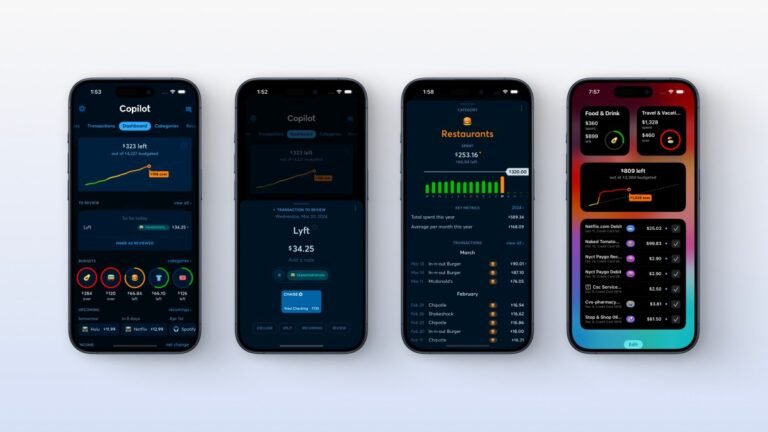

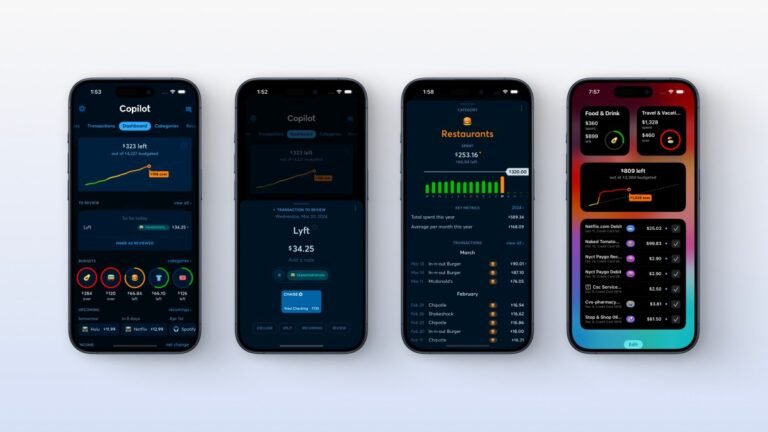

Intuit is winding down budgeting app Mint this week and that’s become good news for competitor Copilot.

The New York-based CEO started the subscription-based personal finance tracker in January 2020 to offer an alternative to Mint.

Users also save an average of 5% after starting with the app, Copilot calculates.

Beyond MintLike millions of others, Ugarte tried some personal finance apps, including Mint, yet found them to be lacking.

Other personal finance apps show where you are spending, even in categories that might not be relevant, he said.

Tesla’s once-leading solar business is in decline, according to the latest figures from its fourth-quarter 2023 earnings report.

It was a bad year for Tesla solar — its worst since 2020.

In Q4 2023, Tesla’s solar deployments dropped 59% year-over-year to 41 MW — down from 100 MW in Q4 2022.

Next to solar, Tesla’s energy generation and storage business is booming (surprise, surprise).

The scale of Tesla’s residential solar business isn’t what it once was.

Tesla’s once-leading solar business is in decline, according to the latest figures from its fourth-quarter 2023 earnings report.

It was a bad year for Tesla solar — its worst since 2020.

In Q4 2023, Tesla’s solar deployments dropped 59% year-over-year to 41 MW — down from 100 MW in Q4 2022.

Next to solar, Tesla’s energy generation and storage business is booming (surprise, surprise).

The scale of Tesla’s residential solar business isn’t what it once was.

Tesla’s once-leading solar business is in decline, according to the latest figures from its fourth-quarter 2023 earnings report.

It was a bad year for Tesla solar — its worst since 2020.

In Q4 2023, Tesla’s solar deployments dropped 59% year-over-year to 41 MW — down from 100 MW in Q4 2022.

Next to solar, Tesla’s energy generation and storage business is booming (surprise, surprise).

The scale of Tesla’s residential solar business isn’t what it once was.

Tesla’s once-leading solar business is in decline, according to the latest figures from its fourth-quarter 2023 earnings report.

It was a bad year for Tesla solar — its worst since 2020.

In Q4 2023, Tesla’s solar deployments dropped 59% year-over-year to 41 MW — down from 100 MW in Q4 2022.

Next to solar, Tesla’s energy generation and storage business is booming (surprise, surprise).

The scale of Tesla’s residential solar business isn’t what it once was.

Tesla’s once-leading solar business is in decline, according to the latest figures from its fourth-quarter 2023 earnings report.

It was a bad year for Tesla solar — its worst since 2020.

In Q4 2023, Tesla’s solar deployments dropped 59% year-over-year to 41 MW — down from 100 MW in Q4 2022.

Next to solar, Tesla’s energy generation and storage business is booming (surprise, surprise).

The scale of Tesla’s residential solar business isn’t what it once was.

Tesla’s once-leading solar business is in decline, according to the latest figures from its fourth-quarter 2023 earnings report.

It was a bad year for Tesla solar — its worst since 2020.

In Q4 2023, Tesla’s solar deployments dropped 59% year-over-year to 41 MW — down from 100 MW in Q4 2022.

Next to solar, Tesla’s energy generation and storage business is booming (surprise, surprise).

The scale of Tesla’s residential solar business isn’t what it once was.

Tesla’s once-leading solar business is in decline, according to the latest figures from its fourth-quarter 2023 earnings report.

It was a bad year for Tesla solar — its worst since 2020.

In Q4 2023, Tesla’s solar deployments dropped 59% year-over-year to 41 MW — down from 100 MW in Q4 2022.

Next to solar, Tesla’s energy generation and storage business is booming (surprise, surprise).

The scale of Tesla’s residential solar business isn’t what it once was.

Tesla’s once-leading solar business is in decline, according to the latest figures from its fourth-quarter 2023 earnings report.

Crucially, the automaker revealed that its solar deployments cratered 36% to a total of 223 megawatts (MW) last year, down from 348 MW in 2022.

In Q4 2023, Tesla’s solar deployments dropped 59% year-over-year to 41 MW — down from 100 MW in Q4 2022.

However, Tesla’s energy generation and storage business is comparatively booming (surprise, surprise).

The company said its 2023 energy storage deployments — which include Powerwall home batteries and utility-scale Megapacks, topped 14,724 megawatt hours (MWh), up 125% from the year earlier.

But because of the country’s naturally dry and biodiverse climate, it’s particularly vulnerable to extreme weather events that have been exacerbated by climate change.

Australia has experienced its fair share of a climate catastrophes, which has only fueled its climate tech startups into action.

The hype for climate tech in Australia is real, as long as it can be sustained.

Local VCs are most excited about the sector this year, with climate and cleantech dominating in funding and deal count in Q3 2023.

In 2022, climate tech in Australia raised $553 million in capital, compared to $338 million in 2021, according to a report from Climate Salad, a community of Australian climate tech stakeholders.