TechCrunch has kept readers informed regarding Fearless Fund’s courtroom battle to provide business grants to Black women.

Today, we are happy to announce that Fearless Fund CEO and co-founder Arian Simone will speak at the Disrupt 2024 Builders Stage in a fireside chat discussing her organization’s fight for racial equity.

This June, an appeals court ruled that Fearless Fund’s business grant likely violates Section 1981 of the Civil Rights Act of 1866 and has banned the grant’s deployment indefinitely.

Fearless Fund is one of many organizations facing the heat for having programs focused on diversity, equity, and inclusion.

Register for your Disrupt pass today and join 10,000 tech leaders for 3 days of startup innovation this October.

What is worth $11 billion and wants to go to Mars to collect rocks?

NASA’s mission to Mars to collect rocks that was expected to cost $11 billion and take ages.

So, the U.S. space agency is throwing the doors open to get more input, and that means that startups are looking at an opportunity that is truly out of this world.

To close, the massive, gobsmackingly big $7.2 billion worth of new funds from a16z.

For the full interview transcript, for those who prefer reading over listening, read on, or check out our full archive of episodes over at Simplecast.

Shakeeb Ahmed, a cybersecurity engineer convicted of stealing around $12 million in crypto, was sentenced on Friday to three years in prison.

In a press release, the U.S. Attorney for the Southern District of New York announced the sentence.

Ahmed was accused of hacking into two cryptocurrency exchanges, and stealing around $12 million in crypto, according to prosecutors.

While the name of one of his victims was never disclosed, Ahmed reportedly hacked into Crema Finance, a Solana-based crypto exchange, in early July 2022.

In the case of Nirvana Finance, the stolen funds “represented approximately all the funds possessed by Nirvana,” which led Nirvana Finance to shut down, according to the press release.

Cendana, Kline Hill have a fresh $105M to buy stakes in seed VC funds from LPs looking to sellIf you ask investors to name the biggest challenge for venture capital today, you’ll likely get a near-unanimous answer: lack of liquidity.

Cash-hungry venture investors, whether VCs themselves or their limited partners are increasingly looking to sell their illiquid positions to secondary buyers.

“We simply passed the hat around to our existing LPS at Kline Hill and Cendana,” said Kim.

It then passes these opportunities to Kline Hill, which values, underwrites and negotiates the transaction price.

Traditional secondary investors, such as Lexington Partners and Blackstone, recently raised their largest secondary funds ever.

In a move implying that the launch went well, JFFVentures today unveiled its second fund, JFFVentures Fund II, with a target of $50 million.

So how is JFFVentures Fund II planning to avoid these pitfalls?

Well, Raja says, while the fund is operationally independent from JFF, JFFVentures Fund II will benefit from the wider JFF community, including its connections with government, corporate, education and nonprofit partners.

“We’ve committed in our fund docs that at least 50% of Fund II founders will identify as underrepresented in terms of founder backgrounds,” he said.

Kerszenbaum pointed to JFFVentures’ inaugural fund performance as evidence Fund II can succeed, though.

But it’s unlikely that startups’ fundraising slog will become much easier soon, mostly because of venture capitalists’ own capital-gathering challenges.

In Q1, U.S. VC funds raised only $9.3 billion, according to PitchBook data.

At this pace, VC fundraising will end 2024 at just above $37 billion, the lowest capital raised since 2013 and a 54% decline from last year.

PitchBook estimates that dry powder, the amount of capital VCs still have to invest from previous funds, remains high.

“One low fundraising quarter is not going to make or break the future of VC,” said Kyle Stanford, lead venture capital analyst at PitchBook.

