Global Screening Services (GSS), a London-based regulatory compliance platform that helps financial institutions meet their global sanctions obligations, has raised $47 million in a round of funding.

The raise comes amid a spike in economic sanctions, with the U.S. issuing trade-restrictions and asset-blocking against states including Russia, China, Iran and more.

The company actually raised a similar amount of funding last year from big-name backers including Japan’s Mitsubishi UFJ Financial Group (MUFG), one of the world’s largest banks.

Banks often find themselves at the forefront of sanctions enforcement, given their role in controlling the flow of money around the globe.

GSS sells a sanctions-screening platform to help banks and other financial institutions comply with regulations.

Teachers’ Venture Growth, the late-stage venture and growth investment arm of Ontario Teachers’ Pension Plan, is investing $80 million in Perfios, an Indian fintech that provides real-time credit underwriting solutions to banks and other financial institutions.

The new investment values Perfios at a valuation of over $1 billion.

Bengaluru-based Perfios provides real-time data aggregation and analysis tools to financial institutions, enabling them to streamline their customer journeys and make more informed decisions.

Perfios said it delivers 8.2 billion data points to banks and other financial institutions every year to facilitate faster decisioning, and processes 1.7 billion transactions a year with an AUM of $36 billion.

Ontario Teachers’ Pension Plan, one of Canada’s largest pension funds, has ramped up its interest in India in recent years.

The company provides community and regional banks with end-to-end deposit management capabilities, including a deposit network so bank customers can grow, retain and manage their deposit base by sourcing deposits, sweeping funds and providing additional security to depositors.

In fact, ModernFi, founded in 2022 by Paolo Bertolotti and Adam DeVita, raised $4.5 million in a seed round a month prior to the SVB news.

Canapi Ventures led the round and was joined by Andreessen Horowitz, Remarkable Ventures and a group of banks including Huntington National Bank, First Horizon and Regions.

“On this whole notion of deposit growth, retention management became first, second and third priority for a lot of institutions.

Bertolotti plans to grow in engineering, new product development, compliance and regulatory adherence and in business development.

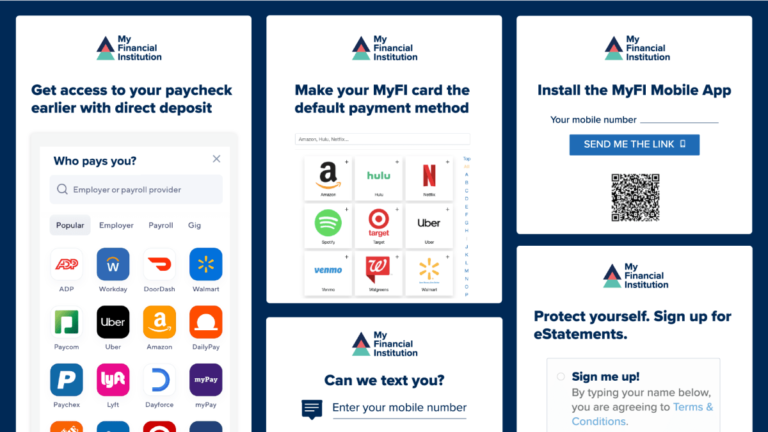

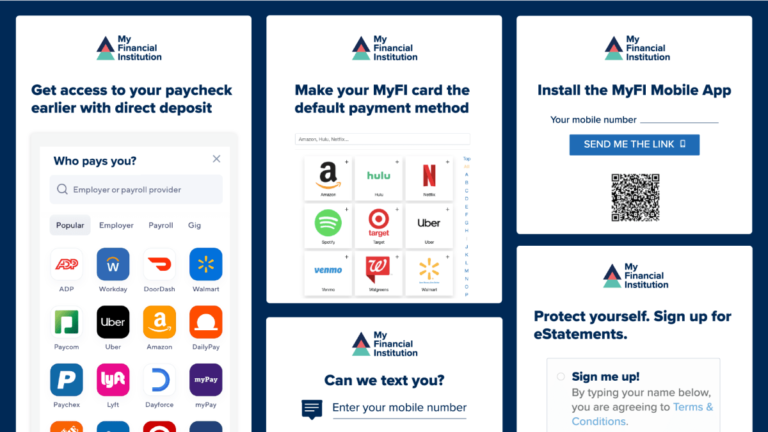

Digital Onboarding, a SaaS company specializing in helping financial institutions strengthen relationships with customers, secured $58 million in growth capital from Volition Capital to continue developing its digital engagement platform.

They changed the name to Digital Onboarding and began selling its engagement platform to banks and credit unions in January of 2018.

Communications from financial institutions, which are under strict regulations, is often paper-based, especially when opening a new account.

This often leads to between 25% and 40% of new checking accounts closed within the first year, said Brown, CEO of Digital Onboarding, citing a statistic from the 2023 Future of Finance Report.

Digital Onboarding is working with more than 140 financial institution customers.

The TikTok Research API allows third-party developers to access and analyze the company’s data in order to create new apps and services. This expansion, which is limited to nonprofit academic…