Welcome to Startups Weekly — your weekly recap of everything you can’t miss from the world of startups.

For the low, low price of being a Robinhood Gold member (because who doesn’t want to pay $5 a month for the privilege of spending more money?

Robinhood unveiled its Gold Card, a credit card so packed with features it might just make Apple Card users pause for a hot second.

For the low, low price of being a Robinhood Gold member (because who doesn’t want to pay $5 a month for the privilege of spending more money?

Trend of the week: Transportation troubleThe New York Stock Exchange has given EV startup Fisker the boot, citing its “abnormally low” stock prices.

Climate-tech VC Satgana has reached a final close of its first fund, which targets to back up to 30 early-stage startups in Africa and Europe.

“I ran it for like five years, and about six years ago I started to really have the awakening to the extent of climate change.

“We are entering the continent to pursue green growth objectives; so deploying renewable energy, low carbon buildings, mobility solutions and so on.

Satgana is among the new funds that are dedicated to the African climate tech sector.

These funds include Africa People + Planet Fund by Novastar Ventures, Equator’s fund and the Catalyst Fund.

Sila, Group14, Envoix, and Amprius are all trying to commercialize their silicon anode technology, hoping to cash in on consumers’ desire for ever more EV range.

Ionobell, a seed stage startup, is hoping to be at the top of that list, claiming its silicon material will be cheaper than the established competition.

Both established companies impregnate porous graphite structures with silicon; Sila also adds a coating to the particles.

Ionobell’s silicon supply comes from a waste material, Neivert said, which helps keep costs down.

Like other battery materials companies, Ionobell faces a challenging road ahead.

Bankrupt commercial EV startup Arrival has sold some of its assets, including advanced manufacturing equipment to Canoo, another struggling startup trying to build and sell electric vehicles.

Canoo said the purchased assets, packed into more than 20 container ships, will be sent to the company’s facility in Oklahoma.

The company previously acquired all of the new, and “like-new” assets owned by Arrival’s business unit in the United States.

Arrival announced in January that it planned to sell off assets and IP from its U.K. division after filing for bankruptcy protection in the U.K.

Arrival never produced any commercial vehicles at scale and its market valuation is now around $7.7 million.

Lucid Motors is raising another $1 billion from its biggest financial backer, Saudi Arabia, as it looks to blunt the high costs associated with building and selling its luxury electric sedan.

The fresh funding comes just a few weeks after Lucid told investors that it only plans to build around 9,000 of its Air electric vehicles this year, a slight bump over last year’s output.

It lost $2.8 billion in 2023 and finished the year with just shy of $1.4 billion in cash and equivalents.

Lucid also plans to start building its electric Gravity SUV at the end of this year.

Lucid announced the investment less than three weeks after CEO Peter Rawlinson told the Financial Times that he was wary of relying too heavily on Saudi Arabia to keep shoveling money into its proverbial furnace.

Chances are you may have noticed that many commercial vehicles are now electric vehicles — think about delivery vans, telecom minivans, utility maintenance trucks, etc.

That’s why Pelikan Mobility has been building a platform and a leasing solution that address this challenge caused by the switch to EVs for commercial fleets.

Many companies lease their commercial vehicles and Pelikan Mobility believes that pricing is broken for commercial EVs.

Leasing contracts — even for commercial vehicles, even for electric vehicles — end far too quickly.

It will also have to raise a debt fund for that new business as Pelikan Mobility plans to address large customers.

One Bay Area startup called Amber thinks it can help them navigate that minefield, starting with Tesla owners.

When owners file a claim, Amber works with qualified repair shops to find the right parts and fix what’s wrong, and will transport the vehicle.

AmberCare is the latest addition to a growing economy built around used EVs.

One group is anyone who is looking to buy a used EV but is scared away by the thought of expensive, time-consuming repairs.

There are other unexpected things to consider in the process of repairing an EV that Pak thinks AmberCare can help with, like transportation.

The number of startups in India’s electric two-wheeler market has surged to over 150 from 54 in 2021, driven by government incentives to promote clean vehicles and cut oil imports, according to a new analysis.

