Egyptian B2B e-commerce startup MaxAB and Wasoko, a Kenya-based e-commerce player with operations in Tanzania, Rwanda, Uganda and Zambia, are in talks to merge operations, TechCrunch has exclusively learned from multiple sources.

The merger talks come as B2B e-commerce companies in Africa continue to scale back operations due to funding scarcity.

TechCrunch learned that the company had only received $30 million by the time merger talks, which are said to be investor-led, started.

As of last year, the prospect of a merger between MaxAB and Wasoko, both asset-heaving B2B e-commerce startups, seemed unlikely.

The eight-year-old B2B e-commerce company has since expanded to Zambia and the Democratic Republic of Congo.

Electric vehicle charging company EVCS is raising a $20 million round, TechCrunch+ has exclusively learned.

The startup has so far raised $7.5 million of the $20 million target, according to paperwork the company filed with the SEC on Wednesday.

If EVCS can raise the rest, this round would make for a slight step up from the $18.8 million Series A the company raised in July 2022, perhaps as an extension to that round.

But the round also suggests a tempering of expectations at the startup, which reportedly explored raising $125 million as recently as this June.

The funds would have helped the company add more than 2,000 fast chargers to its network.

He said there are around 350 shows published weekly, with only around “a handful” of creators making multiple shows, meaning it has around 350 creators using the platform today.

The Danish Export and Investment Fund (EIFO) is leading the round, with HighlandX and Augustinus Fabrikker also participating.

Strunge said that prior to this round, the company had raised just over €200 million.

Podimo’s funding and traction are coming at a tricky time for the podcasting industry.

The plan will be to take this model further, Strunge said, with a focus on ever-more “hyper local” content.

Vestwell, which provides the infrastructure for employers to power workplace savings programs, has raised $125 million in what the company describes as a “preempted” round of funding.

Vestwell CEO Aaron Schumm started the company in 2016 and launched the cloud-native platform in 2017.

Over 1 million people working across 300,000 businesses use the Vestwell platform, which the company said has helped power the savings of nearly $30 billion in assets over time.

As an extension of its partners, Vestwell says it enables a suite of programs, including retirement, health and education, such as 401(k), 403(b), IRA, 529 Education, ABLE disability and Emergency Savings programs.

“We’re now the leading partner in this field, and currently power 80% of the live state auto-IRA savings programs in this country,” he said.

Headquartered roughly 20 miles north of Atlanta, in suburban Roswell, Georgia, GreyOrange was founded in 2011 – the year before Amazon’s Kiva deal shook the industry.

GreyOrange announced a $140 million Series C in 2018 and today announced that it has closed out a $135 million growth financing Series D. Anthelion Capital led the round, which also featured returning investments from Mithril, 3State Ventures and Blume Ventures.

Over the years, it has been working to build a full stack solution for warehouse, fulfillment and 3PL needs.

That includes Kiva-like AMRs (autonomous mobile robots), forklifts and bin systems for picking, coupled with its own first-party (“hardware-agnostic”) fleet management software.

CEO Akash Gupta noted that this round will – in part – go toward delivering systems to customers.

Lingrove is taking on laminates — thin layers of wood and other materials — with a carbon-negative option that they claim performs better while looking as good.

Lingrove has developed a wood veneer alternative out of flax fiber and plant-based resins that’s carbon-negative yet results in a material they say is “very high stiffness, durable, and resistant,” i.e.

They call it “ekoa” — yes, in lowercase — and hope to make inroads in cars and other interior surfaces with a new $10 million funding round.

The Series B round was led by Lewis & Clark Agrifood and Diamond Edge Ventures, with participation from Bunge Ventures and SOSV.

You may wonder, as I did, why not use actual wood — things like sawdust and wood chips already coming out of industrial wood-handling processes?

