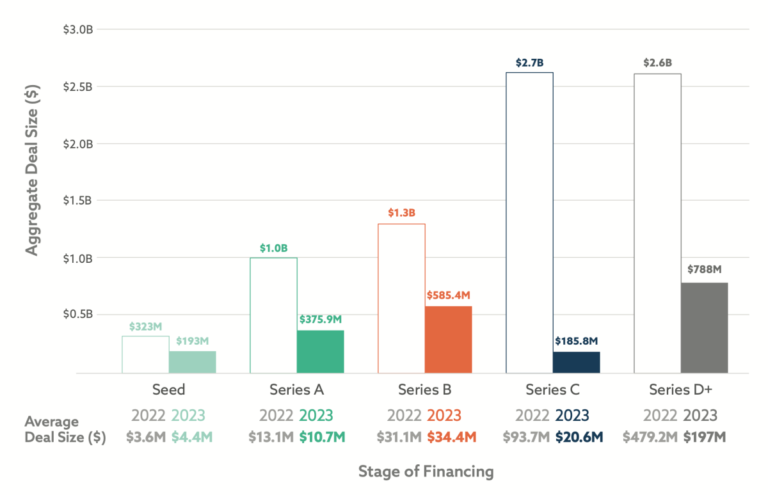

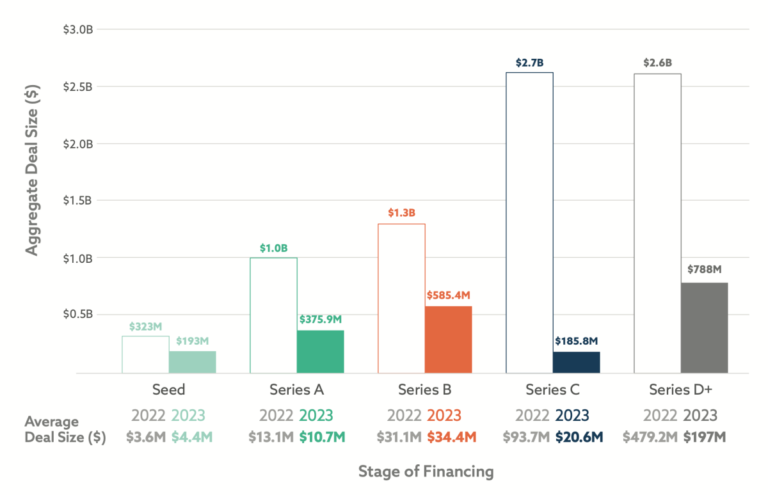

New report confirms Europe’s tech investment doldrums, but there are signs of lifeEurope is suffering from a big hangover after the tech investment party of the 2020-2021 period.

That said, compared to pre-pandemic levels, VC investment in European startups is up, historically speaking, and reached $60 billion, according to a new report.

2023 marked a reset and major correction in investment levels globally.

According to the report, Europe is sitting on “record levels of dry powder” and “producing more new founders than the U.S.”, funding remains slow.

Climate Tech overtook FinTech as Europe’s most popular sectorAI’s share of total investment in Europe soared to a record high of 17%5.

Fisker is laying off 15% of staff and says it needs more cash ahead of a “difficult year”Electric vehicle startup Fisker is planning to lay off 15% of its workforce and says it likely does not have enough cash on hand to survive the next 12 months.

“[W]e have put a plan in place to streamline the company as we prepare for another difficult year,” founder and CEO Henrik Fisker said in a statement.

Fisker said Thursday that it finished 2023 with $396 million in cash, though $70 million of that is restricted.

The company says it is talking with one of its lenders about making “an additional investment” in the company.

Fisker has also been dealing with a number of problems with its Ocean SUV, its only model so far, as TechCrunch reported earlier this month.

Nvidia’s chief rivals in the AI chip space — AMD, Arm and Intel — have been investing aggressively in startups, too, looking to make up ground in markets inclusive of the especially frothy generative AI segment.

IntelOf Nvidia’s competitors, Intel far and away has the biggest startup investment operation thanks to Intel Capital, its long-running VC.

Curiously, AI startups — despite their strategic importance to the chip industry these days — make up a relatively small portion of Intel’s venture portfolio.

According to Crunchbase, Intel’s holdings in software, IT and enterprise SaaS companies far outnumber its AI startup holdings by deal volume.

AMDLike Intel and Arm, AMD invests in startups both directly and through a VC org, AMD Ventures.

But Microsoft and Mistral AI buried the news — or at least an important part.

At the time, the company raised €385 million (around $415 million) with Andreessen Horowitz (a16z) leading the investment round.

Unlike previous Mistral AI releases, Mistral Large isn’t open source.

With this investment, Microsoft is now an investor in OpenAI’s capped profit subsidiary and Mistral AI.

As for Mistral AI, the so-called European AI champion looks more and more like its American competitors with a closed-source approach and a long list of American backers.

Interview Kickstart, a profitable startup helping tech professionals acquire career-advancing skills, has raised $10 million in its maiden funding from Blume Ventures, the companies said on Monday.

The startup avoided raising venture money in the past because Valles said Interview Kickstart has always been profitable and focused on sustainable unit-economics.

Interview Kickstart is finally raising external capital because it plans to focus on two to three new areas aggressively.