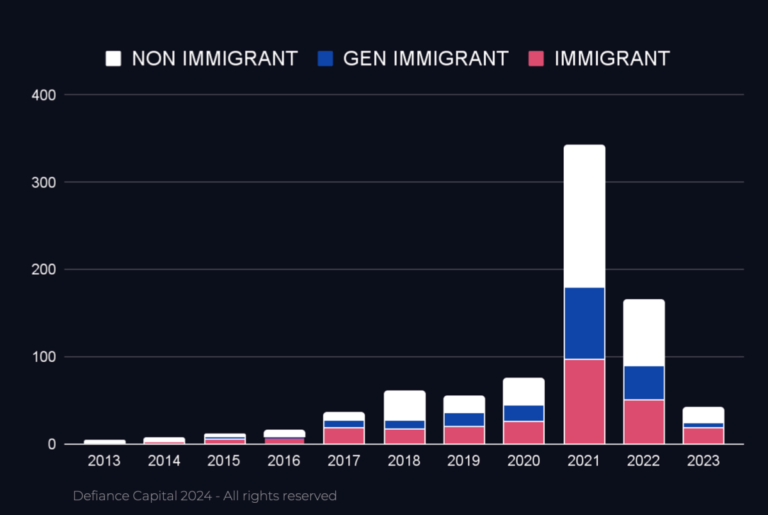

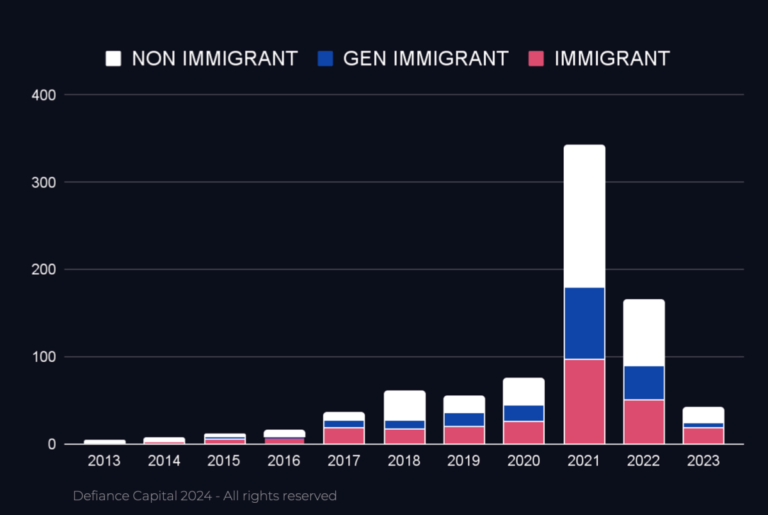

The study (“Unicorn Founder DNA Report) by Defiance Capital of 845 unicorns and 2,018 unicorn founders set out to look at the “DNA” of unicorn founders, concentrating on the US and UK (no EU/European) from 2013 to 2023, to define the common traits of these kinds of founders.

During the last decade, all top Seed funds were generalist funds, and the market for Seed funds is highly fragmented.

Only 34% of unicorn founders had worked at an elite employer prior to founding a unicorn, suggesting a McKinsey or similar background is not a prerequisite to success.

Dorffer, who intends now to produce a podcast with many of the unicorn founders surveyed, said: “The stories that are coming out show crazy determination.

As a female founder, you have to work twice as hard and take twice as many meetings to raise the money.

The negotiations between Fisker and a large automaker — reported to be Nissan — over a potential investment and collaboration have been terminated, a development that puts a separate near-term rescue funding effort in danger.

Fisker revealed in a Monday morning regulatory filing that the automaker terminated the negotiations on March 22.

Fisker said in the filing that it will ask the unnamed investor to waive the closing condition.

In February, Fisker laid of 15% of its staff (around 200 people) and last week reported having just $121 million in the bank.

Fisker had held talks with other automakers, including Mazda, but only Nissan recently remained at the table.

Rails, a decentralized crypto exchange, has raised $6.2 million in attempts to fill the void FTX left behind after crashing in 2022, the startup’s co-founder and CEO Satraj Bambra exclusively told TechCrunch.

The crypto community is watching Rails because it’s attempting to straddle the divide in crypto exchanges by building out both centralized and decentralized underlying technology.

The capital is earmarked for engineering team hiring and expanding its licensing and regulatory strategy to make the exchange “fully compliant,” Bambra said.

That centralized computing was something Rails saw with FTX as “being really, really good,” but when it came to decentralized exchanges like dYdX that exist today it wasn’t as solid, Bambra thinks.

But being a hybrid of decentralized and centralized is better than being fully one side or another, he added.

LACERA decreases venture capital allocation range, but experts say it doesn’t signal a trend Analysts say this is likely more of a one-off than a sign that LP interest in venture is waning.

The Los Angeles County Employees Retirement Association (LACERA) voted to decrease its allocation range to venture capital at a March 13 meeting.

The board of investments voted to decrease its allocation range to venture capital and growth equity from between 15% and 30% of the pension system’s private equity portfolio, to between 5% and 25%.

LACERA’s venture portfolio is currently 10.8% of the PE portfolio.

“They aren’t going to cut their venture allocation.