AppDirect, a San Francisco- and Montreal-based platform for buying, selling and managing tech through a network of IT advisors, has raised $100 million from CDPQ to expand its financing program for small- and medium-sized tech businesses.

“Our Invest program is purpose-built to empower our technology advisors,” Emanuel Bertolin, AppDirect’s chief revenue officer, said in a statement.

“To keep up with today’s ever-changing market, technology merchants need fast access to capital to accelerate their growth.”AppDirect’s Capital Invest program is a loan program, providing capital for tech businesses in the form of upfront payments.

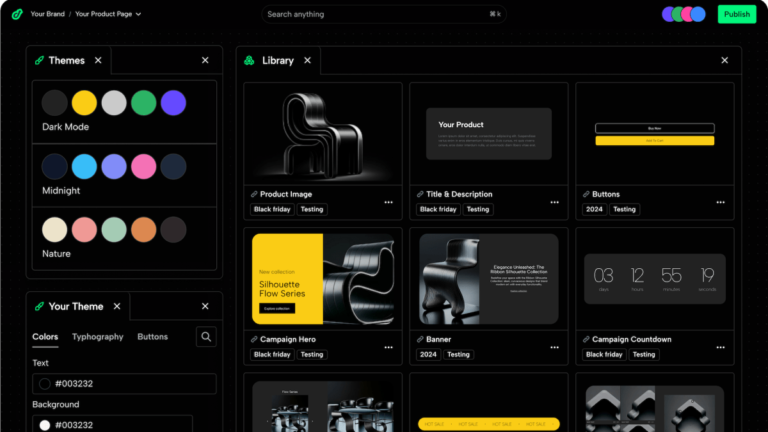

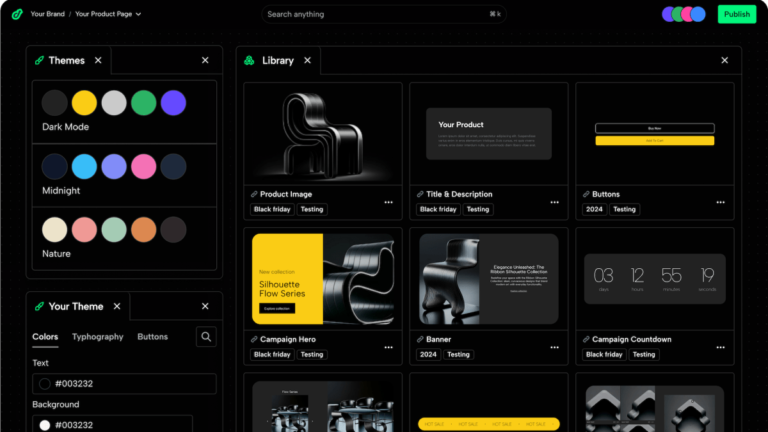

Today, AppDirect offers a set of tools that let businesses monetize — or buy — tech products across a range of different channels and devices.

We also provide the opportunity for our advisor community to procure technology for their customers directly from the AppDirect catalog.”AppDirect launched the Capital Invest program in 2021.

Clients using Deco.cx see, on average, a 5x increase in PageSpeed score and a 30% increase in conversion rates, Crespo said.

Deco.cx signed over 65 clients, including Brazilian retail brands Grupo Reserva, Osklen and Zee.Dog.

It also amassed a community of more than 2,400 web developers and 36 system integration partner agencies.

He also wants to grow the company by bringing on additional engineers so Deco.cx can go into new markets, particularly the United States.

“We want to be the first choice for the next 10 million web developers who don’t want to spend our time connecting pipes.”

Governance, risk management and compliance — GRC for short — remains one of the most active startup areas in terms of VC investments.

GRC helps organizations better manage risk while staying in compliance with regulations — and there’s an increasing number of regulations to worry about.

“Anecdotes is redefining compliance and risk management by transforming it from a labor-intensive task with skyrocketing associated costs into data-oriented processes.”Anecdotes’ platform automatically collects GRC-related “artifacts” (i.e.

Anecdotes’ competitors include VComply, a risk and compliance management startup that’s raised over $10 million in venture capital so far, and Cypago, which aims to automate compliance and governance for companies.

