This week, we’re looking at Robinhood’s new Gold Card, challenges in the BaaS space and how a tiny startup caught Stripe’s eye.

BaaS startup Synctera recently conducted a restructuring that affects about 15% of employees.

The startup is not the only VC-backed BaaS company to have resorted to layoffs to preserve cash over the past year.

MassMutual Ventures also participated in Qoala’s new $47 million round of funding.

It has more primary customers than ChaseInside a CEO’s bold claims about her hot fintech startup, which TC previously covered here.

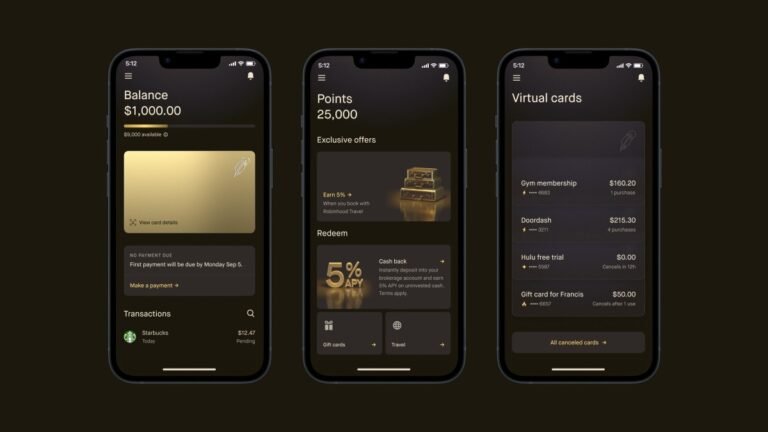

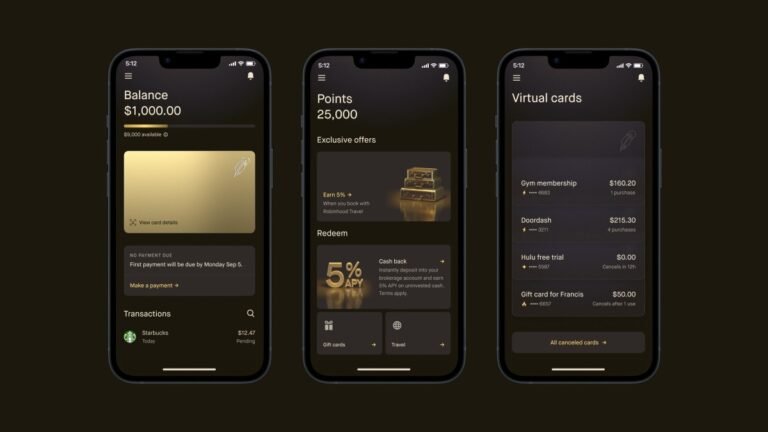

Robinhood’s new credit card was revealed Tuesday, and though it’s only available for Robinhood Gold members, the Gold Card does have a feature that’s spurring headlines: the ability to invest cash back bonuses into investments.

But what gives with tech companies getting into the consumer credit game?

You could argue that Robinhood’s choice to offer a card is just an extension of its already-expanding portfolio of financial products.

But Apple also has a card, recall.

And the tech giant is getting deeper into the realm of personal finance as time goes along.

Robinhood’s new credit card goes after Apple Card with ability to invest cash-back perksEight months after acquiring credit card startup X1 for $95 million, Robinhood announced today the launch of its new Gold Card, with a list of features that could even give Apple Card users envy.

Apple, for instance, offers 3% cash back on all purchases made at Apple, and on purchases made at select merchants when using the Apple Card with Apple Pay.

In general, purchases made on Apple Card with Apple Pay earn users 2% back.

It’s why we started Robinhood…” Robinhood co-founder and CEO Vlad Tenev said in a written statement.

“Today’s announcements…bring us one step closer to the goal of giving everyone better access to the financial system.”Robinhood Gold Card, explained:What are the requirements to apply for a Robinhood Gold Card?

Eight months after acquiring credit card startup X1 for $95 million, Robinhood announced today the launch of its new Gold Card, with a list of features that could even give Apple Card users envy.

However, it will only be available for Robinhood Gold members, which costs $5 a month, or $50 annually.

Apple, for instance, offers 3% cash back on all purchases made at Apple, and on purchases made at select merchants when using the Apple Card with Apple Pay.

The new credit card is part of Robinhood’s evolving business model and offerings over the years.

Gold Membership, a requirement to get the Gold Card, increases the eligible match to up to 3% match.

Welcome to the TechGround Exchange, a weekly startups-and-markets newsletter. The TechGround+ column is inspired by the daily TechGround column where it gets its name and it’s one of my favorite…