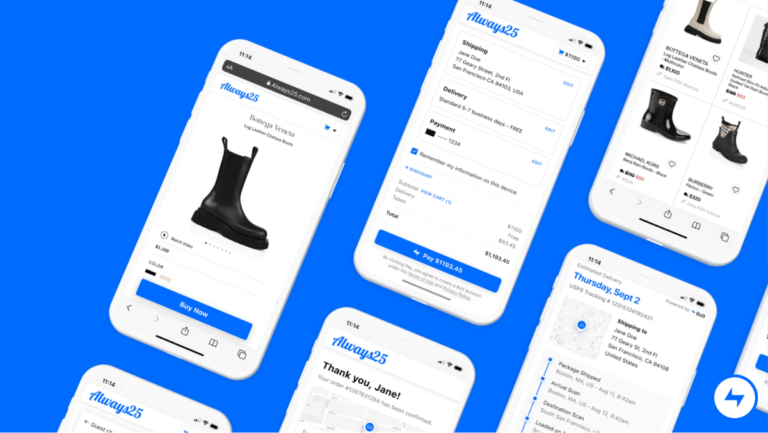

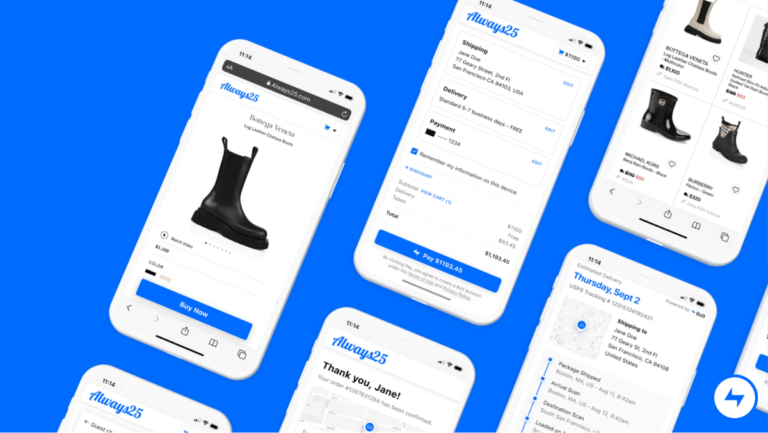

E-commerce and fintech company Bolt, which was at one time the subject of a federal probe, confirmed it laid off 29% of its staff, according to a company spokesperson.

This latest round of layoffs, which the spokesperson said happened last week, follow a handful of other layoffs made by the company since 2022.

It’s not clear how many employees the company had at the time of the layoffs or which roles were impacted.

The company, which provides software to retailers to speed up checkout, raised around $1 billion in total venture-backed funding and at one time was valued at $11 billion.

The company announced partnerships with retailers, including Saks OFF 5TH, Shinola, Filson, Lafayette 148 and Toys”R”Us, in November.

The traditional role of the real estate agent has long been challenged as the internet has made it easier for people to search for, and tour, homes.

The buyers’ agent commission varies from transaction to transaction depending on what is offered by the seller.

In a scenario where the buyer’s agent commission is 3%, for example, the home buyer would receive up to 1.5% as a rebate and Prevu as a company would retain the other 1.5%.

Buyers receive the commission rebate via check after closing.

Making home buying “more attainable”So besides rebates, what is Prevu doing that’s different from its competitors?

The investment arm of the UK retail bank M&G has led a funding of $340 million into Udaan, a business-to-business e-commerce startup, in one of the largest financing rounds secured by an Indian startup in 2023.

The Bengaluru-headquartered startup, which helps merchants in smaller Indian cities and towns secure inventories from major brands as well as gain access to working capital, said the new funds include some convertible debt.

Existing backers Lightspeed Venture Partners and DST Global have also participated in the new round, which awaits regulatory nod.

Udaan competes with a number of players, including Mukesh Ambani’s $100 billion Reliance Retail, the largest retail chain in India.

Udaan didn’t share how M&G and other investors valued the startup in the new round.

Now, one of the companies building security tools for SMBs has raised a round of funding to expand its business, underscoring the demand in the market for better defenses.

It’s no longer selling directly to SMBs but is working with managed service providers that in turn sell and manage IT services for SMBs.

MSPs, it found, were the primary route to getting their product to get used by SMBs (meaning direct business was not taking off).

“Guardz has developed an impressive, holistic, and user-friendly cybersecurity and cyber insurance risk-assessment platform that is cleverly tailored to MSPs, who serve the often-overlooked long-tail small business market.

We are excited to lead this funding round and join the Guardz team on their journey to secure the digital world for those who today need it most.”