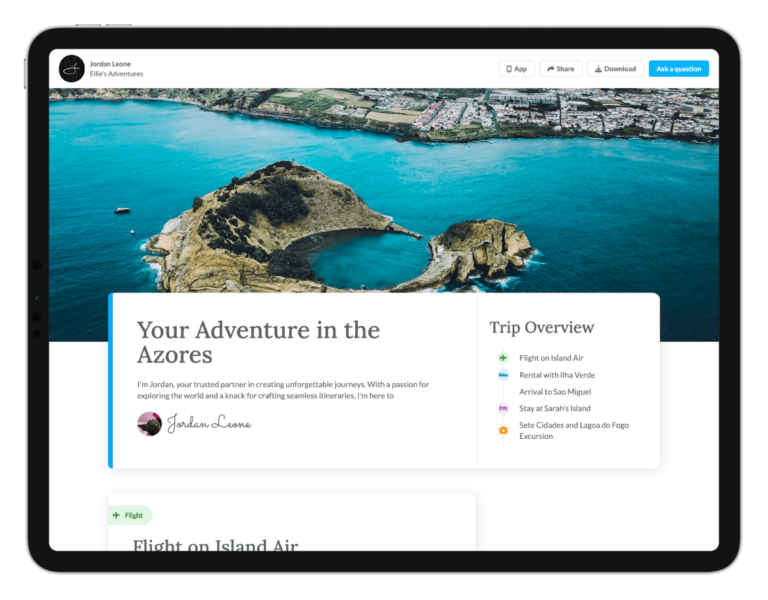

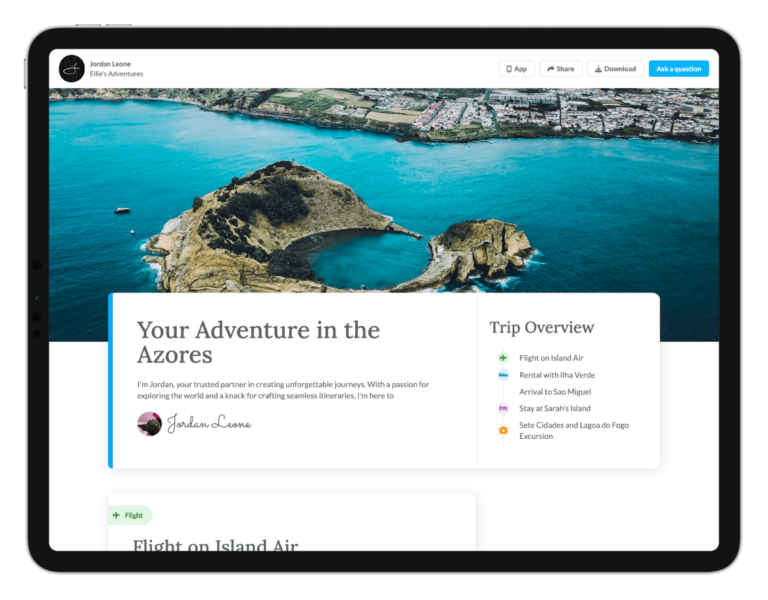

For co-founder and CEO Dayo Esho, the idea for TravelJoy emerged from his experiences growing up in the travel industry, supporting his mom’s travel agency business.

The co-founders began working TravelJoy in 2018, while participating in NFX’s accelerator.

The company also recently added integrations with travel insurance provider Faye and Viator, a marketplace for travel experiences.

The idea is to centralize the travel entrepreneur’s workflow, with CRM, messaging, invoicing, payments, proposals, itineraries, and group trip management in one digital solution.

Despite the pandemic’s massive and immediate impact on global travel, TravelJoy surprisingly didn’t shut down.

Bitcoin jumped and Coinbase’s app crashed, while Aptos eyes Hong Kong and Telegram rolls out rewards with TONWelcome to TechCrunch Crypto, formerly known as Chain Reaction.

This week in web3Crunching numbersThis week the crypto market was very hyped up as the two biggest cryptocurrencies by market capitalization, bitcoin and ether, both jumped about 23.6% and 18%, respectively, on the week, according to CoinMarketCap data.

The total crypto market cap increased 19.4% over a seven-day period to $2.34 trillion.

Our favorite ‘Crypto Twitter’ postICYMI, last week a lot of crypto people were tweeting about emails from Satoshi Nakamoto, the creator of Bitcoin.

In June 2022, Magic Eden raised $130 million in a Series B round that granted it unicorn status.

The startup’s eponymous app lets people self-publish stories, and then, using AI and data science, it selects what it believes are the most compelling of these to tweak and subsequently distribute and sell on a second app, Galatea.

The $37 million, a Series C, is being led by Vinod Khosla of Khosla Ventures.

The investment brings the total raised by Inkitt to date to $117 million (other rounds included a $3.9 million seed; a $16 million Series A and a $59 million Series B).

The average number of books read (and completed) has also dropped to around 5.

“Inkitt is doing just that with stories, creating content that is hyper-personalized and meaningful to every person.”

Social media giant Reddit filed to go public today.

Today Reddit approaches the public markets with more than $800 million worth of revenue in 2023, up from $666.7 million in 2022.

In 2022 Reddit generated a net loss of $158.6 million, and adjusted EBITDA of negative $108.4 million.

That figure includes a massive $410 million Series F raised in 2021 and a smaller $368 million Series E raised earlier the same year.

That makes it worth roughly 7.5% of its 2023 revenue, a very nice tailwind for its 2024 results.

Back in 2016, Netflix open-sourced Conductor, its microservices orchestration platform, but last December, it announced that it would discontinue maintaining it.

Thankfully, for the many companies that rely on it, the creators of Conductor had previously left the company to launch Orkes, a startup that provides an enterprise-grade microservices platform based on the open-source project.

