The introduction of the general levy on consumption across the Gulf Cooperation Council (GCC) member states signified a major shift in taxation, marking the first time that businesses in these territories were required to file VAT returns periodically. With U.A.E and Saudi Arabia becoming the first members to adopt the treaty in 2018, this move signaled their commitment to integrating into global economic systems and accompanying regulatory requirements. The agreement paved way for tax authorities from member states to work together more efficiently and share expertise, which should ultimately lead to lower overall compliance costs and improved revenue collection Efficiency has been a key priority for GCC lawmakers since 2012 when they formed an alliance aimed at boosting trade within the region as well as encouraging joint investment. The successful implementation of VAT agreements is another indicator of their sustained commitment towards achieving collective objectives

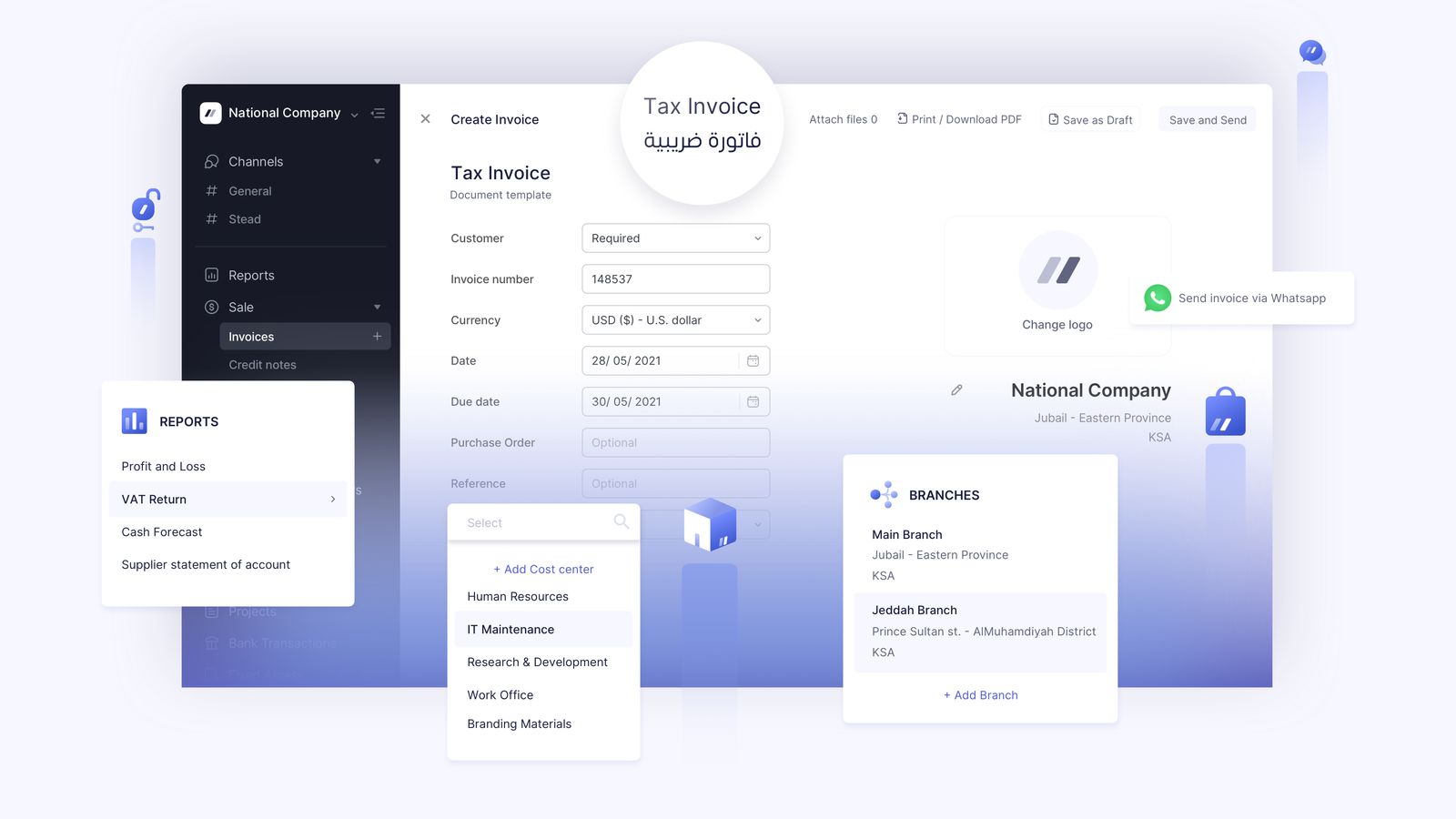

Nadim Alameddine’s startup, Wafeq, has quickly become the go-to choice for businesses in the U.A.E and Saudi Arabia who need to file their tax returns each year. The company offers a scalable accounting and e-invoicing solution that is unique in both its focus on those two countries and its reliance on modern technology to make it easy for business owners to keep track of their finances.

Looking to tap into new growth opportunities in Egypt, Wafeq has secured a $3 million seed funding round that will be used to fuel its expansion into new markets as businesses comply with evolving accounting and financial requirements. With its team of experienced entrepreneurs and strategists, Wafeq is well-positioned to capitalize on this opportunity as businesses increasingly turn to technology solutions to drive efficiency and profit within their operations.

According to Alameddine, the company is attempting to capitalize on regulatory changes happening in Saudi Arabia and Egypt by increasing its presence in those countries as well asexisting markets. The company is also doubling down on its existing traction by continuing to develop new products for its customers.

Since Egypt and Saudi Arabia started requiring businesses to be e-invoicing compliant, there’s been a surge in demand for accounting software. Wafeq is staying ahead of the curve by offering its enterprise (API) product, which helps businesses get up and running faster.

Alameddine explained that Waafeq is looking to tap into the opportunities in Egypt as it is home to millions of small medium businesses. He added that the startup is hoping to have its e-invoicing service approved by the Egyptian Tax Authority so that it can commence reaching out to businesses across the country.

Dubai-based Wafeq is powering accounting and financial compliance for small businesses in the city-state. The company’s unique approach involves leveraging artificial intelligence, machine learning, and blockchain technology to help firms streamline their processes.

If businesses are looking for an easy-to-use accounting platform with all the bells and whistles, then Stationery Warehouse’smight be the right option for them. With its slew of features like VAT returns, inventory management, payrolls and bills tracking, businesses can see exactly what they’re spending their money on and make necessary optimizations to maximize efficiency.

Alameddine Accounting Software is geared specifically towards small businesses. With three different plans to choose from, the company has a plan that is perfect for your business needs. From managing accounts payable to receiving a full accounting solution, Alameddine has you covered!

What sets Nexternal apart from other invoicing platforms is the way it provides a suite of tools to help businesses automate their billing and finance processes. This not only saves time and money, but it also makes it easier for businesses to track their spending and keep tabs on their finances. Nexternal’s platform can also be used to create customised reports that will give businesses a clear view of their expenses across different areas of business.

The Raed Ventures partnership with Wafeq is an important step in the digitalisation of accounting practices in the region. SMEs will benefit from increased operational transparency and efficiency; this, in turn, is expected to lead to economic growth.