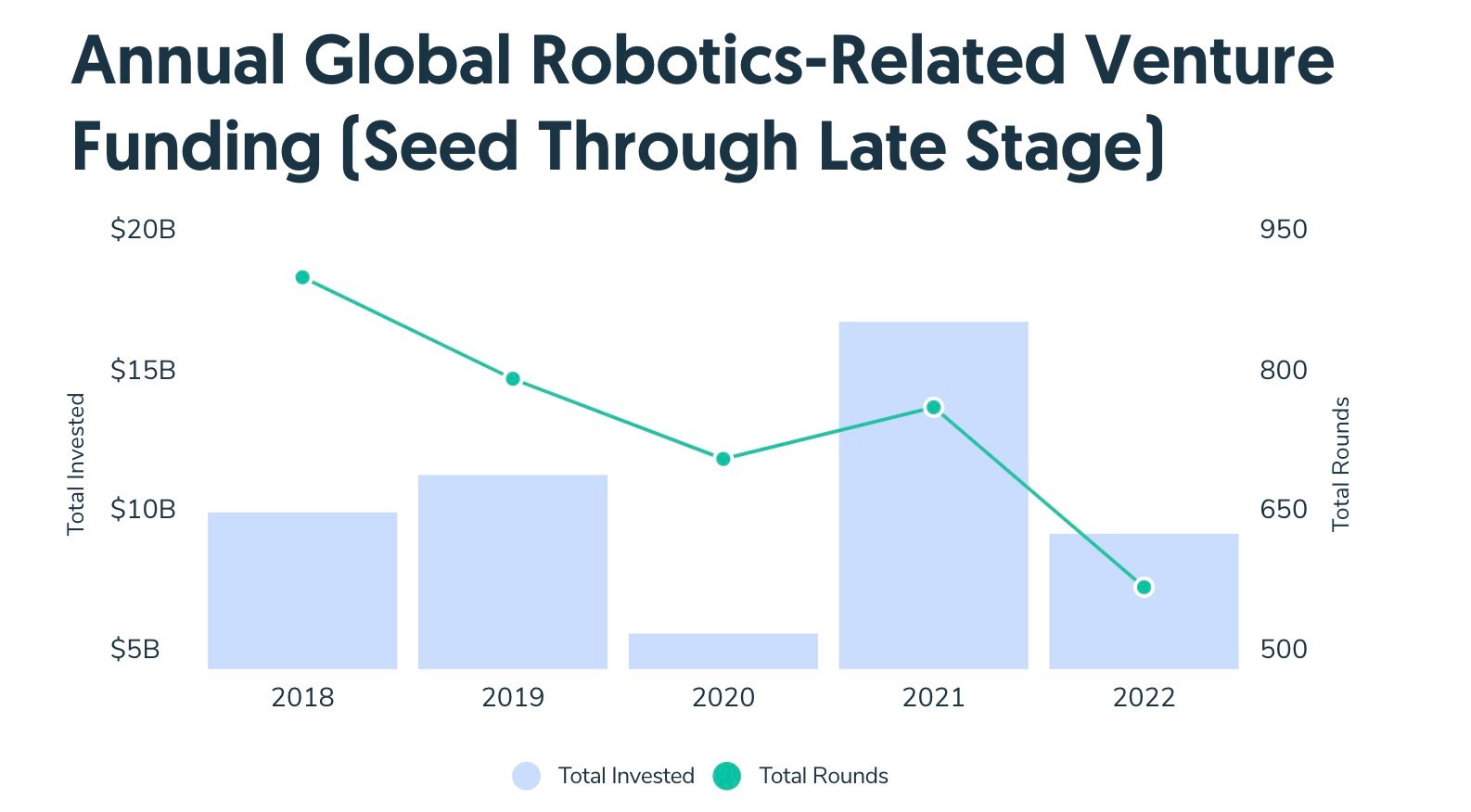

Robotic investment had been growing exponentially for over a decade by the time 2021 came around. In general, people were optimistic about its future and saw it as a means to earn sizable returns on their investments. However, in 2021 there was a brief moment when it seemed like robotic investments may be immune from broader market forces. Even though we all fundamentally understood this not to be the case, it was nice nonetheless watching the market reflect this optimism with an influx of robotic money into asset classes like equities and bonds.

Our economy is already feeling the effects of the Burst. With prices skyrocketing, unemployment increasing, and businesses closing their doors all over the country, it’s clear that there is more to this than just a simple power outage. Although we may not know the full extent of how things will play out in the short and long term, it’s important to be prepared for anything.

Inventive minds are in high demand, and the tech industry is no exception. According to a study by Forbes, the top 10 highest paying jobs

People who enjoy camping or hiking tend to be independent and resourceful. They don’t need many things, so they are often appreciation of what they have.

