For them, the difficulty hasn’t been opening local USD accounts; it’s been cost-effectively facilitating payments from international employers and online platforms.

“Using local products meant many remote workers had large chunks of their earnings eaten away with excessive fees.

The USD products couldn’t be local,” said Oudjidane, who is also the founding partner of emerging markets fintech fund Byld Ventures.

“The product would need to move to offering U.S.-based USD accounts,” accounts that, critically, would facilitate ACH payments to enable those freelance payments and came with the security that you get with U.S. banking, such as FDIC assurance.

“Freelancers and remote workers in these markets will undoubtedly be a critical source of foreign income to help rebuild,” Oudjidane said.

Most recently, the company expanded its offer its virtual therapy sessions to services for adolescents across its footprint.

The virtual clinic’s medication-assisted treatment for substance use disorders is available across 50 states for adults and teens.

Since its Series B, Pelago has experienced an impressive 11x revenue surge and claims to have 100% client retention.

Pelago members have regular sessions with virtual care teams in the app, consisting of health coaches or licensed drug and alcohol counselors.

In addition to its virtual therapy interface, the company is investing in bringing more tech to bear on its business.

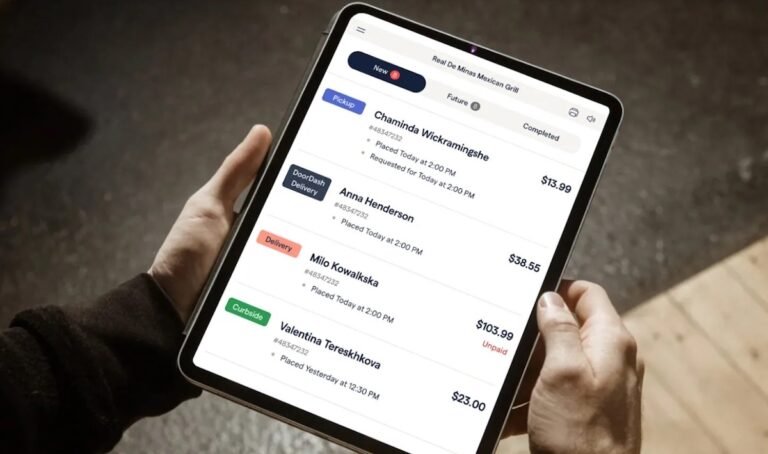

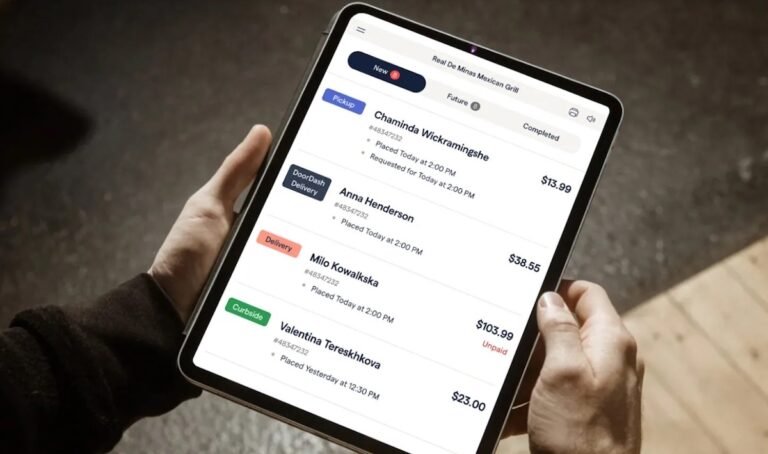

ChowNow snaps up YC-backed POS platform Cuboh and is laying off staffChowNow, the online ordering platform and marketing service for local restaurants, acquired Cuboh, a Y Combinator-backed point-of-sale (POS) platform that consolidates all orders from delivery apps into one place.

This marks ChowNow’s first acquisition, which will help strengthen its POS integration solution and help restaurants tackle orders across multiple services.

Meanwhile, Cuboh’s entire 30-person team — including marketing, sales, product and engineering — is transitioning to ChowNow.

Starting next week, restaurant owners can access a newly launched bundle, “ChowNow + Cuboh,” for $275 per month.

