Discover the forefront of hard tech innovation in an exclusive session sponsored by HAX at TechCrunch Early Stage 2024.

Duncan and Susan will share insights into HAX’s investment philosophy and the exciting opportunities they see in hard tech sectors.

TechCrunch Early Stage 2024 is your opportunity to engage with the leaders shaping the future of hard tech.

Join HAX at TechCrunch Early Stage 2024 and be part of the movement driving meaningful change in hard tech innovation — buy your tickets now before prices go up at the door.

Is your company interested in sponsoring or exhibiting at TechCrunch Early Stage 2024?

Wen Hsieh and Haomiao Huang, both Kleiner Perkins investors, left the firm in 2023 to start their own venture capital fund called Matter Venture Partners.

The median venture fund raised that year was around $37 million, according to a PitchBook-NVCA Venture Monitor report.

Matter Venture Partners invests at the large seed rounds, Series A and Series B.

He believes that Matter Venture Partner’s focus on hard tech was the reason for the oversubscription.

We like to fund them and entrepreneurs that contribute to these new innovations.”So far, Matter Venture Partners invested in six companies not made public yet.

Stell, a two-year-old software startup, is focused on this latter part of the engineering ecosystem.

The company has developed a tool for requirements management that allows teams to track, verify and validate requirements on complex projects.

She founded Stell in 2022 with Anne Wen, a professional with experience in venture capital and getting space startups off the ground.

They imagined something different: a tool that was truly useful and user-friendly, that cut down on paperwork, and that engineers would actually want to use.

People might not have time to go to a two-week training on how to use a tool,” McLemore said.

A few years ago, setting up shop in Europe was the soup du jour for North American VCs.

North American VCs, understandably, want a piece of that market, but setting up a successful, long-term strategy in the region hasn’t proved easy.

The European startup market comes with nuances that make it a difficult one for North American investors.

It’s no wonder then that North American investors have struggled to find a secure footing as they try to straddle the Atlantic.

The American guys will enter anyway at the Series A or B.”Reason to keep tryingDespite all those challenges, though, North American firms are still trying to plant roots in the region.

When HPE announced its intention to acquire Juniper Networks for $14 billion in cold, hard cash earlier this month, it was a bit of a shock.

In fact, in a blog post announcing the deal, Juniper CEO Rami Rahim suggested it was more about AI.

“This combination with HPE is expected to enable us to deliver more comprehensive, more competitive, truly end-to-end experience-first AI-native solutions,” he wrote.

Assuming regulators don’t object — not exactly a given these days — this deal could close later this year or early next.

Since the deal was announced on January 12, HPE investors seem lukewarm about it; that is, if the stock price is any indication of their sentiment.

Consumer tech is bound for a comeback among unicorns, but maybe not just yetTen years after Cowboy Ventures’ founder Aileen Lee gave unicorns their nickname, she and her team are back with fresh analysis on private companies worth more than $1 billion.

As the number of unicorns boomed from 39 to more than 532, Cowboy found that their very nature also changed.

“The pendulum swung hard to enterprise, with 78% of unicorns today focused on B2B, the inverse of 2013,” Lee and her team member Allegra Simon wrote.

But spending more than a decade in tech teaches you something: to be ready for the pendulum to swing back.

Hence Cowboy’s prediction that “given the hard shift to enterprise,” we can “hope and expect more exciting consumer unicorns will be born in coming years.”

When was the last time you watched an automotive company wax poetic about diesel engine controllers for Class 8 trucks?

It’s true that Hyundai has invested in hydrogen fuel cells for decades, but it has also been one of the more successful legacy automakers at navigating the electric transition.

It’s odd that a company with so much momentum on its side would throw a hydrogen Hail Mary.

But maybe Hyundai’s EV rollout isn’t going as planned.

Enter hydrogen, a sector with a green aura about it, a useful distraction from more polluting realities.

Welcome to the TechCrunch Exchange, a weekly startups-and-markets newsletter.

It’s inspired by the daily TechCrunch+ column where it gets its name.

This week, I’m reminded that democracies are fragile but that technology can help.

On a side note, this newsletter will be taking a break until January 6 next year, so wishing you all happy holidays.

— AnnaWhy agentic tech?

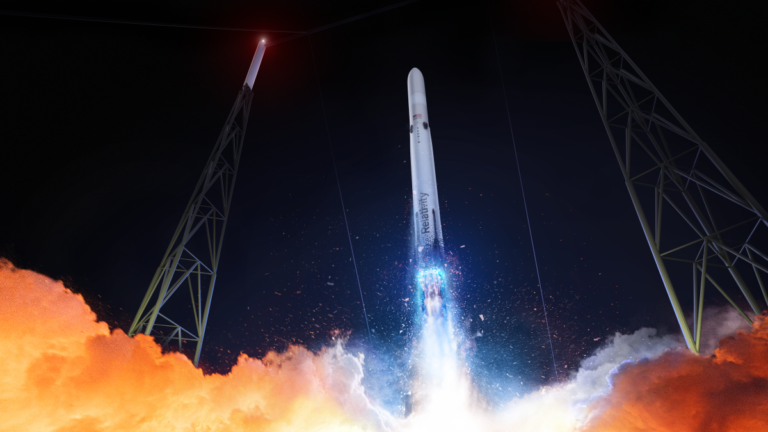

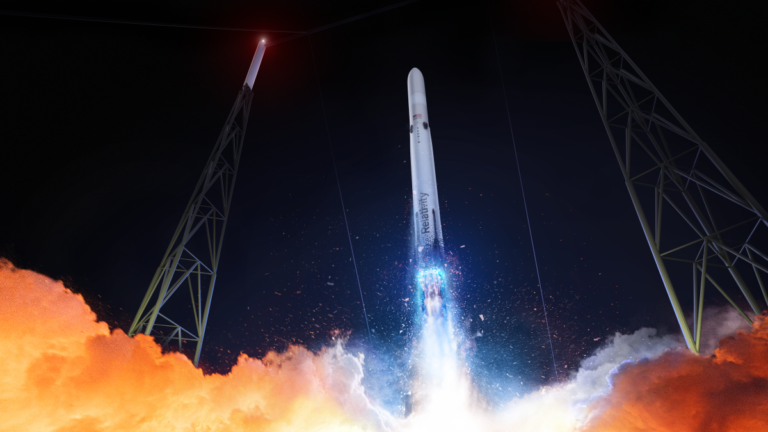

The retirement of Terran 1 is a loss for spaceflight, as it was the first and only rocket designed specifically for conducting space missions. However, the retirement of Terran 1…

Startups and markets are two of the most interesting things to watch on the planet. They are constantly changing and evolving, which allows for exciting new opportunities for those that…