If death and taxes are inevitable, why are companies so prepared for taxes, but not for death?

In the immediate aftermath of Linder’s loss, founding a company would have been a long shot.

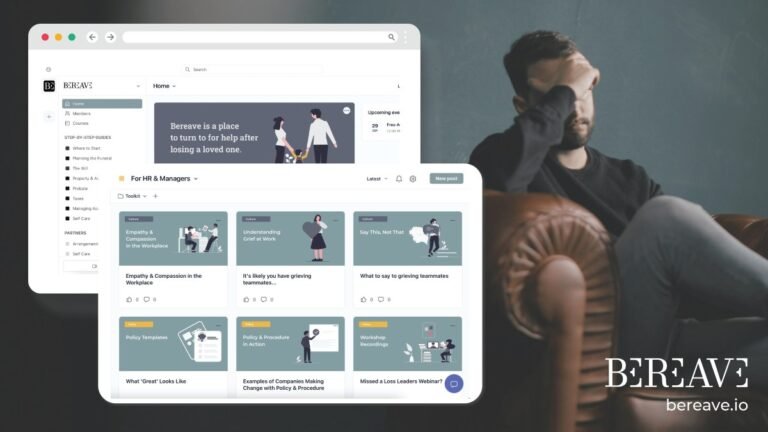

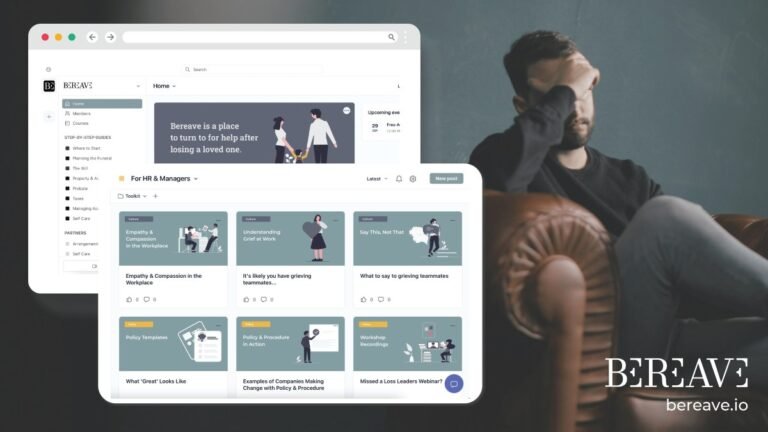

So Bereave built a B2B product to sell to employers, which they can offer their employees in times of need.

The platform catalogs resources for people experiencing loss, walking them through the steps of closing out a loved one’s affairs.

Tall Poppy, a company that offers digital safety guidance for employees navigating online harassment and hacks, also uses step-by-step checklists.

HR startup Rippling is in discussions to raise at a $13.4B valuation, up from $11.25B The round could total $870M, including $670M worth of secondaryLate stage HRtech startup Rippling is raising new capital.

This will be Rippling’s Series F, and could raise its valuation to as high as $13.4 billion on a post-money basis, up from the $11.25 billion valuation it reached when it last raised capital in a $500 million Series E just a year ago.

Rippling had raised $1.2 billion total previous to this round.

Rippling competitor Gusto told TechCrunch that it reached $500 million in trailing revenue last year, along with cash flow positivity.

Earlier this year Deel, which focuses on payroll for teams that cross borders, said that it had reached $500 million worth of annual recurring revenue.

Seso was founded five years ago to help streamline that process and now looks to expand into a one-stop-shop HR platform for the agriculture industry.

Michael Guirguis co-founded the startup after his cousin asked for his advice on whether or not her organic farm should expand.

Once he started talking to potential farm customers, he realized that farms could use a lot more help with their HR beyond just finding workers.

“When it comes to the back office, every farm we visited had thousands of filing cabinets,” Guirguis said.

“Your HR team is in the back office doing traditional HR work,” Guirguis said.

Remofirst raises $25M to take on Deel and Rippling in the global HR tech spaceIn the world of HR tech startups, there are the Davids and the Goliaths.

Deel and Rippling are the Goliaths, both having raised millions of dollars in venture capital.

But Remofirst, which just secured $25 million in Series A funding, is proving to be a very worthy David.

Remofirst, an HR tech startup, touts that it hires its clients’ employees and contractors in more than 180 countries on their behalf without those companies having to set up local entities.

“We see SMBs as an underserved segment of the market,” Serik told TechCrunch.

On Tuesday, the HR startup announced it is acquiring African-based payroll and HR software and services company PaySpace in a deal that marks its largest acquisition to date.

Financial terms of the PaySpace acquisition were not disclosed.

Separately, San Francisco-based Deel also revealed Tuesday that it has crossed $500 million in annual recurring revenue (ARR), organically, outside of this acquisition.

With the various buys, Deel claims that it now owns the full HR stack — entities, local teams (legal, HR payroll), and local payroll engines — across six continents.

Theirs is one of the best technologies we’ve ever seen … We had to do a lot of convincing.”In a written statement, PaySpace Director Clyde van Wyk said: “Like PaySpace, Deel strives to evolve its offering through disruption.

Consolidation is afoot in the world of HR services, with larger players snapping up interesting, smaller startups en route to more robust unit economics and providing one-stop shops for customers looking to cut down on suppliers.

In the latest development, Deel — the $12 billion HR business out of Paris — is scooping up Zavvy, a Munich-based AI-based “people development” startup building tools for personalized career progression, training, and performance management.

Finally, Deel will also make its existing Deel HR tool, which was free for organizations of up to 200 users, now “free” for existing customers regardless of their size.

Originally Deel approached Zavvy with a partnership proposal before making an offer to buy it outright.

By Zavvy’s and Deel’s accounts, the former company has not found it hard to build its business in a tighter market.