“It’s getting back to the longer-term product vision of what we’re building, of being the only platform restaurants need for their entire takeout business,” Webb said.

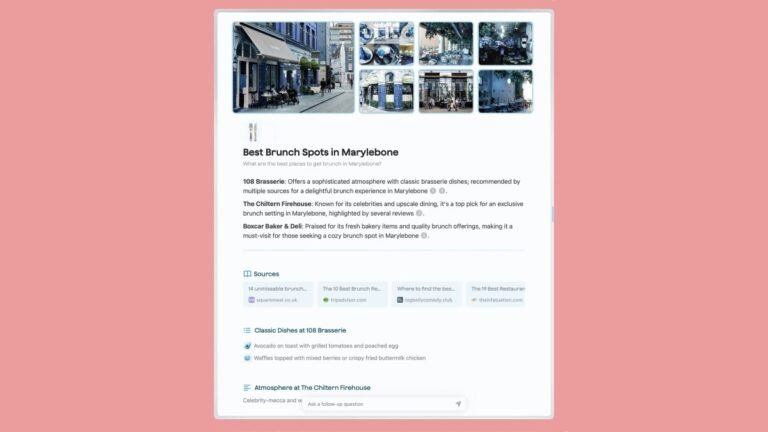

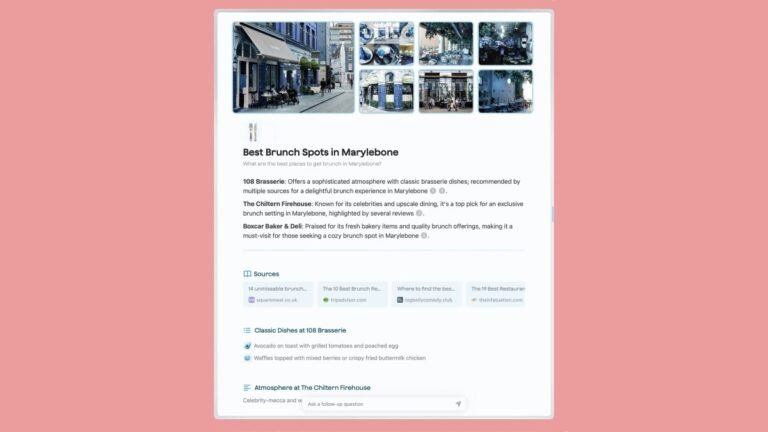

Some of these features sound and work like rival browser Arc’s recent releases.

But SigmaOS claims that its feature returns better-quality results, which is a hard metric to quantify.

Going all out on AILast year, SigmaOS released some AI-powered features such as a contextual assistant called Airis, which can answer your questions about a web page or the broader web.

Now, the company is looking to monetize its AI features.

It said that all users would get access to AI-powered features but for $20 per month users would get better rate limits for AI features.

Miami-based Onyx Private, a Y Combinator-backed digital bank that provided banking and investment services for high-earning Millennials and Gen Zers, is terminating its bank operations.

Y Combinator has listed the company as “inactive” on its on its website, something Santos could not explain.

Santos claimed that Onyx had been exploring the idea over the past year and had made developments with some partners.

Santos today declined to disclose how many banking customers Onyx had.

Although a source told TechCrunch that regulatory issues may have played a part in this decision, Santos dismissed that, telling us that no regulatory issues caused the startup to shut down its direct-to-consumer banking operations.

Nigerian fintech Cleva, focused on creating a banking platform for African individuals and businesses to receive international payments by opening USD accounts, has raised $1.5 million in pre-seed funding.

“The team is uniquely qualified to address this given their experience building banking products at Stripe and robust platforms at AWS.

Both founders share a strong connection with the African market.

(It’s worth highlighting that while Cleva exclusively provides USD accounts, other players offer GBP and EUR accounts.)

Meanwhile, the YC-backed startup, which generates revenue when users swap and exchange their funds (in USD accounts) for the local currency (in naira for now), also charges a 0.9% fee on deposits into customers’ USD accounts.

The global HR payroll market is expanding at a rapid pace, with the market expected to reach a valuation of $14.31 billion by the close of this decade. This growth…