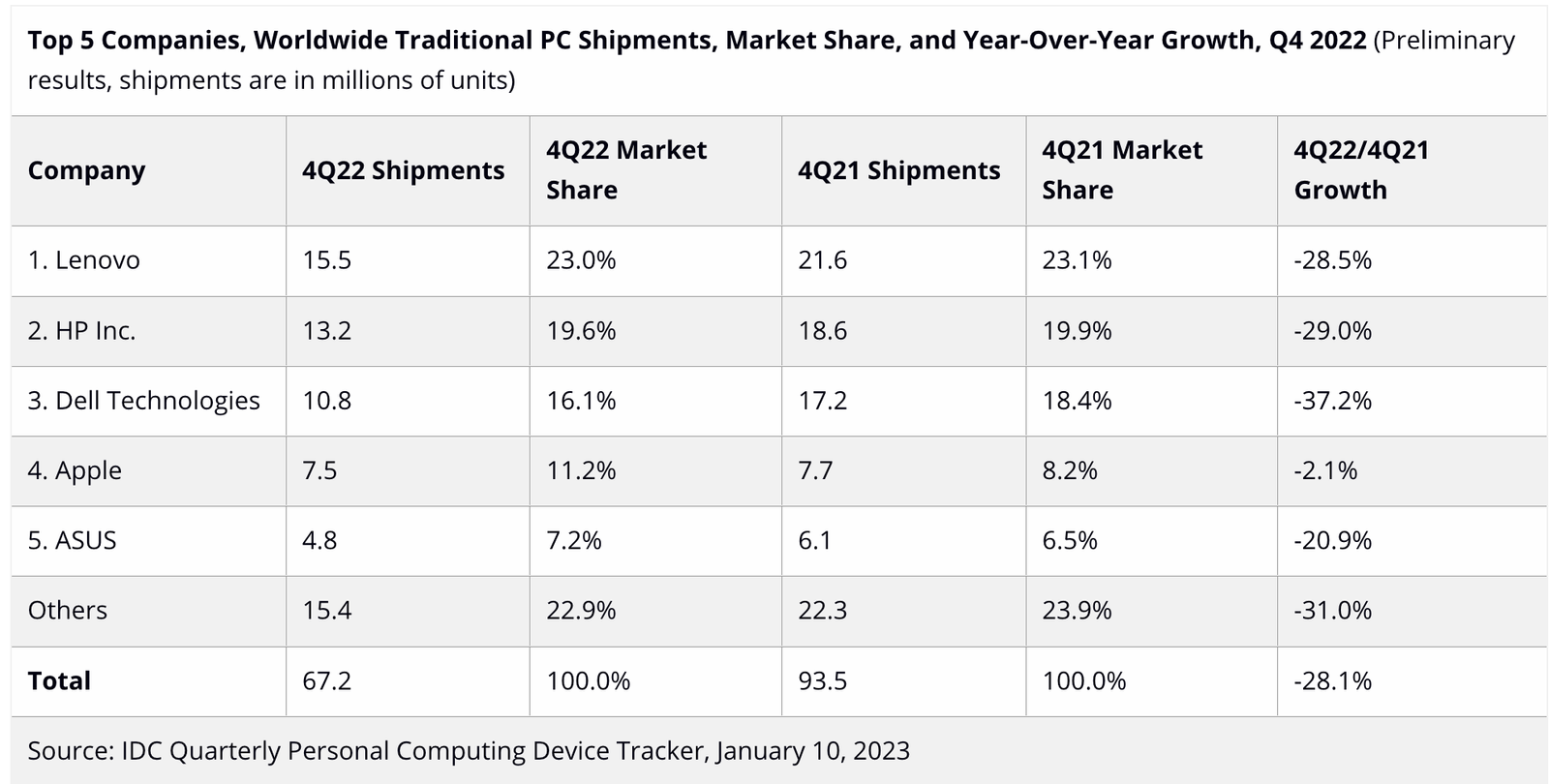

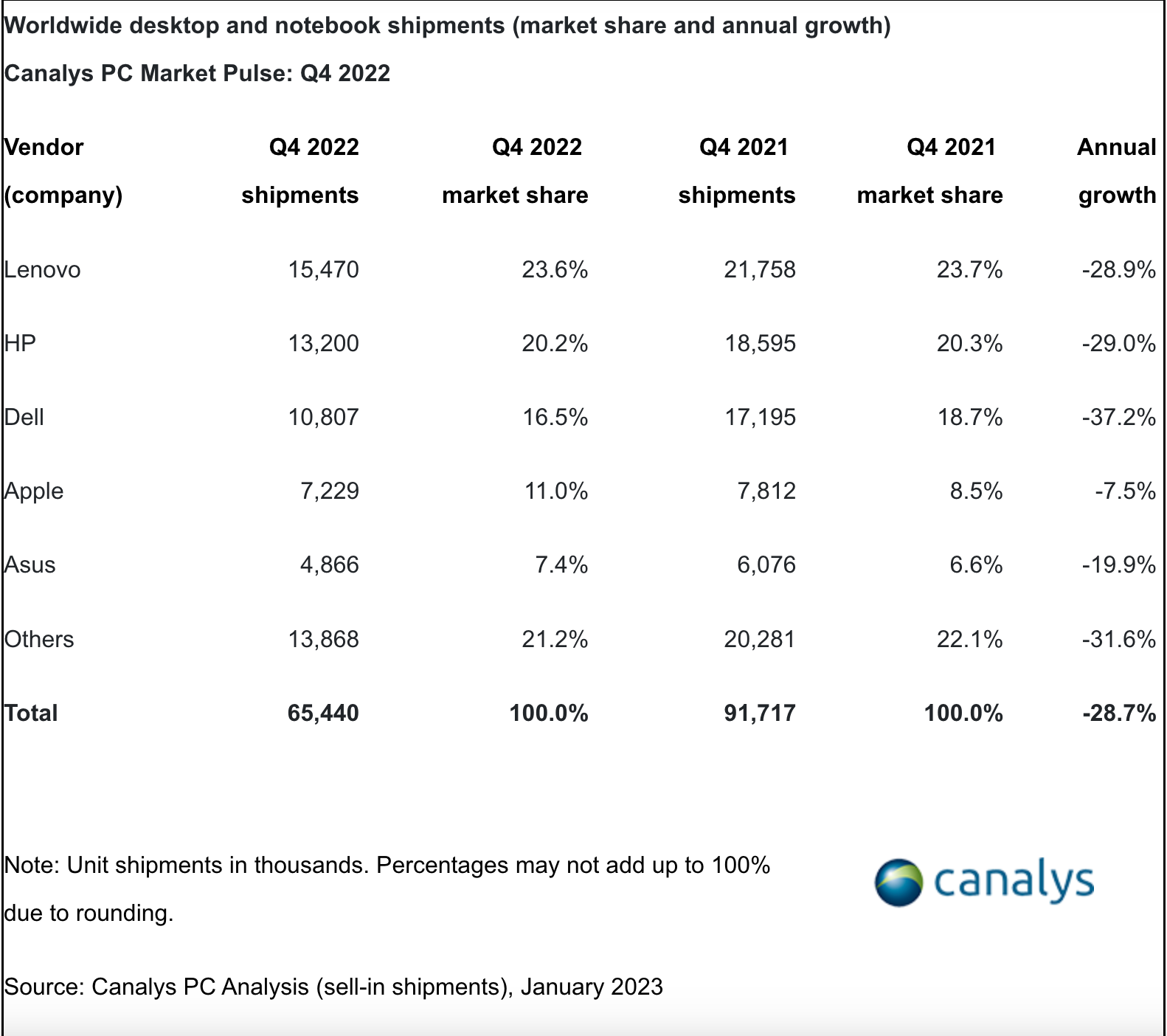

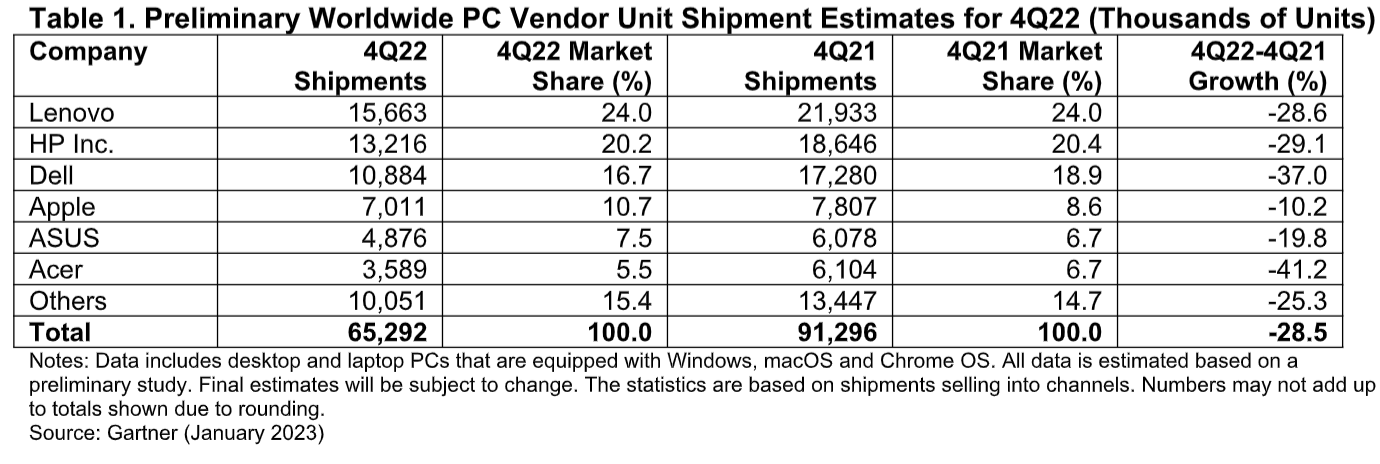

Global PC sales dropped significantly in Q4, with all three firms (Canalys, IDC and Gartner) reporting declines from 2021 highs.

Sales of laptops and desktop computers running Windows, macOS, or Chrome OS plummeted for the fourth quarter in a row; IDC reports 28%, Gartner 28.5%, and Canalys 29%.

All three firms reported a -16% decline in year-over-year totals, but Ryan Reith of IDC noted that the figures may not be as bleak when factoring in 2021’s stellar performance.

Reith noted that 2021 saw “near historic” PC shipments, making comparisons difficult. Despite this, he expressed optimism for the future of the industry: “The rise and fall of the PC market will be one for the record books, but there’s still plenty of opportunity.”

