“More big partners kept coming and closing with us, pushing to get on our roadmap,” Betesh told TechCrunch.

Coverdash offers small businesses, e-commerce merchants and freelancers the ability to buy business insurance in areas like business owner’s policies, cyber and worker’s compensation.

Businesses then answer a few questions, select a policy and get coverage in minutes.

That comes with some requirements, like having liability insurance for board directors and company officers and other management, Betesh explained.

“It all kind of fell into place really quickly, and in over two weeks, we had offers from multiple firms.

Media startup Dailyhunt is in advanced stages of talks to acquire the Bengaluru-headquartered social network Koo, two sources familiar with the matter told me.

The potential deal under discussion involves a share-swap agreement and could be finalized within weeks, the sources added, requesting anonymity as the matter is private.

The deliberation follows Koo, which has sought to become a Twitter rival, aggressively hunting for new capital throughout last year.

The social network, available in India and Brazil, is betting on the idea that its approach of supporting multiple local languages will help the eponymous app resonate broadly with the larger masses.

Dailyhunt, which was last valued at $5 billion, and Koo declined to comment.

Dubai-based early-stage venture capital firm COTU Ventures is announcing that it has raised $54 million for its inaugural fund to support startups in the Middle East from pre-seed to seed stages.

Founder and general partner Amir Farha revealed in an interview with TechCrunch that COTU Ventures is inclined slightly towards fintech and B2B software.

Noteworthy investments by COTU Ventures include Huspy, a UAE mortgage platform backed by Peak XV and Founders Fund, and Egyptian fintech startup MoneyHash.

While at Beco Capital, Farha and his partner returned the first fund following Uber’s acquisition of Careem.

By fostering such open dialogue, COTU Ventures aims to establish trust and strong connections with founders, enabling informed investment decisions.

The Qatar Investment Authority (QIA) is launching a $1 billion venture capital (VC) fund of funds for international and regional venture capital funds, the sovereign wealth fund announced on Monday.

Similar to typical fund-of-funds structures, QIA’s initiative will invest indirectly through other VC funds but also make targeted co-investments with participating funds.

These funds, aiming to reduce reliance on oil, have increasingly poured money into tech startups in the region, hoping to nurture a thriving venture capital industry.

However, unlike Jada, the PIF’s $1 billion fund of funds and Saudi Venture Capital (SVC), which targets both venture capital and private equity funds, QIA’s fund of funds focuses solely on venture capital funds, marking the first of its kind in the region.

Historically, these wealth funds have backed foreign startups primarily in the U.S. and Asia, with limited ties to the Gulf region.

Today on The Exchange, we’re digging into continuation funds, counting down through some of our favorite historical Exchange entries, and discussing what we’re excited to report on for the rest of the year!

It is also a very topical one: “The greatest source of liquidity now is going to be continuation funds,” VC Roger Ehrenberg predicted in a recent episode of the 20VC podcast.

If you have been following the last few months of venture capital activity, the “why now?” is easy to answer.

“It’s a viable strategy for a decent swath of the venture industry,” Ehrenberg told 20VC host Harry Stebbings.

We went from tallying monster rounds and a blizzard of IPOs to watching venture capital dry up and startup exits become rarer than gold.

Frost Giant, a venture-backed startup building a real-time strategy (RTS) game called Stormgate, is turning to its community to top up its coffers ahead of the game’s launch this year.

The venture capital market for gaming companies has retreated sharply since Frost Giant last raised money (a $25 million Series A back in 2022).

Thus far, Frost Giant has picked up $611,421 in reservations for its community fundraise on its Start Engine page.

Reg CF offerings are limited to $5 million, so Frost Giant has a hard cap on how much it can raise.

We got a similar peek into Substack’s financials when it raised capital from its community last year, and we’ll get a similar influx of data from Frost Giant.

Ina Herlihy believes e-commerce brands are losing out on organic traffic and potential revenue by relying on third-party community sites, like Reddit and Facebook Groups.

By building an onsite community, brands are able to increase that retention and drive more organic traffic because the community is on their own domain.

In addition, AddGlow integrates with a brand’s catalog so community members can tag products when mentioning them.

“We started partnering with smaller brands, and now we’re building additional functionality to support larger brands, too,” Herlihy said.