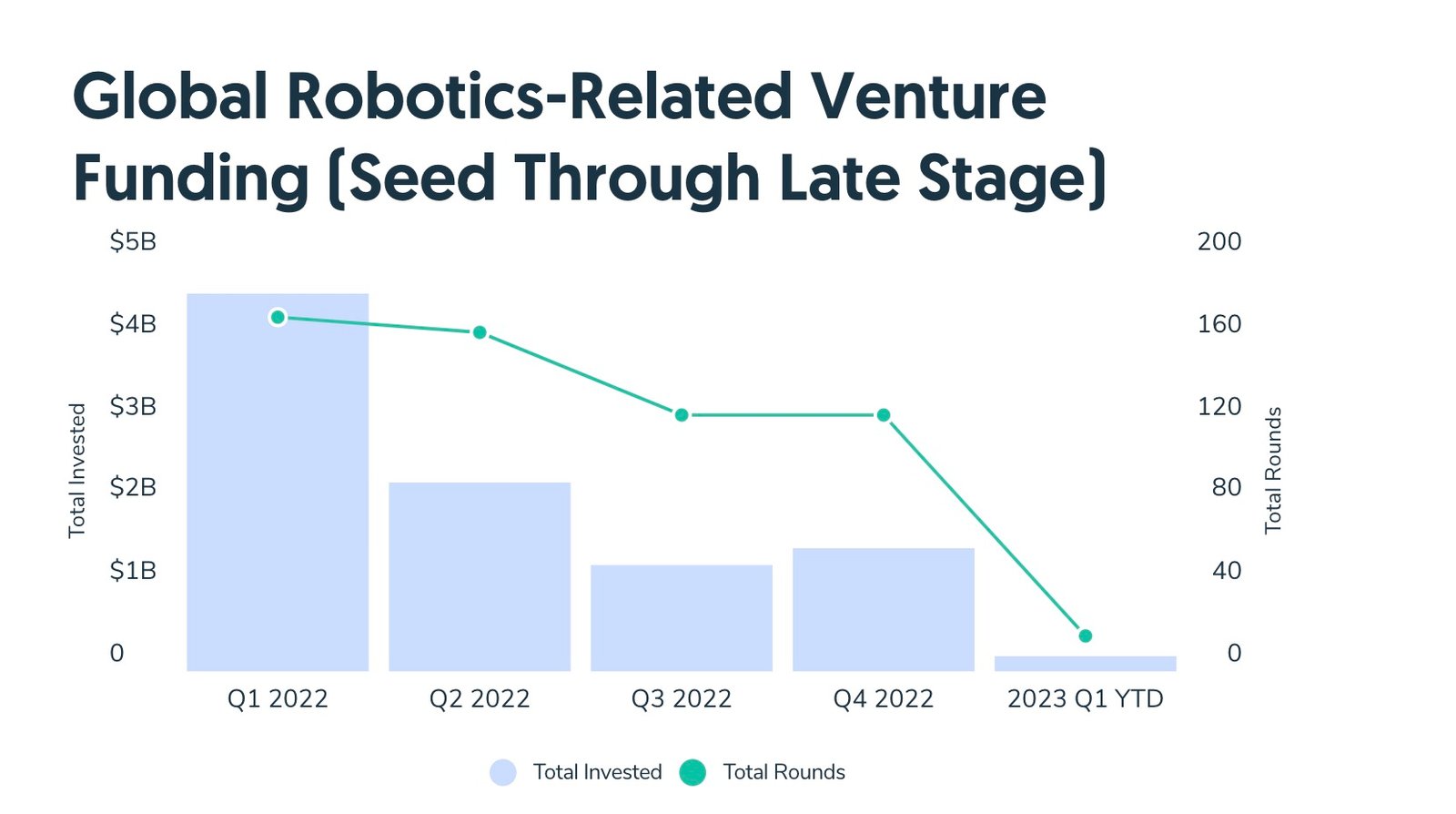

- 2022 was the second worst year for robotics investments over the past five years.

- The figures have been on a fairly steady decline for the past five quarters.

Investor confidence ebbs and flows, with certain periods seeing a resurgence in activity while others are more subdued. This is to be expected, as certainty breeds confidence and when uncertainties abound investors become hesitant to commit capital. 2020 was an anomaly in that sense – the global pandemic created a degree of uncertainty for many, which dissuaded investors from committing resources. However, as soon as things started calming down in Q2 of that year, investor confidence started picking up again. 2021 may well see a continuation of this trend due to the number of ambitious projects expected to come online – both domestically and internationally – throughout the year.

Sloan Digital Sky Survey is a large-scale astronomical survey that employs the Sloan Digital Sky Survey telescope to create a three-dimensional map of the

Robots and automation are not just recession-proof, they’re actually creating new opportunities for those who watch out for them. As difficult as it may be to find a job in today’s economy, the growth of robotics and automation is making it easier for companies to replace human workers with machines. In turn, this is opening up new opportunities for those who are willing to learn how to operate these technologies.

Many early-stage startups find themselves with shortened runway this year. There is some consolation that could come down the road, but decisive action needs to be taken for those who suddenly find themselves unable to close a round that might have felt like a foregone conclusion 12 months ago.

Given that acquisition fever is likely to spike in the near future, many companies may feel forced to sell themselves at considerable discounts. If a company isn’t acquiring new customers, it may be time to make a strategic decision about whether or not to pursue continued growth. For some, this could mean shutting down operations while others will try their hardest to stay afloat by selling off redundant assets or even entering into partnerships with other companies.

This year has been a mixed bag for the ecommerce industry. Investment rounds and enthusiasm seem to be ramping up, but users remain hesitant to invest given that there have been multiple closures already this year. A true bounce back seems inevitable, but no one can say for certain when it will happen.