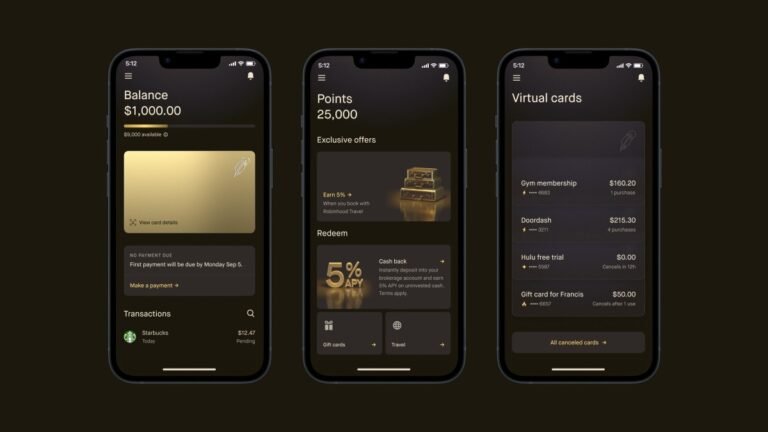

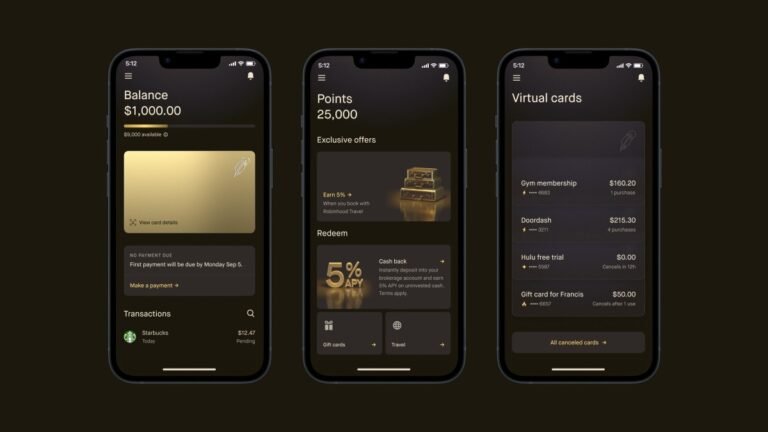

This week, we’re looking at Robinhood’s new Gold Card, challenges in the BaaS space and how a tiny startup caught Stripe’s eye.

BaaS startup Synctera recently conducted a restructuring that affects about 15% of employees.

The startup is not the only VC-backed BaaS company to have resorted to layoffs to preserve cash over the past year.

MassMutual Ventures also participated in Qoala’s new $47 million round of funding.

It has more primary customers than ChaseInside a CEO’s bold claims about her hot fintech startup, which TC previously covered here.

In Stripe’s annual letter, the company discussed several fast-growing areas, one of them being the “Revenue and Finance Automation” unit.

Stripe’s RFA unit will reach a $500 million annual run rate this year, the company said.

So they built a product that helps companies import and centralize customer data from third-party data sources like Salesforce or other customer relationship management systems into their own applications.

How did a tiny four-person startup catch the attention, and an acquisition offer, from mighty Stripe?

Considering the growth Stripe alluded to in its annual letter, Supaglue will likely quickly find fast friends within Stripe’s ecosystem.

This week, we look at Griffin Bank getting its license ahead of some heavy hitters, and we go inside Stripe’s annual letter, some funding rounds, and more!

The banking-as-a-service company managed to do something that even the region’s most valuable fintech company, Revolut, hasn’t been able to do yet — obtain a banking license.

Granted, as Mike Butcher writes, banking licenses are difficult to come by (Griffin’s took a year), but Revolut has talked about securing a banking license for the past three years.

Now that Griffin has a banking license, it offers a full-stack platform for fintech companies to offer banking, payments and wealth solutions via automated compliance and an integrated ledger.

In a new SEC filing, Reddit’s IPO involves around 22 million shares, priced between $31 and $34.

Stripe is sufficiently large that when we consider its growth we have to weigh it against the overall growth in the payment space more generally.

Major growth pointsIn its annual missive, Stripe noted that it crossed the $1 trillion total payment volume metric in 2023, a figure that is large, and round, if imprecise.

Certainly the threshold is notable, but when paired with recent growth figures becomes all the more impressive.

Stripe said that in 2023 its payment volume rose 25%.

Any company processing that much total payment volume through Stripe could build their own in-house stack, or pursue a more DIY option.

Payments infrastructure giant Stripe said today it has inked deals with investors to provide liquidity to current and former employees through a tender offer at a $65 billion valuation.

Notably, the valuation represents a 30% increase compared to what Stripe was valued at last March when it raised $6.5 billion in Series I funding at a $50 billion valuation.

But it is also still lower than the $95 billion valuation achieved in March of 2021.

A Stripe IPO has been long anticipated and was widely expected to happen in 2024.

But with this deal, it appears that an initial public offering may not take place until next year.