As Orkes co-CTO Viren Baraiya told me, the project quickly became popular within Netflix.

Currently, Orkes offers Conductor as a fully managed platform on the customer’s cloud of choice, as well as a Conductor-based AI orchestration platform.

The founders of Orkes wrote a new playbook for building and operating complex, observable and large-scale applications when they helped create the Conductor open-source project at Netflix.

Clumio, a data backup and recovery provider for companies using the public cloud, has raised $75 million in a Series D round of funding.

‘live”) data and backup data in separate secure domains, something that many backup solutions (including first-party from the cloud providers themselves) don’t do.

Indeed, Clumio stores its backup data in what Kumar calls a “hyper-optimized data plane” on AWS.

“We leverage our serverless data processing engine in AWS to perform all core backup operations using.

Prior to now, the company had raised around $186 million, the lion’s share arriving via a $135 million Series C round more than four years ago.

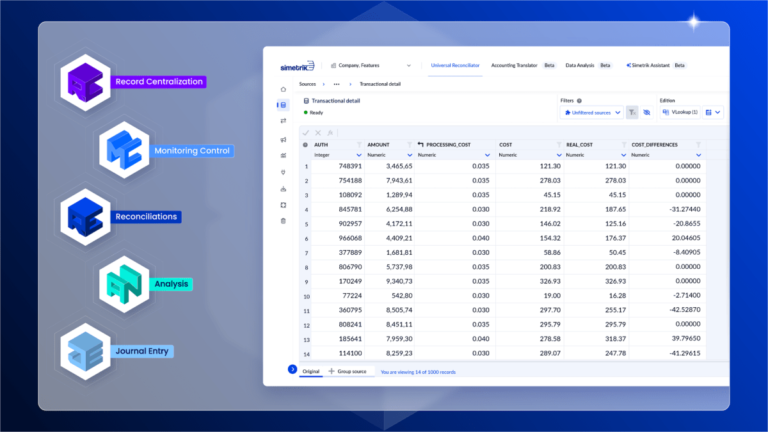

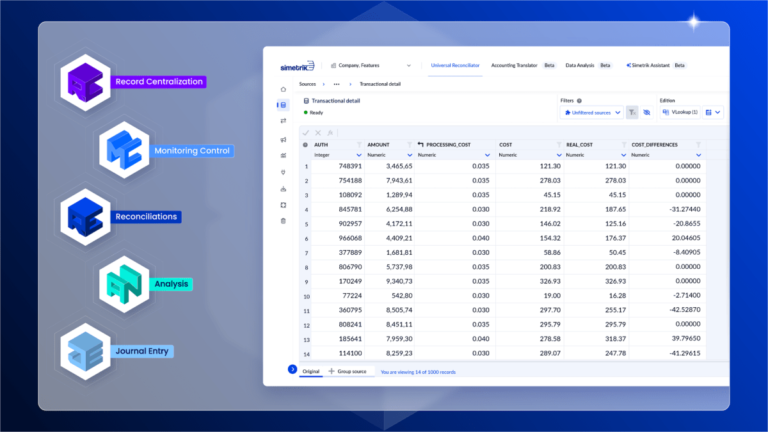

Where it is differentiating itself is through its Simetrik Building Blocks, or SBBs, which are scalable and adaptable concepts based on no-code development and generative AI technologies.

In the past two years, the company grew to have clients in more than 35 countries, up from 10, and is monitoring over 200 million records every day.

Previously that was 70 million records daily.

The use of the new funds will go into further developing the Simetrik Building Blocks, enhancing AI capabilities and continuing to expand Simetrik’s international reach.

They need a new approach, and that is where our building blocks have a strong product market piece.”

Partech closes its second Africa fund at $300M+ to invest from seed to Series CPartech has closed its second Africa fund, Partech Africa II, at €280 million ($300 million+), just one year after reaching its first close.

Amidst a backdrop of global VCs and institutional investors pulling back from Africa, Partech Africa’s recent fund closure is significant.

However, he clarified that the firm will deploy the majority of its second fund between Series A and B rounds.

Among the investments from its second fund is Revio, a South African payment orchestration platform, where Partech Africa co-led the seed round with global fintech fund QED.

Partech Africa intends to back over 20 companies, with initial investments ranging from $1 million to $15 million, it disclosed.

This week, we’re looking at a new finance-based dating app, Robinhood’s earnings results and the startup in which PayPal Ventures made its first investment.

Launched by financial platform Neon Money Club, Score is a dating app for people with good to excellent credit, and it seeks to help raise awareness about the importance of finances in relationships.

Dollars and centsFinom, a European challenger bank aimed at SMEs and freelancers, has raised €50 million ($54 million) in a Series B equity round of funding.

Rasa, an enterprise-focused conversational generative AI platform with financial services companies as clients, raised $30 million in a Series C round co-led by StepStone Capital and PayPal Ventures.

Cash App announced it will now offer “up to” a 4.5% APY (annual percentage yield) for its Cash App Savings customers, with a few caveats.

What went wrong at Cruise, a pivot at Vroom and a home for Tesla’s Dojo supercomputerTechCrunch Mobility is a weekly newsletter dedicated to all things transportation Sign up here — just click TechCrunch Mobility — to receive the newsletter every weekend in your inbox.

Autonomous vehicle and EV startups — even those that have since gone public — are trying to cut costs in hopes of extending their capital runway.

Now, a few little birds are telling us that Canoo and Faraday Future — both EV startups that went public via mergers with special purpose acquisition companies — are either reducing salaries or furloughing employees.

So what went wrong at Cruise?

Cruise also revealed that the Department of Justice and the Securities and Exchange Commission have also opened investigations into the company.