The folks at Collaborative Fund certainly like a challenge.

Oh, and they decided to raise their sixth flagship fund at a time when limited partners have grown more miserly.

Collaborative recently raised $125 million for its sixth flagship fund, the firm exclusively told TechCrunch, completing the process in just over 90 days.

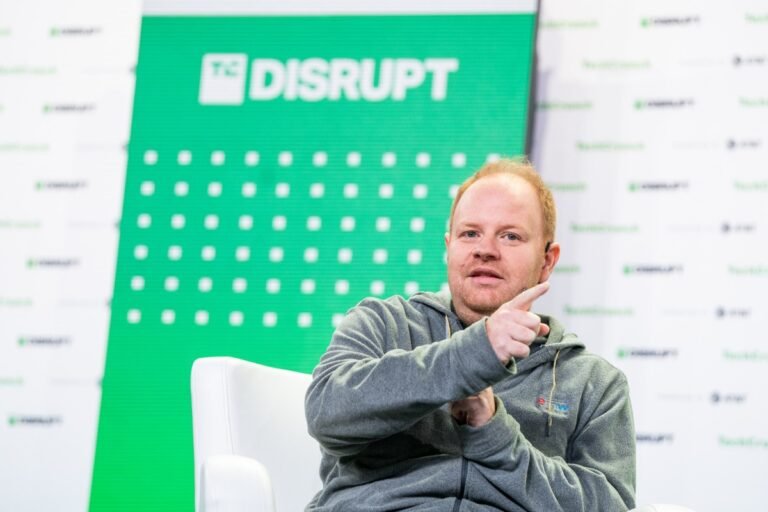

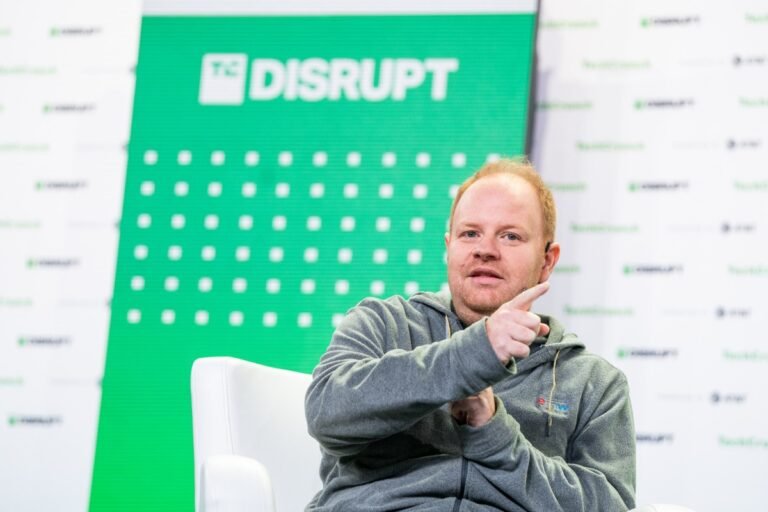

“This fundraising environment is tougher than any I’ve seen since starting the firm well over a decade ago,” founder and managing partner Craig Shapiro told TechCrunch.

Part of that could be the fact that Collaborative has recently returned capital to its LPs, Shapiro said.

William A. Anders, the astronaut behind perhaps the single most iconic photo of our planet, has died at the age of 90.

On Friday morning, Anders was piloting a small plane that dove into the water near Roche Harbor, Wash. His son Greg confirmed his death.

Anders retired from the Air Force Reserve as a major general, but was a major at the time of the Apollo 8 mission in 1968.

Wow, is that pretty!”The resulting photograph, titled “Earthrise,” captured Earth’s loneliness and fragility in a way that no image ever had before.

“Here we came all the way to the moon to discover Earth,” he said.

Sources tell TechCrunch that employees at those companies received no information about the tender offer, but heard about their exclusion through the grapevine.

None of the former employees TechCrunch spoke to were surprised to hear one name on the list: Deel.

“Rippling put together a tender offer for the benefit of its employees, ex-employees, and early investors.

To be sure, as a private company, Rippling certainly has the freedom to place restrictions on participation in its stock sales.

