“I couldn’t get a credit card because my parents couldn’t co-sign,” Kobe recalls, “and I didn’t want to put down a large security deposit.

Scott points out that New York-based Fizz set out to offer college students a different entry ramp into building credit.

And if you ask any of them, they’ll tell you that they’re credit card averse, but they’re not necessarily credit averse,” he told TechCrunch.

”Fizz is one of several fintechs aiming to serve the expansive Gen Z market.

For instance, Frich, a financial education and social community for Gen Z, just raised $2.8 million in seed funding.

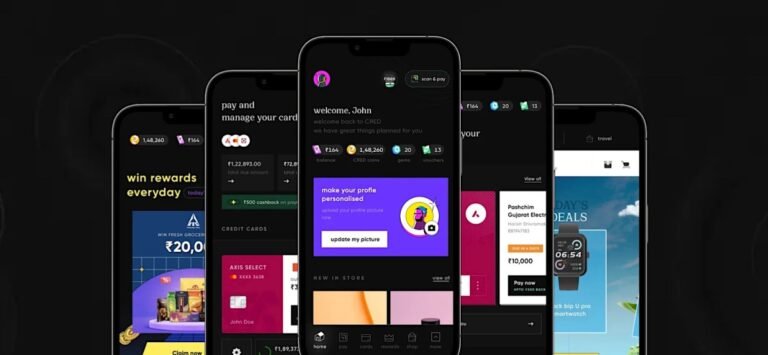

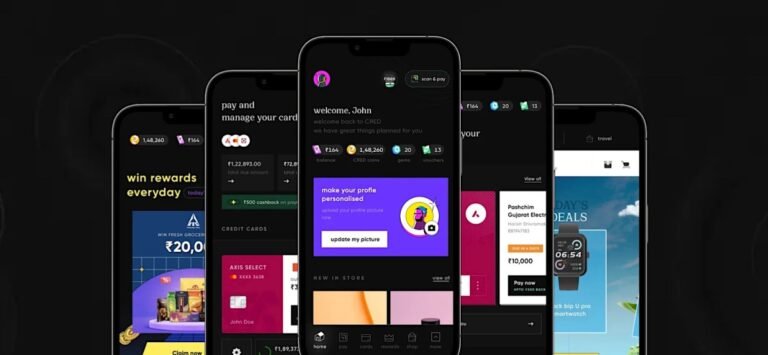

CRED has received the in-principle approval for payment aggregator license in a boost to the Indian fintech startup that could help it better serve its customers and launch new products and experiment with ideas faster.

The RBI has granted in-principle approval for payment aggregator licenses to several companies, including Reliance Payment and Pine Labs, over the past year.

Typically, the central bank takes nine months to a year to issue full approval following the in-principle approval.

Without a license, fintech startups must rely on third-party payment processors to handle transactions, and these players may not prioritize such mandates.

Obtaining a license allows fintech companies to process payments directly, reduce costs, gain greater control over payment flow, and onboard merchants directly.

New U.S. ‘green bank’ aims to steer over $160B in capital into climate techFor years, banks have been financing large renewable power projects, from utility-scale solar farms to horizon-spanning wind farms.

But the demand is there, which is why advocates have been clamoring for the federal government to support a so-called green bank, which will underwrite these sorts of projects.

That green bank is now a reality.

Green bank loans have a pretty good track record, too.

The Connecticut Green Bank, for example, has a delinquency rate that’s on par with other commercial lenders across both residential and commercial portfolios.

The cross-border payments market is forecasted to reach over $250 trillion by 2027, according to the Bank of England.

So it’s no surprise that one of the trends among Y Combinator’s Winter 2024 batch of nearly 30 fintech startups is how to more easily move money globally.

Users get a U.S. bank account and access to low-cost local payment rails.

InfinityWhat it does: Cross-border banking for small businesses in IndiaWe heard from a lot of childhood friends during the past two days, so it was refreshing to see two siblings form a company.