“Most are competing in the mainstream, and 85% of the 65 models launched last year were such products: high-speed as against speed and range-constrained products, which used to be a feature of the startups,” Bernstein analysts wrote.

The government has offered incentives under its FAME II scheme, which provides subsidies to buyers and was recently extended to 2024.

Bernstein’s analysis found low barriers to entry, with electric two-wheelers built using outsourced models and readily available components.

Most established automotive companies have been granted PLI while only a few startups qualified, potentially providing a cost advantage for major incumbents, Bernstein said.

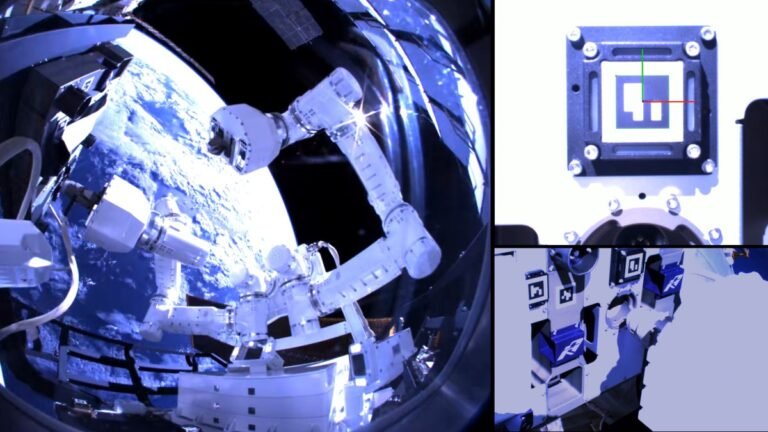

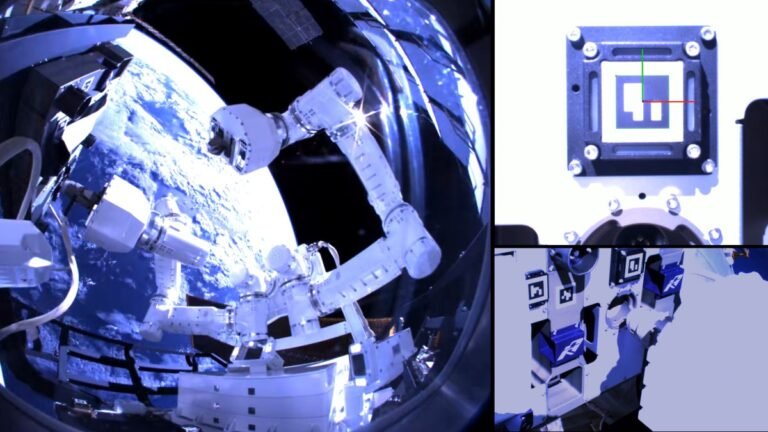

Los Angeles-based Gitai said Tuesday that its autonomous robotic arm has nailed a tech demonstration outside the International Space Station.

Autonomous robotic systems still have a ways to go before they render human labor obsolete, especially here on Earth; but in space, human labor is expensive (and dangerous), which provides an opening for a robotic alternative.

The 1.5-meter autonomous robotic arm, which the startup calls S2, launched to the ISS aboard a SpaceX Falcon 9 in January.

In the nearer term, the company is targeting on-orbit satellite servicing for spacecraft in low Earth orbit and geostationary orbit.

The arm’s technology readiness level (TLR), a standard used by NASA to chart the maturity of technology, is now at 7, the highest level, Gitai said.

Fisker’s finances are back in the news after the company warned back in February that it didn’t have enough cash to make it through its next year.

The company said this week that it intends to halt production for six weeks to get its business back in order.

Softening demand growth for EVs is making the normal challenges of scaling a company all the harder for Fisker and its peers.

Not that we’re all doom and gloom here at TechCrunch — we’re actually rather bullish on the prospect for EVs in the near and far future.

Let’s take a look at what’s going on under the hood here: