Gorilla, a Belgian company that serves the energy sector with real-time data and analytics for pricing and forecasting, has raised €23 million ($25 million) in a Series B round led by U.S. venture capital firm Headline.

Founded in 2018, Antwerp-based Gorilla works with energy providers across Europe, the U.S. and Australia, including British Gas’ parent Centrica, Shell Energy, and Atlanta, Georgia-based Gas South.

Throw into the mix geopolitical factors such as the Russia-Ukraine conflict, ever-evolving regulations, increasingly distributed energy sources across fossil and renewables, and the increasing use of connected technology, and we now have fertile ground for data-focused energy startups to flourish.

“No one knows what the energy sector will look like 10 years from now,” Gorilla’s co-founder and CEO, Ruben Van den Bossche, said in a statement.

Other participants in the round include the startup’s existing investors Beringea and Belgian private equity firm, PMV.

When you’re looking for a startup idea that could slow climate change, you might become an expert at home energy assessments.

Instead, the startup has put together a small team of engineers to create its own AI model specialized in home energy assessments using machine learning.

The company uses open data, such as satellite images, as well as its own training data set with millions of photos and energy assessments.

In the company’s first tests, its home energy assessments have been accurate within 5% of old-fashioned assessments.

The startup has now raised €4.7 million ($5.1 million at today’s exchange rate) with Racine² leading the round and a non-dilutive investment from Bpifrance.

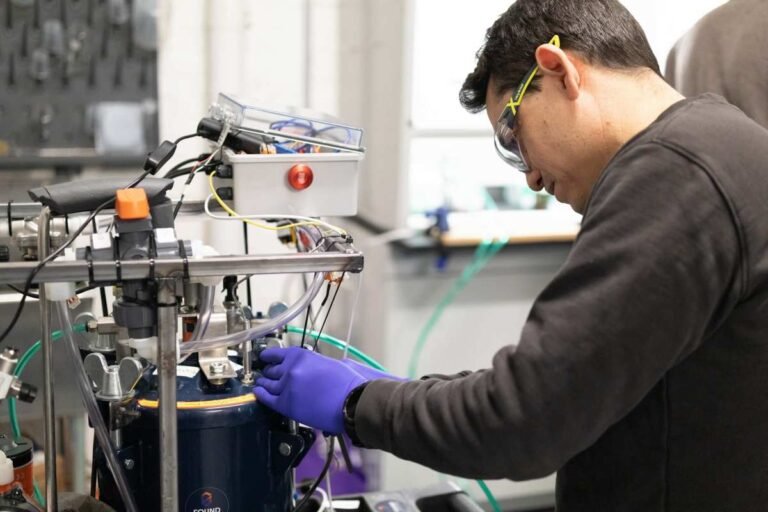

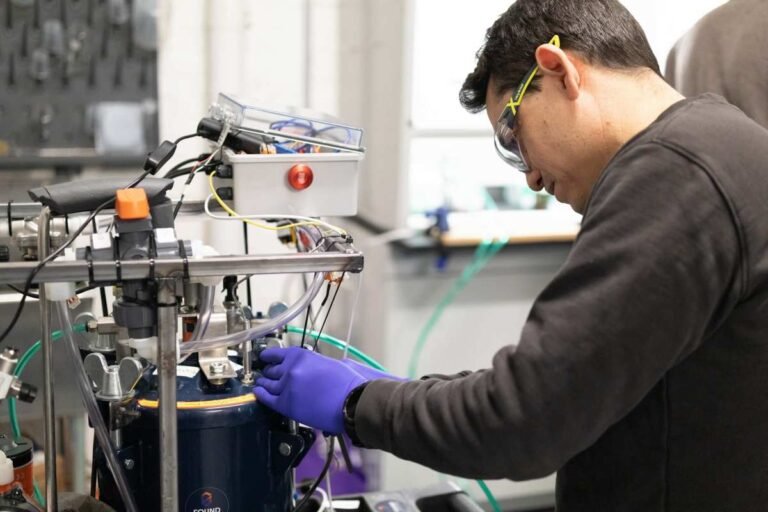

The aluminum used to make the spacecraft held more than 10 times the energy of any cutting-edge battery.

To release the energy embodied in refined aluminum, Godart had to figure out how to get past the metal’s defenses, so to speak.

“One of the hardest elements of heavy industry to decarbonize is the heat,” Godart said.

Aluminum is slightly heavier than diesel or bunker fuel, but its energy density could be game changing for those industries.

One could imagine future ships powered by aluminum dropping their waste powder off at a smelter to be refueled for a return voyage.

Currently, Exponent Energy has 60 charging stations in six cities: Delhi-NCR, Bengaluru, Chennai, Ahmedabad, Kolkata and Hyderabad.

Vinayak told TechCrunch that Exponent Energy’s charging stations offer 10x efficiency by charging 20 to 30 vehicles daily, whereas other EV charging stations typically charge two vehicles.

Similarly, setting up an Exponent charging station costs nearly $6,000 (500,000 Indian rupees), while a CNG station demands hundreds and thousands of dollars.

This has restricted the availability of CNG to around 60 stations in Bengaluru, while Exponent Energy already has 40 charging stations in the city, the executive said.

It is also looking to deploy its charging tech on electric buses in India later this year.

Venture capitalists’ appetite for fusion startups has been up and down in the last few years.

The road to true fusion power remains long, but the kicker is that it’s no longer theoretical.

He added the timeline was to be able to get to fusion energy by the mid-2030s.

If we manage to get to that then the middle of the 2030s is possible.”The startup’s investors are equally convinced.

And there are at least 43 other companies developing nuclear fusion technologies.

Alsym wants to ‘light up homes for a billion people’ with its new batteryLithium-ion batteries have transformed the global economy, making possible everything from smartphones and laptops to electric vehicles, e-bikes, and more.

With the advent of cheap solar, making electricity has never been cheaper or easier.

The electrolyte is water-based, a departure from the flammable organic solvents used in lithium-ion batteries.

Alsym also says its batteries will be cheaper than lithium-ion, thanks to the less exotic materials and simpler packs.

Ultimately, it will partner with existing battery manufacturers, since Alsym’s batteries can be produced using existing equipment.

For years, the solar energy sector has grappled with interseasonal energy storage.

The claim is this tech does the storage more cost-effectively than any battery or liquid hydrogen solution on the market.

It enables hydrogen storage at densities approximately 50% greater than liquid hydrogen, presenting a significant advancement in hydrogen storage solutions.

A robust, reusable energy storage solution could bridge these timings, ensuring a stable energy supply when these renewable sources encounter unavoidable intermittent periods.

The firm certainly has investors’ attention: Photoncycle just raised $5.3 million (€5 million) to build its first few power storage devices in Denmark, which Photoncycle has chosen as its test market.

Nearly everything else that’s being built on or enabled by blockchains replaces something that’s already being done fairly well.

Yes, there are companies that facilitate crypto trades like Coinbase and Block (formerly Square).

But there’s no actual company that’s developed economic value by doing something brand new or better on a blockchain.

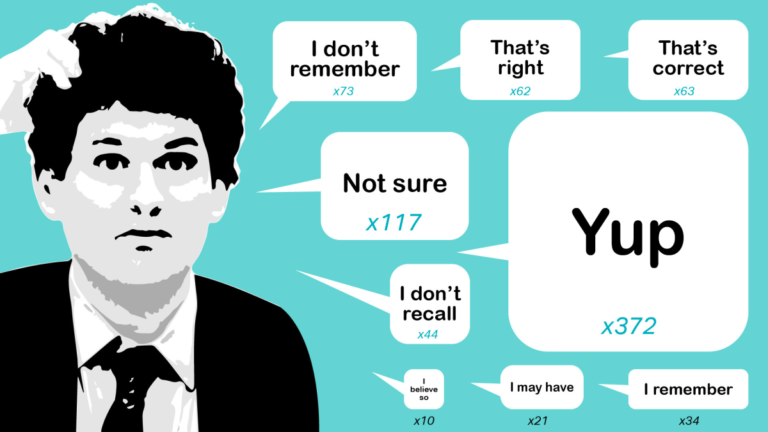

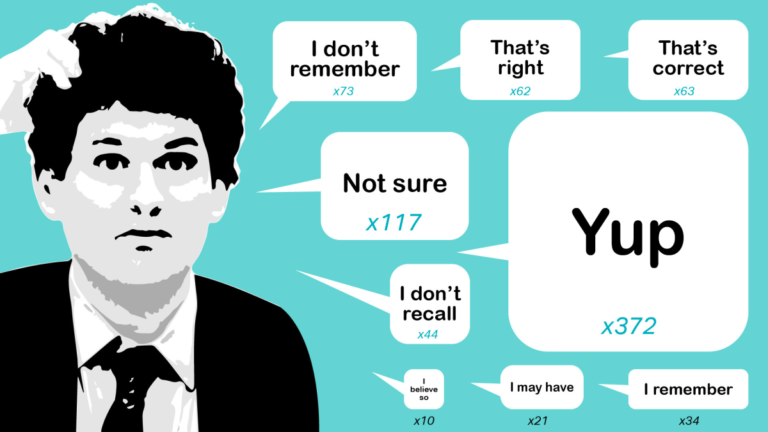

Energy drives the real-world economy, and unless Sam Altman or somebody successfully unlocks fusion and delivers energy that’s truly “too cheap to meter,” it’s going to remain a real asset with real value for some time.

In fact, it wouldn’t surprise me in the least if Satoshi had some kind of connection to the energy industry.

That’s one way to think about direct air capture, a technology which uses machines to pull carbon dioxide straight from the atmosphere.

The ability to use heat from geothermal energy, Cyffka said, is helpful.

Geothermal is a really promising pathway for where DAC needs to go.”Along those lines, the company is working with Fervo, pairing its carbon capture system with the geothermal startup’s advanced geothermal project in Utah.

In 2026, AirMyne is planning to deploy its carbon capture technology to a sequestration site in San Joaquin County, California, where it will be injected underground.

Still, the demand for carbon capture is likely to be so large that the market will have space for several different companies.

Draijer said the company started off as an installer of solar panels in Spain, but after the pandemic, it decided it should offer a solar energy management system.

“Solar is not a product,” Draijer said, explaining why most Spaniards can’t or just don’t want to pay upfront for solar panels.

That’s why SolarMente offers subscription-based energy management services, which include installing solar panels without upfront costs.

“We’re using this round to really power our super app for home energy,” Gardrinier said.

But first, SolarMente wants to further expand across Spain, where its subscription solar offer just became available nationwide, Draijer told TechCrunch.