Our goal is to foster a safe space for community members to seek personal advice and build meaningful connections.”

Golden Ventures, a Canada-based venture capital firm, closed on over $100 million in capital commitments for its fifth fund targeting high-potential, seed-stage founders working across technologies, including AI, climate, blockchain and quantum.

“This is a continuation of our core thesis and created to be super founder-aligned,” Golden told TechCrunch.

The firm makes both core investments and those that lean more on the angel side.

Over 13 years, Golden Ventures has backed over 100 companies at the seed stage.

Golden Ventures V is backed by a group of existing institutional limited partners, including BDC Capital, ECMC Group, Foundry, HarbourVest Partners, Kensington Capital Partners, Northleaf Capital Partners, RBC, Teralys Capital, University of Chicago and Vintage Investment Partners, and new institutional partner Deloitte Ventures.

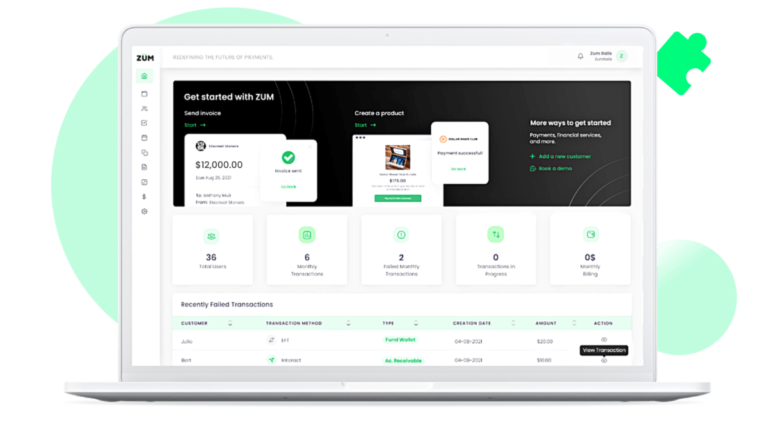

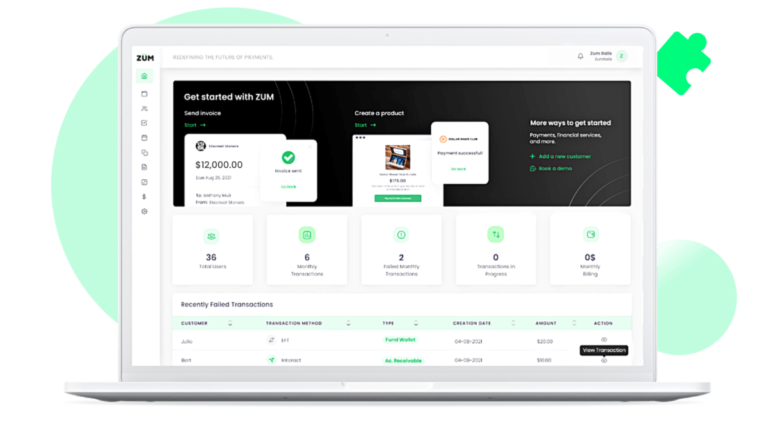

Milewski and Schwartz bootstrapped Zūm Rails, building it up to a team of 30 people.

“We reached the point where we realize that bootstrapping is no longer healthy for our business,” Schwartz told TechCrunch.

In addition, Zūm Rails is working on a FedNow offering in the U.S. that will enable businesses to send and receive FDIC-insured payments within seconds.

Zūm Rails’ performance to date “is really impressive,” Jake Olson, vice president at Arthur Ventures, told TechCrunch.

Any organization that views the streamline digital financial interaction coupled with the instant payments capability as a competitive advantage will be a great fit for Zūm Rails.”

Chris Power, founder and CEO of industrial automation startup Hadrian, is a student of history.

“Never before in history has a declining empire beaten a rising empire, ever,” he said in a recent interview.

He had been running small e-commerce businesses and had been head of sales and marketing at an enterprise software company in Australia.

Construct Capital, WCM, Bracket Capital, Shrug Capital, Lux Capital, A16Z, Founders Fund, S&A, Silent Ventures, Cubit Capital, Caffeinated and other existing investors also participatedc.

Power said some customers expressed interest in alternate models, like having Hadrian build a dedicated facility to ensure committed factory capacity.