Two years ago, Prolific Machines unveiled its technology for a unique manufacturing approach to grow cells for industries, including cultivated meat.

In addition, cell growth is hard to optimize because it’s not in a format that machines can understand.

“For the last few decades, the way that we’ve been controlling cells is with molecules,” Kent said.

We add these molecules into the bioreactors and hope for the best.”Prolific Machines’ protein manufacturing bioreactor (Image credit: Prolific Machines) Image Credits: Prolific Machines /Prolific Machines believes it has a way of transitioning away from these molecules to something better: light.

It includes convertible notes and brings Prolific Machines’ total funding to date to $86.5 million.

Oda, the Norway-based online supermarket delivery startup, has confirmed layoffs of 150 jobs as it drastically scales back its expansion ambitions to focus on just two markets, its homebase and Sweden, the homebase of Mathem, an online grocery that Oda merged with last year.

Online grocery is hard — complex orders with perishable items and a multi-temperature supply chain in a highly price sensitive category,” Oda’s CEO, Chris Poad, wrote on LinkedIn last week (before the layoffs were announced).

Prior to the pandemic, Oda – founded in 2013 – carved out a place for itself as one of the strong regional players in online grocery delivery in Europe.

But by late 2022 Oda was raising $151 million at a valuation of $353 million.

Local publication e24 says Kinnevik and other existing backers Summa Equity and Verdane are expected to provide the bulk of the NOK600 million ($57 million) Oda is reportedly raising.

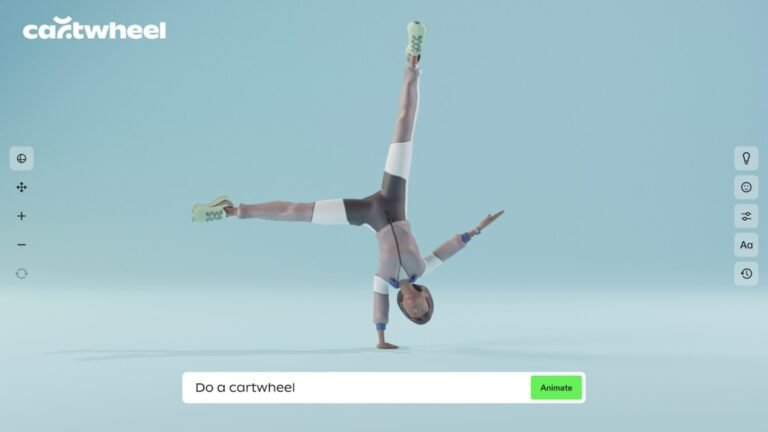

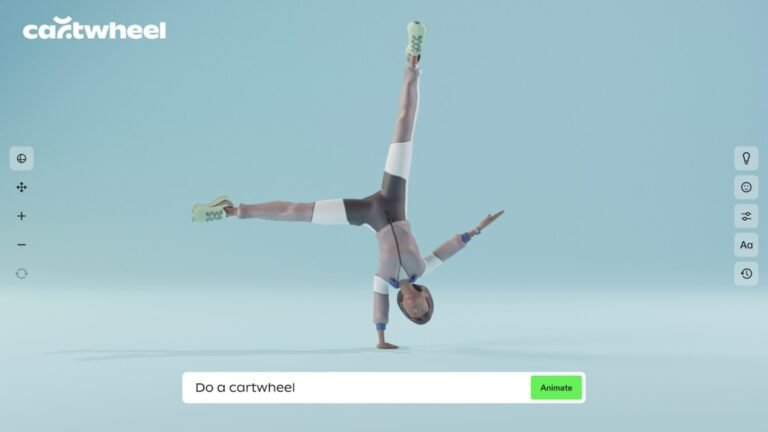

Animating a 3D character from scratch is generally both laborious and expensive, requiring the use of complex software and motion capture tools.

Cartwheel wants to make basic animations as simple as describing them, generating a basic movement with AI and letting creators focus on more expressive tasks.

There’s a lot of value in just quickly getting it out of your head and moving.

“There’s this notion of AI replacing creative work, and as someone who does creative work, it’s like… no!

This leads to more animation, more motion, one person doing more,” said Jarvis.