In addition to the price of the stock, employees may face huge tax bills on options they exercise from the paper gains of the value of the stock.

BlackRock, an investor in Byju’s, estimates that its stake of Indian edtech giant, once valued at $22 billion, is now worth nothing.

So it doesn’t come as a surprise that BlackRock has implied a zero valuation to Byju’s.

At the end of October last year, BlackRock had cut the valuation of Byju’s to about $1 billion.

However, the research’s note chart (embedded below) did use zero in the column for estimated value.

The story has also been updated to emphasize BlackRock’s valuation adjustment in its Byju’s stake.

Welcome to Startups Weekly — Haje’s weekly recap of everything you can’t miss from the world of startups.

Image Credits: OdaHardware is hard, episode 234: We already knew that Humane’s Ai Pin launch was going anything but smoothly.

Image Credits: Sword Health / CompanyLive by the sword : Sword Health, an AI-powered virtual physical therapy startup, raised a $30 million primary funding round and a $130 million secondary funding round that brought its valuation to $3 billion.

: Sword Health, an AI-powered virtual physical therapy startup, raised a $30 million primary funding round and a $130 million secondary funding round that brought its valuation to $3 billion.

Where’s your head at: Austrian startup Storyblok raised $80 million to add more AI to its “headless” content management system (CMS) for non-technical people.

Meta is quietly rolling out a new “Communities” feature on Messenger, the company confirmed to TechCrunch.

The rollout comes as Meta introduced Communities on WhatsApp back in 2022.

They could create dedicated group chats for topics like upcoming events, security alerts, trash pickup schedules, and more.

Although the feature works similarly to Communities on WhatsApp, Meta says there is one key differentiator, which is the fact that Messenger Communities are connected to Facebook’s social graph.

On a help page, Meta says Communities on Messenger are designed for more public conversations when compared to Facebook groups.

Following the collapse of its electric car project, Apple reportedly shuffled a number of employees into its internal generative AI efforts.

iOS 18 with more AIImage Credits: Darrell EtheringtonAlong with that partnership, expect iOS 18 to be the centerpiece of the event.

Siri will be getting a long-awaited refresh, courtesy of Apple’s generative AI work.

Generative AI is even coming to emojis, allowing users to customize and create their own in Messages.

A lot of the iOS updates should also make their way to macOS, including those in Siri, Notes and Safari.

In order to have users spend more time on the platform and ramp up engagement, TikTok is testing streaks that are similar to what people see on Snapchat.

TikTok confirmed that it is testing the feature but didn’t provide any statement related to it.

The company said that it is experimenting with the streaks feature in limited markets and select users.

Once you do that, you will get a streak badge displayed on the chat, along with the number of streak days.

Y'all don't got TikTok streaks like dis 😝😝😝 pic.twitter.com/LnZc8jAvub — Buzz 🩵 (@trollsbuzz) June 6, 2024Mika welcome to my tiktok streaks pic.twitter.com/hZPRbdintk — CARBY!!

Only a few years ago, one of the hottest topics in enterprise software was ‘robotic process automation’ (RPA).

The rise of generative AI, however, may just be the missing key to building these kinds of systems.

“Last year, generative AI happened and I realized that it unlocks some software scenarios that were impossible before,” Surpatanu said.

You have to combine it with more traditional software if you want to squeeze the best out of it,” he said.

Generative AI, Surpatanu argues, can bring a degree of adaptability to context and an understanding of the user’s intent to these systems that wasn’t really possible before and something that RPA often struggles with.

Torpago, a commercial credit card and spend management provider, is no different, but with one caveat — banks are who it builds technology for, particularly community banks.

“We started as a competitor with Brex and Ramp, as well as American Express and Capital One,” Jackson told TechCrunch.

The Torpago Powered By tools and infrastructure enable means that those banks’ to customers don’t have to leave the bank’s brand domain to get sophisticated fintech features.

Banks have all the customers, and they have all the card volume, but “they have the absolute worst credit card tools and technology,” he said.

Since making the shift to banks as customers, that was whittled down to 300 companies while it goes after bank customers.