Gartner reported 65.3 million units shipped in Q4, while Canalys and IDC recorded 65.4 and 67.2 million respectively.

Q4 was a tough quarter for all manufacturers, with no one in positive territory and most reporting double-digit losses. The best outcome was minimal losses.

Apple had the smallest drop of all three reports, at -2.1% (IDC), -7.5% (Canalys) and -10.1% (Gartner). Unfortunately, it only gets worse from here.

Dell saw the largest losses among the top three PC manufacturers, dropping 37%, followed by HP (-29%) and Lenovo (-28%). These are significant drops regardless of cause.

Credits for the images used in this document go to IDC.

Images courtesy of IDC.

Images used in this report provided by Canalys.

This text was supplied by Canalys.

Images for this report courtesy of Canalys.

Gartner is a global research and advisory firm that provides technology-related insights to help organizations make informed decisions. Gartner’s mission is to provide high-quality insights, advice, and tools that empower leaders in

Q4 sales plummeted despite manufacturer’s efforts to stimulate growth with price cuts, according to Gartner who noted it was the largest decline since the mid-1990s.

Analysts are cautiously optimistic that the economy will start to recover by late 2021 or early 2024.

Once the pandemic’s effects subside, Canalys analyst Ishan Dutt predicts delayed purchases will start to lift the market in late 2023, with a stronger rebound expected in 2024.

IDC predicts a rebound of the market in 2024, with some recovery in 2021. Gartner’s Mikako Kitagawa believes the slump could last until early 2024.

The market has taken a hit this year, but when comparing figures from before the 2020 lockdown, there is much more optimism. Despite the large decreases in year-over-year percentages, it’s important to view these numbers in context.