Businesses in India account for $700 billion in cross-border trades per year, and Infinity makes 1% from those transactions.

Banking-as-a-service startup (BaaS) Synctera has conducted a restructuring that has resulted in a staff reduction, the company confirmed to TechCrunch.

While Synctera did not share how many employees were impacted, a report in Fintech Business Weekly pegs the number to be about 17 people, or about 15% of the company.

Synctera built a platform designed to bring together fintech companies and sponsor banks.

Treasury Prime slashed half its 100-person staff in February, a year after it announced a $40 million Series C raise.

Meanwhile, Piermont Bank reportedly cut ties with startup Unit, FinTech Business reported.

Miami-based Onyx Private, a Y Combinator-backed digital bank that provided banking and investment services for high-earning Millennials and Gen Zers, is terminating its bank operations.

Y Combinator has listed the company as “inactive” on its on its website, something Santos could not explain.

Santos claimed that Onyx had been exploring the idea over the past year and had made developments with some partners.

Santos today declined to disclose how many banking customers Onyx had.

Although a source told TechCrunch that regulatory issues may have played a part in this decision, Santos dismissed that, telling us that no regulatory issues caused the startup to shut down its direct-to-consumer banking operations.

EV startup Fisker is pausing production of its electric Ocean SUV for six weeks as it scrambles for a cash infusion.

The company said in a Monday morning regulatory filing that it had just $121 million in cash and cash equivalents as of March 15th, $32 million of which is restricted or not immediately accessible.

Fisker finished 2023 having shipped roughly 5,000 of the 10,000 cars that its contract manufacturing partner, Magna Steyr, produced.

Automotive manufacturing is incredibly expensive, even for a company like Fisker which is outsourcing much of the work to suppliers like Magna.

In the near-term, Fisker said Monday it is trying to raise $150 million through the sale of convertible notes.

Appzone is one of the standout local fintech software providers for banks and fintechs, providing better pricing and flexibility.

As such, it rebranded to Zone, a licensed blockchain-enabled payment infrastructure company–and carved out its original banking-as-a-service business into a separate standalone company, Qore.

Today, Zone, its blockchain network that enables payments and acceptance of digital currencies, is announcing that it has raised $8.5 million in a seed round.

Therefore, the fintech is developing an interoperable payment infrastructure using blockchain technology — known for its ability to scale infinitely — to connect banks and fintech companies, facilitating transaction flow without intermediaries.

“We are excited by the potential for Zone’s technology to be replicated across borders to advance payment innovation globally.

This week, we look at Griffin Bank getting its license ahead of some heavy hitters, and we go inside Stripe’s annual letter, some funding rounds, and more!

The banking-as-a-service company managed to do something that even the region’s most valuable fintech company, Revolut, hasn’t been able to do yet — obtain a banking license.

Granted, as Mike Butcher writes, banking licenses are difficult to come by (Griffin’s took a year), but Revolut has talked about securing a banking license for the past three years.

Now that Griffin has a banking license, it offers a full-stack platform for fintech companies to offer banking, payments and wealth solutions via automated compliance and an integrated ledger.

In a new SEC filing, Reddit’s IPO involves around 22 million shares, priced between $31 and $34.

The third-party application provider license will enable Paytm to offer payments through the UPI network even as Paytm’s parent firm One97 Communications’ banking unit — Payment Payments Bank — is scheduled to cease operations on Friday.

The Reserve Bank of India ordered Paytm in late January to cease operations at Paytm Payments Bank, an affiliate of the financial services firm that processed majority of its transactions.

The move created shockwaves through the industry, and also meant that Paytm needed to secure the third-party application provider license to continue many of the Paytm app’s operations.

Axis, HDFC, State Bank of India and Yes Bank will serve as payment system provider to the Paytm app, NPCI said Thursday.

The RBI had advised NPCI to swiftly issue the third-party application provider license, or TPAP, to Paytm to help mitigate disruptions for its customers.