Quibi founder Jeffrey Katzenberg ultimately blamed the COVID-19 pandemic for the failure of his short-form video app, but maybe it was just too soon.

In the first quarter of 2024, 66 short drama apps like ReelShort and DramaBox pulled in record revenue of $146 million in global consumer spending.

In March 2024 alone, consumers spent $65 million on short drama apps, a 10,500% increase from the $619,000 spent in March 2023.

In Q1 2024, short drama apps were installed nearly 37 million times, up 992% from 3.4 million in Q1 2023.

Short drama apps claimed a 6.7% share of the total across all three categories combined, up from 0.15% a year ago.

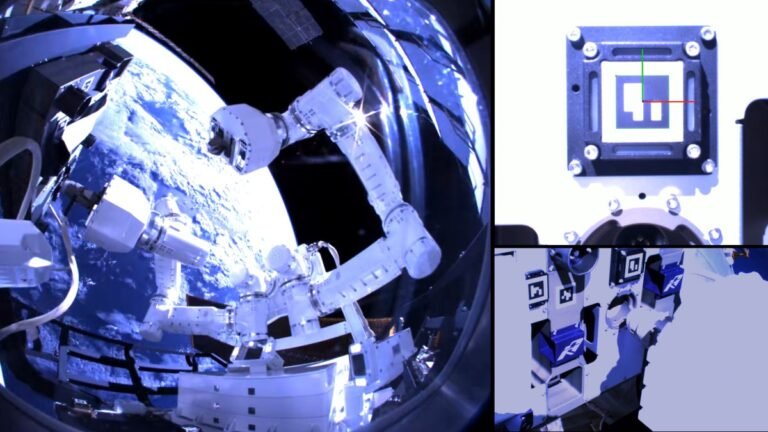

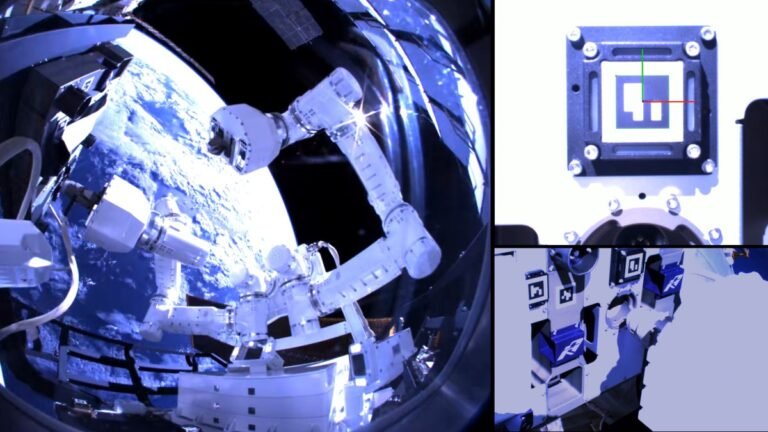

Los Angeles-based Gitai said Tuesday that its autonomous robotic arm has nailed a tech demonstration outside the International Space Station.

Autonomous robotic systems still have a ways to go before they render human labor obsolete, especially here on Earth; but in space, human labor is expensive (and dangerous), which provides an opening for a robotic alternative.

The 1.5-meter autonomous robotic arm, which the startup calls S2, launched to the ISS aboard a SpaceX Falcon 9 in January.

In the nearer term, the company is targeting on-orbit satellite servicing for spacecraft in low Earth orbit and geostationary orbit.

The arm’s technology readiness level (TLR), a standard used by NASA to chart the maturity of technology, is now at 7, the highest level, Gitai said.

For example, on February 25, 2024, Threads saw 486,803 installs on Google Play and 342,228 on iOS.

X, by comparison, saw 225,408 Google Play downloads and 112,625 on iOS, Appfigures data shows.

That’s nearly triple the downloads on iOS for Threads and more than double the downloads on Google Play.

Then, Threads had 382,999 daily installs on iOS versus just 113,649 installs of X on the same platform — or more than triple.

Threads’ Google Play downloads were 660,882 at this time, versus just 210,475 for X on the Play Store — also more than triple.

Tesla’s once-leading solar business is in decline, according to the latest figures from its fourth-quarter 2023 earnings report.

It was a bad year for Tesla solar — its worst since 2020.

In Q4 2023, Tesla’s solar deployments dropped 59% year-over-year to 41 MW — down from 100 MW in Q4 2022.

Next to solar, Tesla’s energy generation and storage business is booming (surprise, surprise).

The scale of Tesla’s residential solar business isn’t what it once was.

Tesla’s once-leading solar business is in decline, according to the latest figures from its fourth-quarter 2023 earnings report.

It was a bad year for Tesla solar — its worst since 2020.

In Q4 2023, Tesla’s solar deployments dropped 59% year-over-year to 41 MW — down from 100 MW in Q4 2022.

Next to solar, Tesla’s energy generation and storage business is booming (surprise, surprise).

The scale of Tesla’s residential solar business isn’t what it once was.

Tesla’s once-leading solar business is in decline, according to the latest figures from its fourth-quarter 2023 earnings report.

It was a bad year for Tesla solar — its worst since 2020.

In Q4 2023, Tesla’s solar deployments dropped 59% year-over-year to 41 MW — down from 100 MW in Q4 2022.

Next to solar, Tesla’s energy generation and storage business is booming (surprise, surprise).

The scale of Tesla’s residential solar business isn’t what it once was.

Tesla’s once-leading solar business is in decline, according to the latest figures from its fourth-quarter 2023 earnings report.

It was a bad year for Tesla solar — its worst since 2020.

In Q4 2023, Tesla’s solar deployments dropped 59% year-over-year to 41 MW — down from 100 MW in Q4 2022.

Next to solar, Tesla’s energy generation and storage business is booming (surprise, surprise).

The scale of Tesla’s residential solar business isn’t what it once was.

Tesla’s once-leading solar business is in decline, according to the latest figures from its fourth-quarter 2023 earnings report.

It was a bad year for Tesla solar — its worst since 2020.

In Q4 2023, Tesla’s solar deployments dropped 59% year-over-year to 41 MW — down from 100 MW in Q4 2022.

Next to solar, Tesla’s energy generation and storage business is booming (surprise, surprise).

The scale of Tesla’s residential solar business isn’t what it once was.

Tesla’s once-leading solar business is in decline, according to the latest figures from its fourth-quarter 2023 earnings report.

It was a bad year for Tesla solar — its worst since 2020.

In Q4 2023, Tesla’s solar deployments dropped 59% year-over-year to 41 MW — down from 100 MW in Q4 2022.

Next to solar, Tesla’s energy generation and storage business is booming (surprise, surprise).

The scale of Tesla’s residential solar business isn’t what it once was.

Tesla’s once-leading solar business is in decline, according to the latest figures from its fourth-quarter 2023 earnings report.

It was a bad year for Tesla solar — its worst since 2020.

In Q4 2023, Tesla’s solar deployments dropped 59% year-over-year to 41 MW — down from 100 MW in Q4 2022.

Next to solar, Tesla’s energy generation and storage business is booming (surprise, surprise).

The scale of Tesla’s residential solar business isn’t what it once was.