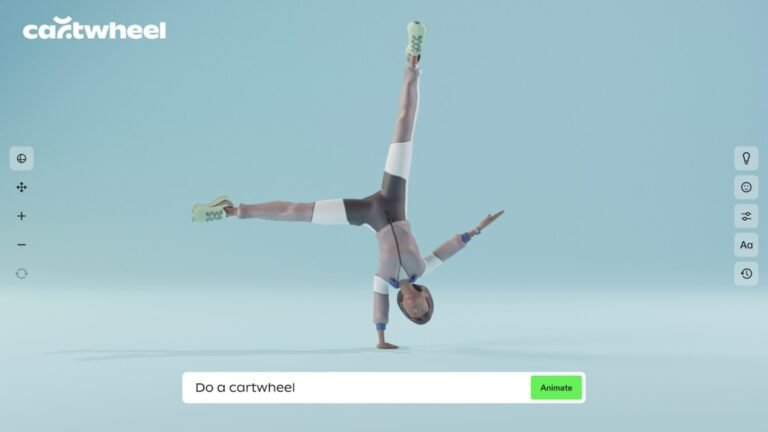

Animating a 3D character from scratch is generally both laborious and expensive, requiring the use of complex software and motion capture tools.

Cartwheel wants to make basic animations as simple as describing them, generating a basic movement with AI and letting creators focus on more expressive tasks.

There’s a lot of value in just quickly getting it out of your head and moving.

“There’s this notion of AI replacing creative work, and as someone who does creative work, it’s like… no!

This leads to more animation, more motion, one person doing more,” said Jarvis.

Welcome to TechCrunch Fintech!

This week, we’re looking at how two fintech companies serving the underserved are faring, and more!

The big storyPayJoy is an example of a company with positive unit economics and a mission to help the underserved.

It last raised a $50 million Series C funding round in 2021.

And with fintech funding on the decline, this could perhaps partly explain YC’s lack of LatAm interest.

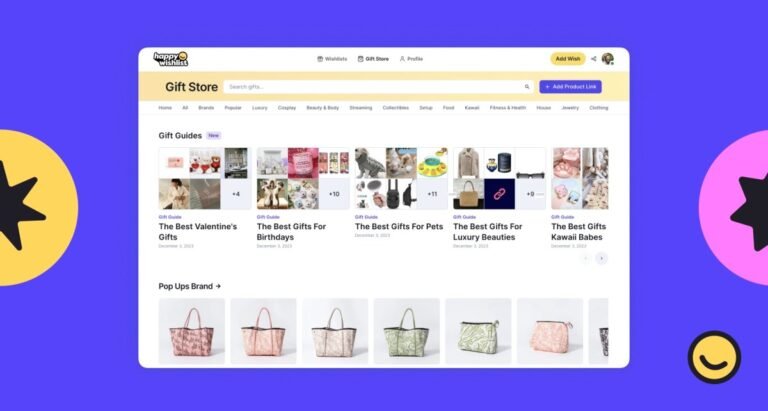

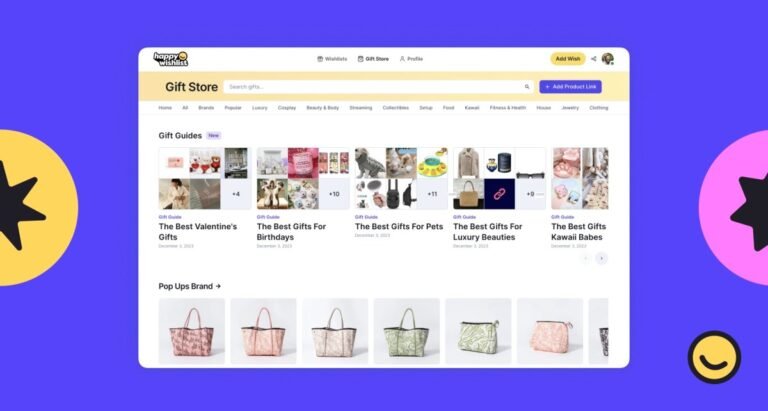

Throne, which lets fans gift items to creators from their wishlist, is launching a new gifting portal for family and friends called Happy Wishlist.

The co-founders started exploring the idea of Throne when some of their creator friends talked about issues like creating a P.O.

Fans can gift creators items from that list.

While the company was about to raise Series A, it decided to turn towards profitability and returned the investor money by December 2023.

Essentially, Throne is diversifying its revenue sources already — instead of raising money, it wants to make money.

In the face of recent economic downturns and fears of a startup bubble-burst, it may be surprising to hear that startups are faring better than you might think.

I’ve been talking to a bunch of founders who are struggling to raise funding — and that is a real problem — but there are some startups that focus on the business fundamentals that are still thriving.

Looking at the numbers, this presents as an uptick in median runway length, a decrease in operating expenses, and an encouraging rise in profitable revenue.

This is founders focusing on being more efficient,” Healy Jones, VP of financial strategy at Kruze Consulting, told me.

It now stands at an impressive 12.5 months, significantly higher than the nine to 10 months usually expected after an average funding round.