Donald Trump’s beleaguered SPAC deal is finally going through, and just in time to pay nearly half a billion dollars owed over several legal actions — if the board agrees to let him sell.

And that’s without reckoning with the questionable success of Truth Social, the partisan social network hurriedly stood up after the former President was booted from Twitter.

TMTG reportedly had a net loss of around $49 million in 2023, on revenues of under $4 million — not exactly hot numbers.

There’s no doubt that many, many shareholders in the newly public TMTG will sell their shares as soon as possible.

But if Trump wanted to finance his current liabilities, he’d have to sell some 12 million shares at the current price — around 15% of his total stake.

Apple Pay is no stranger to regulatory controversy.

PayPal — the payments behemoth that has substantial businesses in mobile transactions and point-of-sale technology — was apparently instrumental in the original EU complaint around Apple’s payment monopoly.

The DOJ’s argumentApple today takes a 0.15% fee on any transaction made via Apple Pay.

In the meantime, Apple has continued to develop Apple Pay, launching — for example — its own buy now, pay later offering last autumn (pictured above).

Apple Pay and Apple Wallet are both a small part of Apple’s services revenues — which were upwards of $90 billion in 2023 — or indeed overall revenues.

“The trajectory of privacy and data protection is at a critical juncture, and it is imperative that all stakeholders, including tech giants like yours, uphold their responsibilities to safeguard these rights.

One of the signatories, Pirate Party MEP Patrick Breyer, summarizes Meta’s demand for a “privacy fee” as “economic coercion”.

noyb has subsequently filed another GDPR complaint against Meta’s model, focused on how easy/not is it for people to withdraw consent.

There are also a series of consumer protection complaints in the mix — which argue Meta’s approach breaches EU consumer protection rules.

Completing the circle, consumer right groups have filed as series of GDPR complaints against Meta’s ‘pay or okay’ model, too.

PayPal launches Tap to Pay on iPhone for businesses using Venmo and Zettle in the USPayPal announced today that it’s launching “Tap to Pay” for merchants with an iPhone through the Venmo and Zettle apps in the U.S. PayPal, which owns both Venmo and Zettle, says the feature will allow businesses to accept contactless card and digital wallet payments directly on their iPhones with no additional cost or hardware.

In addition to being able to accept payments from cards or digital wallets like Apple Pay or Google Pay, Tap to Pay allows merchants to add taxes, accept tips, send receipts and issue refunds without any additional hardware.

Funds from sales are quickly put into a business’s Venmo or PayPal Zettle account, the company says.

With Tap to Pay on iPhone, Venmo business profile users will be able to reach for customers by accepting payments from buyers even if they don’t have a Venmo account.

A year later, Strip enabled businesses to carry out Tap to Pay transactions on NFC-equipped Android devices, as well.