Notable Capital’s Hans Tung on the state of VC and the upside to down roundsTo some investors, “down round” is a dirty phrase, but not to Notable Capital’s Hans Tung.

Hans is a managing partner at Notable Capital, formerly GGV Capital, a venture firm focusing on investments in the U.S., Latin America, Israel, and Europe.

Hans, whose portfolio includes the likes of Airbnb, StockX and Slack, sat down with TechCrunch’s Equity podcast to discuss the overall state of venture and why he still believes down rounds can make a lot of sense.

Of course, we dug into recent changes at his own firm, which evolved from 24-year-old cross-border firm GGV Capital and rebranded its U.S. and Asia operations to Notable Capital and Granite Asia, respectively.

GGV’s transformation is the latest in a string of changes we’ve seen in the world of venture capital, including personnel changes at Founders Fund, Benchmark and Thrive Capital.

Validating consumer demand is a crucial step for any startup, and TechCrunch Early Stage is offering a golden opportunity to learn how to do it right.

In this workshop, Gladstone will guide founders on how to leverage their expertise to understand and solve consumer problems effectively.

With hands-on advice and practical strategies, attendees can expect to gain insights into testing solutions, refining product development processes, and ultimately validating consumer demand.

With a BA from Brandeis University and an MBA from the Tuck School of Business at Dartmouth, Gladstone’s expertise is grounded in both academic rigor and real-world experience.

For founders eager to validate their ideas and drive meaningful consumer engagement, this workshop is a must-attend event at TechCrunch Early Stage.

For Informatica investors, it was the opposite: The price was too low to warrant selling — they wanted more, more, more — and their stock also dropped, down a similar amount over the same period.

The biggest by far of that bunch was the $28 billion deal to buy Slack at the end of 2020.

Informatica is also far smaller than Salesforce, making its potential revenue bump to Marc Benioff’s company modest.

The ace up Informatica’s sleeve is that while its total revenue growth is slow, one important segment of its revenues is expanding quickly.

If we were to compare Informatica cloud net-new ARR that it expects this year instead, the percentage becomes even smaller.

Welcome to Startups Weekly — your weekly recap of everything you can’t miss from the world of startups.

Despite this general downturn, certain segments like generative AI continue to attract significant funding, indicating a selective yet substantial interest in specific AI applications.

AI investment is slowing down for a few reasons, like the crowded market and the steep costs of building big AI models.

Investors are getting pickier and want to see real, solid returns instead of just throwing money at hopeful growth.

(That isn’t stopping them from raising billion-dollar funds focusing on AI, of course.)

Cover slide Problem slide 1 Problem slide 2 Product image slide Solution slide What Is Unique?

The business model comes up shortClosely related to the previous point: Pricing is one side of the business model, but there are many more parts to the puzzle.

The business model slide is very light on details, and the details that are there are a little confusing.

The full pitch deckIf you want your own pitch deck teardown featured on TechCrunch, here’s more information.

Also, check out all our Pitch Deck Teardowns all collected in one handy place for you!

Apple has removed the Meta-owned end-to-end encrypted messaging app WhatsApp from its App Store in China following a government order citing national security concerns, the news agency Reuters reported Friday.

Meta’s newer, Twitter-esque text-based social networking app, Threads, has also been pulled from the App Store for the same reason, it said.

But the AppleCensorship site, which tracks App Store removals, records both Signal and Telegram as having been “disappeared” from Apple’s mainland China App Store.

Last year another Twitter alternative, Jack Dorsey-backed Damus, was also pulled from Apple’s China App Store shortly after it had been approved.

Although quite a number evidently managed to do so, as Threads quickly landed in the top 5 on Apple’s China App Store last summer.

As I wrote recently, generative AI models are increasingly being brought to healthcare settings — in some cases prematurely, perhaps.

Hugging Face, the AI startup, proposes a solution in a newly released benchmark test called Open Medical-LLM.

Hugging Face is positioning the benchmark as a “robust assessment” of healthcare-bound generative AI models.

It’s telling that, of the 139 AI-related medical devices the U.S. Food and Drug Administration has approved to date, none use generative AI.

But Open Medical-LLM — and no other benchmark for that matter — is a substitute for carefully thought-out real-world testing.