Kuznitsov asserts that Anecdotes is well-positioned, though, with around 100 customers including Snowflake, Coinbase SoFi, Grafana and Payscale.

All eyes are on United Launch Alliance and Pittsburgh-based startup Astrobotic this week, with the two companies gearing up for inaugural missions with huge stakes.

The launch features two firsts: the first flight of ULA’s Vulcan Centaur rocket, and the first time Astrobotic is attempting to put hardware on the moon.

If Astrobotic is successful, it would be the first time a private company has put a spacecraft on the moon.

Countdown Capital, an early-stage venture capital firm focused on hard tech industrial startups, will shut down by the end of March and return uninvested capital, firm founder and solo general partner Jai Malik said in an annual letter.

In addition to the ULA/Astrobotic launch mentioned above, this past week also saw the launch of the first six Starlink satellites equipped for direct-to-cell connectivity.

Venture debt has its merits.

That’s why it’s interesting that startup finance company Arc Technologies is choosing now to take on the $30 billion venture debt industry with a venture debt marketplace for Silicon Valley.

There’s a larger pool of debt capital that’s now available to these companies because they’re stronger and more resilient.

That’s what Arc is solving with its Arc Capital Markets debt marketplace.

“We want to help founders and CFOs weather the ongoing storm in the venture capital funding route and ensure that they’re continuing to grow efficiently with minimal dilution.”

The following is a compilation of 12 “dos and don’ts” for how innovators should pitch and partner with a new class of technology venture investors who balance market realism with optimism in driving a vision with substance.

Early-stage venture capital requires a team effort to find product-market fit and accelerate revenue growth.

DON’T give upLike many activities in the startup world, success finds those who have grit, courage, persistence, durability, and adaptability.

Venture capital often finds nonconsensus and nonobvious deals, but the process may take hundreds of meetings before the first yes.

Almost every company is better serviced by not raising venture capital and instead relying on profitable growth and other sources of capital.

CES 2024 or bust, Superpedestrian e-scooters hit the auction block and Fisker struggles to meet sales goalsThe Station is a weekly newsletter dedicated to all things transportation.

I appreciated a bit of rest and recovery, just in time for CES 2024.

The Big Three U.S. automakers (Ford, GM and Stellantis) won’t have big splashy displays and announcements as in past years.

However, there will be plenty of automotive, and more broadly, transportation companies and startups in attendance.

Shell Ventures, InMotion Ventures, Porsche Ventures, and Revo Capital also participated.

New fundsWe started the year with news of a couple new venture funds that will be writing checks into fintech startups.

I had the pleasure of interviewing Ruth at TechCrunch Disrupt 2022 and was impressed with her knowledge and insights around venture capital.

Back in October, I reported on this after speaking with Synapse, which operates a platform enabling banks and fintech companies to easily develop financial services, and Evolve.

— Mary AnnMeanwhile, Mary Ann looked back at the biggest fintech hits and misses of 2023.

Among the fintech companies were Braid, Daylight and ZestMoney.

Even though news of potential interest rate cuts has led to optimism that the IPO window might reopen and things might improve in Startup Land, it appears the global venture capital market has yet to level-out: Early data from PitchBook indicates global VC investment in startups continued to slide in the fourth quarter of 2023.

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

While things are down sharply in the United States compared to the heady days of 2021, investment trends seem to have largely reached a new normal — U.S. startups raised $37.5 billion in Q4 2023, which wasn’t much less than the $37.6 billion they raised in Q2 2023 and $39.8 billion in Q4 2022.

In contrast, here’s what’s happening globally:We are still going down, folks!

Hopes that it would become easier for startups to raise capital in 2023 were left unmet as the year ended.

The Exchange explores startups, markets and money.

New data from business database PitchBook paints a modestly dim picture of venture capital investment activity in the fourth quarter of 2023.

Per PitchBook’s preliminary count, startups in the U.S. raised 2,879 rounds worth about $37.5 billion in the fourth quarter — the lowest quarterly deal value since Q3 2019, and the lowest deal count since Q4 2017.

Across stages, venture capital investment activity in the United States is flagging, and this extends past aggregate figures — for example, we saw less total capital invested in U.S. startups last year than in 2020.