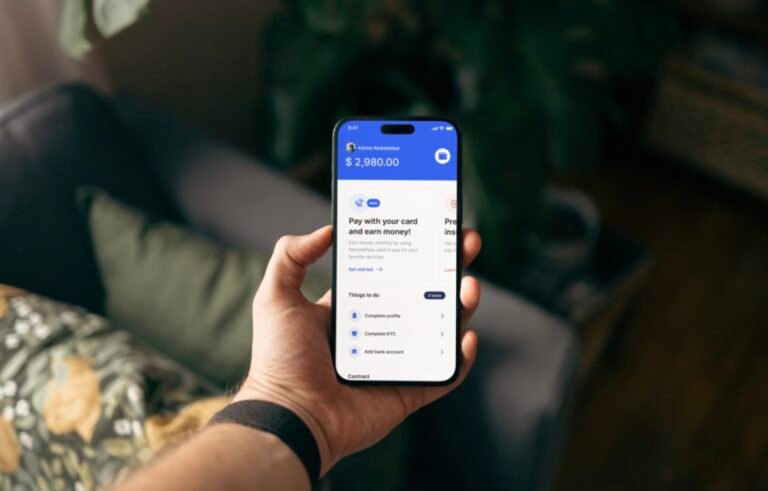

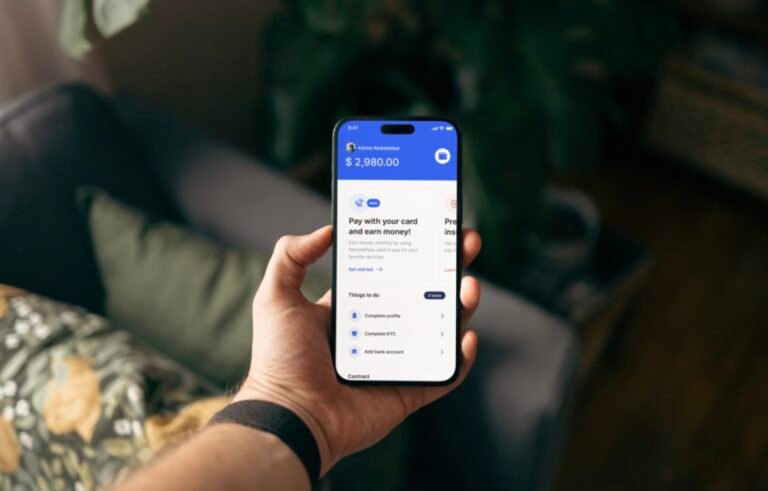

As remote work becomes increasingly prevalent, organizations globally are adapting, especially regarding onboarding procedures for new employees and navigating cross-border payment complexities.

RemotePass, one such business out of the UAE, has raised $5.5 million in Series A funding led by New York-based 212 VC.

CEO Kamal Reggad and Karim Nadi founded RemotePass in late 2020 to allow businesses to onboard, manage and pay their talent base in countries where they lack local legal presence.

Several companies are actively facilitating remote work and aiding employees in receiving payments from employers.

“Addressing today’s workforce challenges like talent mobility and remote work, RemotePass stands out as a key enabler.

Now the EU is asking questions about Meta’s ‘pay or be tracked’ consent modelMeta’s controversial pay or be tracked ‘consent’ choice for users the European Union is facing questions from the European Commission.

Meta’s ad-free subscription is controversial because under EU data protection law consent must be informed, specific and freely given if it’s to be valid.

Now the EU itself is stepping in with an RFI under the DSA, the bloc’s recently updated ecommerce rulebook.

In follow-up questions last month, the MEPs criticized internal market commissioner, Thierry Breton, for what they couched as “inadequate answers” — repeating their ask for a clear verdict on Meta’s ‘pay or consent’ model.

We also reached out to Ireland’s DPC for an update on its review of Meta’s consent or pay model — which has been ongoing for around six months.

As we’ve reported before Meta’s self-serving ‘consent or cough up’ offer is already facing a number of other GDPR complaints.

Today’s complaints are not the first filed against Meta’s consent or pay tactic by consumer protection groups — some of which argue it’s breaching the bloc’s rules on consumer protection, too.

However its blog post defending the controversial tactic does not make any mention of how it complies with EU consumer protection law.

So another very pertinent question, vis-a-vis Meta’s consent or pay offer in the EU, is what the Commission will do?

*The BEUC members filing GDPR complaints against Meta are: CECU, dTest, EKPIZO, Forbrugerrådet Tænk, Forbrukerrådet, Poprad, Spoločnosť ochrany spotrebiteľov (S.O.S.

It’s hard to keep track of crypto’s technical development, but one thing hasn’t changed much: blockchain applications are notoriously hard to build.

This stems in part from their decentralized nature, resulting in a lack of uniform standards across different infrastructure pieces.

Initia, founded by a group of developers in their late 20s, is trying to bring more interoperability to multi-chain networks and simplify the process of creating app-specific blockchains, or app chains.

In layman’s speak, Initia is abstracting away app chains’ technical complexity, aiming to make them more friendly to both end users and app developers.

They paused the project after the FTX implosion and eventually changed tack to work on blockchain infrastructure.

Google is sunsetting the Google Pay app in the US later this yearGoogle has announced that Google Pay is shutting down in the United States in June, as the standalone app has largely been replaced by Google Wallet.

Users can continue to access the app’s most popular features right from Google Wallet, which Google says is used five times more than the Google Pay app in the United States.

After June 4, users will no longer be able to send, request or receive money through the U.S. version of the Google Pay app.

Users who used the Google Pay app to find offers and deals can still so do using the new deals destination on Google Search, the company says.

Google says millions of people in over 180 countries use Google Pay to check out when shopping on desktop, mobile and in store.

Google said Thursday it plans to roll out the SoundPod, its portable speaker designed to instantly validate and announce successful payments, to small merchants across India over the coming months.

The Google Pay expansion in India, where the company is among the mobile payment market leaders, comes even as the firm winds down some of its payments apps in the U.S.

The sound-box was invented to serve small Indian merchants unable to afford regular point-of-sale devices but accepting of UPI payments.

The company said merchants who use SoundPod to process 400 payments in a month will get $1.5 in cashback.

Reliance, India’s largest firm by market cap, also began testing a similar device at its campus last year, TechCrunch earlier reported.