For Blume Ventures, the investment in Interview Kickstart is its largest opening check in its decade-old history.

“Interview Kickstart presented a unique opportunity,” said Karthik Reddy, Managing Partner of Blume Ventures, in a statement.

After a few years of funding frenzy, autonomous driving companies in China are experiencing a slowdown in investment.

Haomo.ai, an autonomous driving startup backed by Chinese automaker Great Wall Motor, has raised 100 million yuan, or $14 million, from a fresh round of funding, it said today.

Four-year-old Haomo has raised over $200 million worth of equity funding, according to startup database ITJuzi, and all of that money was denominated in Chinese yuan.

Chinese food delivery giant Meituan and Qualcomm Ventures, the corporate venture arm of Qualcomm, are among Haomo’s past investors.

Haomo is competing with a rank of Chinese AV upstarts that raised money from Western VCs and, such as Pony.ai, WeRide, Momenta, Deeproute.

India has updated official rules in the space sector to attract global investors and companies, after opening it up to private players four years ago.

The new foreign direct investment (FDI) policy raises limits on foreign investment, potentially spurring renewed interest in the South Asian space community.

Private and public actors in India have been taking measures to increase participation in the country’s space sector.

India has around 190 space tech startups, offering solutions including launch vehicles, space situational awareness and hyperspectral imagery.

Investments in Indian space startups reached over $124 million last year, per government data.

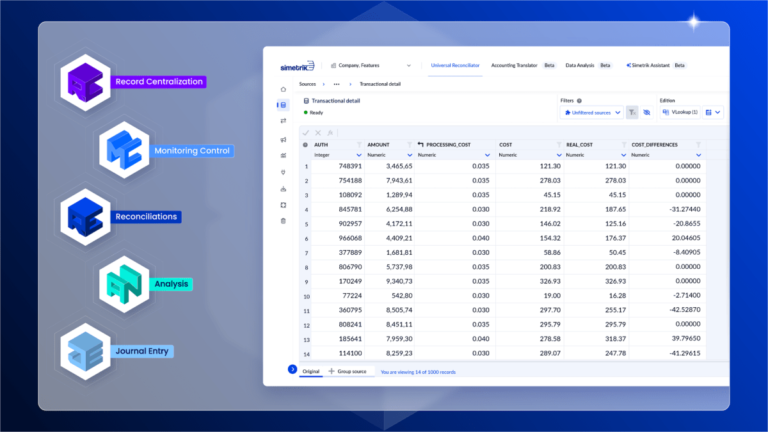

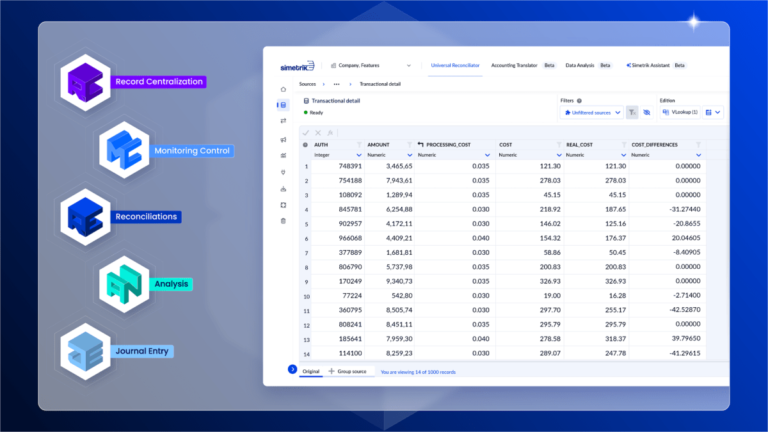

Where it is differentiating itself is through its Simetrik Building Blocks, or SBBs, which are scalable and adaptable concepts based on no-code development and generative AI technologies.

In the past two years, the company grew to have clients in more than 35 countries, up from 10, and is monitoring over 200 million records every day.

Previously that was 70 million records daily.

The use of the new funds will go into further developing the Simetrik Building Blocks, enhancing AI capabilities and continuing to expand Simetrik’s international reach.

They need a new approach, and that is where our building blocks have a strong product market piece.”

“[AI] affects all parts of an investment fund, from analysts to partners and back-office functions,” Song said.

Dili isn’t the first to apply AI to the due diligence process.

Gartner predicts that by 2025, more than 75% of VC and early-stage investor executive reviews will be informed using AI and data analytics.

The question is, can Dili’s AI — or any AI really — be trusted when it comes to managing a portfolio?

Dili ran an initial pilot last year with 400 analysts and users across different types of funds and banks.

This week, we’re looking at a new finance-based dating app, Robinhood’s earnings results and the startup in which PayPal Ventures made its first investment.

Launched by financial platform Neon Money Club, Score is a dating app for people with good to excellent credit, and it seeks to help raise awareness about the importance of finances in relationships.

Dollars and centsFinom, a European challenger bank aimed at SMEs and freelancers, has raised €50 million ($54 million) in a Series B equity round of funding.

Rasa, an enterprise-focused conversational generative AI platform with financial services companies as clients, raised $30 million in a Series C round co-led by StepStone Capital and PayPal Ventures.

Cash App announced it will now offer “up to” a 4.5% APY (annual percentage yield) for its Cash App Savings customers, with a few caveats.