Remote payroll startup Deel acquired fintech Capbase for an undisclosed amount in a cash and stock deal, TechGround has exclusively learned.

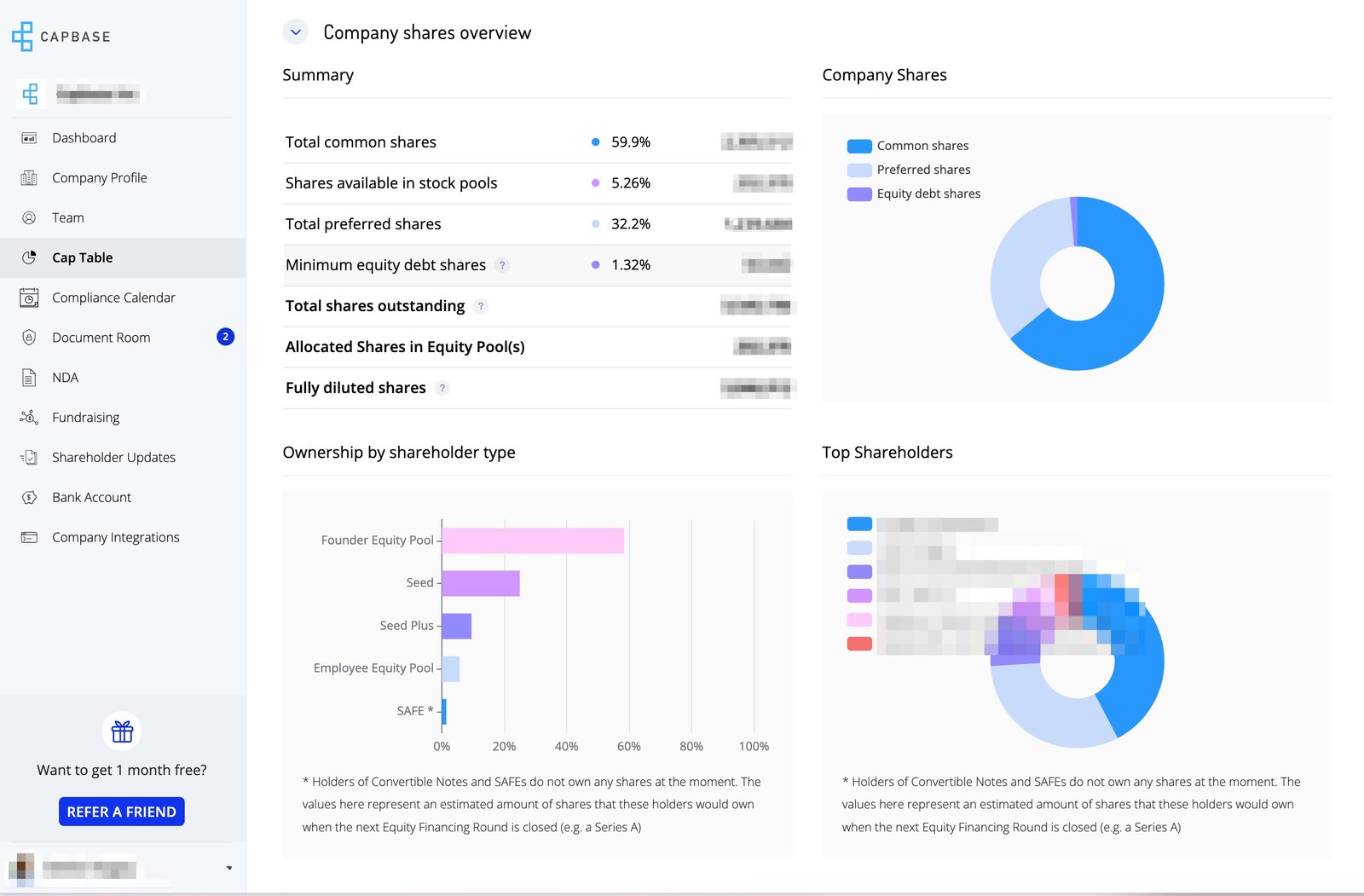

Capbase, based in San Francisco, streamlines company operations by updating cap tables in real time as shares are issued, contracts signed and funds raised from investors. This data then provides API integrations for setting up bank accounts, payrolls and business insurance. Founded by Greg Miaskiewicz & Stefan Nagey in 2018, Capbase has attracted $6M venture capital from Better Tomorrow Ventures; Clocktower Technology Ventures; Great Oaks Venture Capital; Village Global & angel investors.

