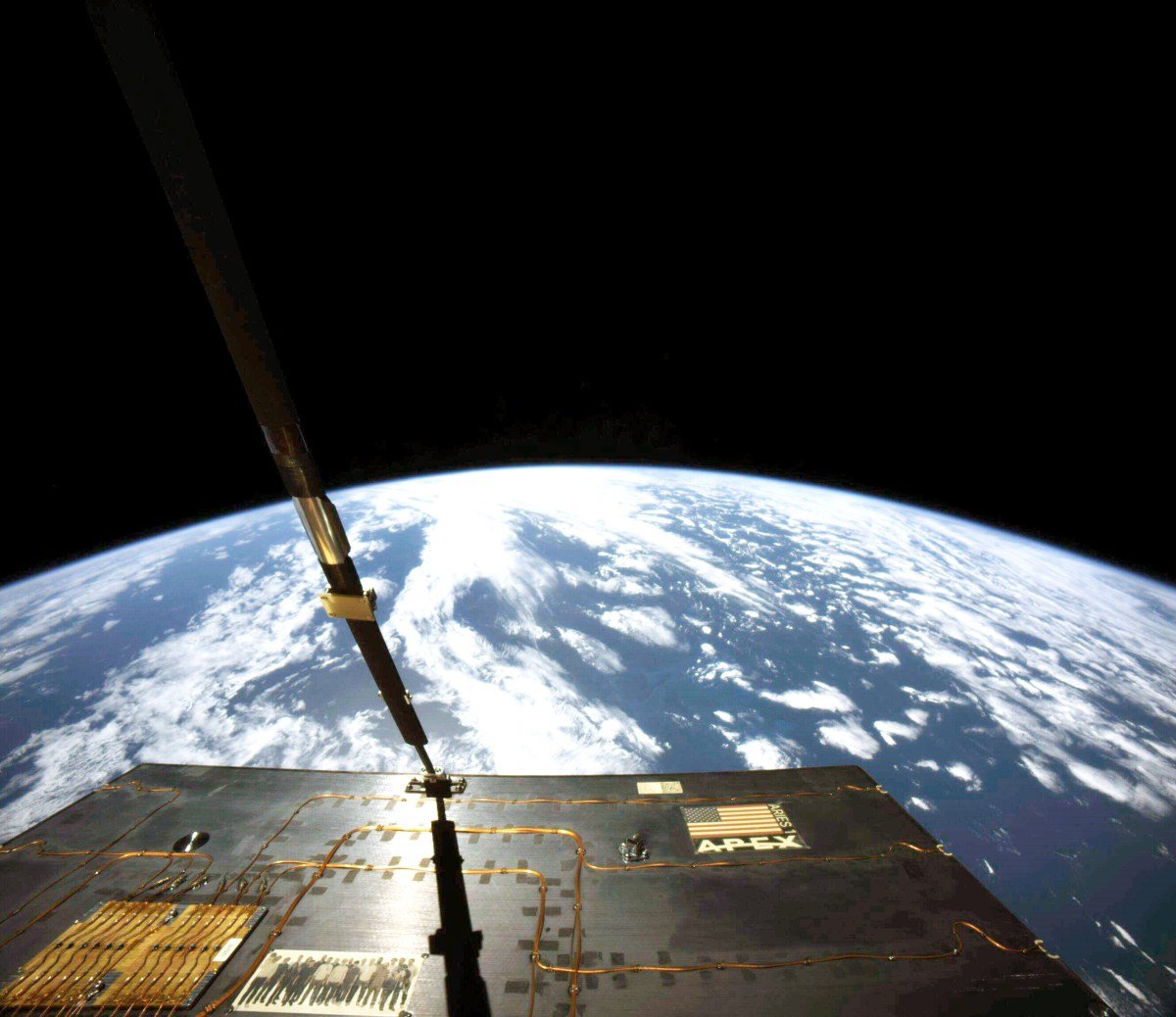

The Los Angeles-based startup accomplished the successful launch and deployment of its first spacecraft, named Aries, in March. In an industry where setbacks are common, the mission went flawlessly, solidifying Apex’s reputation and putting the company on a path towards expansion.

With the Aries’ flight heritage now established, Apex is fully focused on scaling its operations. This includes ramping up production of the Aries model and investing in the development and manufacturing of Nova, a larger spacecraft with twice the mass of Aries. According to Apex CEO and co-founder Ian Cinnamon, the company is well on track to produce five Aries vehicles just this year alone.

At its core, Apex was founded on the belief that satellite bus manufacturing is a major bottleneck hindering the growth of the space industry. Cinnamon and co-founder Maximilian Benassi set out to streamline this process by essentially creating standardized satellite buses that can be mass-produced and sold. This eliminates the need for lengthy bespoke engineering processes and significantly reduces lead times, ultimately allowing companies to send their payloads into orbit much faster.

The timing for this innovative approach couldn’t be better. With the rise of launch cost reductions thanks to SpaceX Falcon 9 ride-share missions, the demand for access to space has increased dramatically. As a result, there is now a significant market for standardized spacecraft. And with customers paying a fixed cost for launch regardless of payload size, Apex’s standardized and even slightly over-engineered models can easily win over competitors on the market.

Cinnamon credits the company’s focus on productization for building a strong foundation for their business. “For every satellite bus we’ve sold or are in the process of selling, we can clearly outline the selling price, unit economics, and margins we achieve,” he explained. “We are transparent with our customers that we’re not necessarily offering the lowest price, but we do provide exceptional delivery times and quality.”

These sound economic principles undoubtedly drew the attention of investors. While buzz around hard tech has been on the rise, Cinnamon notes that the desire among investors to see solid fundamentals in a business remains strong.

Apex is also benefiting from the fact that most customers not only purchase one satellite, but continue to buy multiple ones as they build out their constellation. As a result, the company, which has a current workforce of around fifty people, is looking to double in size by the end of the year.

The funding round was primarily led by early Apex investors XYZ Venture Capital, and co-led by CRV, with participation from new investors Upfront, 8VC, Toyota Ventures, Point72 Ventures, Mirae Asset Capital, Outsiders Fund, GSBackers, as well as current investors Andreessen Horowitz, Shield Capital, J2 Ventures, Ravelin, Robinhood co-founder Baiju Bhatt, and Avalon Capital Group.