CEO Miaskiewicz told TechGround that Capbase has worked to make it easier for companies to start up, raise funds and give out equity. During their private beta period until April 2021, the customer base grew from 10 to an impressive 500 customers in less than a year and a half – though he didn’t share revenue figures.

In 2019, Alex Bouaziz and Shuo Wang founded Deel, a remote-first company based in San Francisco. With the mission to allow businesses to hire staff and contractors abroad “in just five minutes”, Deel also allows companies to pay these teams in over 150 currencies with one click. By March 2022, $680 million had been raised for total funding; the company was valued at $12 billion and reported crossing the $100 million ARR mark that month (although current numbers remain undisclosed due to rapid growth of their ARR).

Deel has continuously evolved its model, adding features and acquiring other startups to offer comprehensive equity-related services. From consulting clients on managing taxable events for Employer of Record employees/contractors to handling payroll for those events, Deel is now furthering its offerings with the acquisition of Capbase – a product dedicated exclusively to equity management & issuance.

In an interview, Bouaziz noted that Deel’s customers often grapple with questions of how to grant equity in countries without entities and how to comply with local laws.

Deel’s earliest customer, Capbase, appreciated Miaskiewicz’s compliance-focused thinking. Bouaziz says he was always grateful for it.

Deel searched for a solution to customers’ questions about granting equity abroad, especially considering different labor laws. They had to solve this problem for themselves since they offer “equal equity regardless of location.”

“U.S. compliance is a difficult challenge,” Bouaziz noted to TechGround, “but equity is essential for businesses, so we felt compelled to create an effective solution that could grant it across borders and at scale.”

Rather than starting from scratch, Deel chose to collaborate with Capbase.

Deel is excited to acquire Capbase, which helps companies with incorporation and fundraising during the early stages of growth, as well as filing compliance documents and granting equity in their later years. According to Bouaziz, this will simplify the complexities associated with setting up and developing businesses.

He noted that their tech and compliance expertise help hundreds of businesses incorporate in the U.S., set up bank accounts, manage cap tables, establish boards and grant equity – all within one platform to ensure seamless expansion compliantly.

Having an image credit is a crucial part of protecting the rights of creative professionals. Image credits help to ensure that photographers, illustrators and other visual artists are given proper attribution for their work. Additionally, having an accurate image

Deel says that adding Capbase will enable them to better support startups and help companies expand internationally, giving them a competitive edge.

Last October, Rippling unveiled its new global payroll product, which CEO Parker Conrad admitted would compete with Deel. He told TechGround the offering would enable their U.S.-based clients to pay workers worldwide more “seamlessly” – both full-time and contract employees.

Deel isn’t aiming to rival Carta; they’re two separate entities.

Bouaziz noted that Capbase’s initial product is similar to Carta and Stripe Atlas, but they’re not investing in that since many companies have already built a product around it–they don’t want to reinvent the wheel.

“We’re passionate about creating a product that can make global equity for employees through employer of record models,” he added. “Our goal is to take the expertise we’ve gained in the U.S. and use it to build a product with worldwide impact.”

“Capbase’s offer to be acquired was much more appealing than seeking additional funding in a difficult economic climate,” Miaskiewicz admits.

All 20 employees of the startup are now part of Deel’s team.

Miaskiewicz believes that Deel will become even more powerful with the combined forces of the two companies.

To maximize customer lifetime value, selling services to startups or potential tech giants early in their lifecycle is key. This will enable you to provide more and better services as they scale, enabling monetization of the relationship.

By early to mid-February, Deel anticipates having a “solid working product” for customers such as Nike, Cloudflare, Shopify and Subway.

“As our product becomes increasingly complex and tailored to local jurisdictions and laws, we’ll need to continually adjust in order to maintain global compliance,” Bouaziz stated.

Equity management is a popular topic; on January 10, Fidelity acquired Shoobx, a venture-backed fintech startup. Shoobx provides automated equity operations and financing software to private companies of all sizes–from small startups to pre-IPO firms. Services include offer letter drafting, granting equity for new hires, managing cap tables and 409A valuation reports.