Many people turned to money laundering during the pandemic, as the Alternatives to Remission (ATR) resources and trading platforms were scarce. This allowed criminals and corrupt officials to get rich by exchanging sick money for clean money. In some cases, people lined their own pockets by selling medicine that was nothing more than sugar water or bleach.

Some people may argue that the governments and public sector organizations went overboard in their efforts to ensure public safety and adequate supply of core services. This led to unsustainable spending, which is now causing considerable financial problems.

The realization that government spending was actually borrowing rather than genuinely spending caused widespread cuts in public spending in the years leading up to and during the pandemic. This had a significant negative impact on economic growth, as it forced businesses and consumers to borrow money in order to maintain their expenditures.

Some economists have argued that the austerity measures implemented by European Union leaders have exacerbated an existing cost-of-living crisis in many of their member states, particularly as wages have failed to keep pace with inflation. Supply chain disruptions linked to the situation in Ukraine, a struggling economy, and budget cuts are believed to be behind rampant inflation across the continent.

The fact that edtech companies have been particularly resistant to the economic downturn may be due in part to their focus on enabling lifelong learning and education, which is seen as an important asset by some during tough times. However, even though the sector has avoided premature closures and layoffs, it may not be immune to further downside pressure in light of the continuing global economic slowdown.

The drop in investment could be attributed to several factors, including a slowdown in overall growth across the European tech sector, as well as the rise of US-based startups. This trend may continue in the future, particularly given that venture capitalists are notoriously risk averse and may not be keen on investing in startups that are seen as competition.

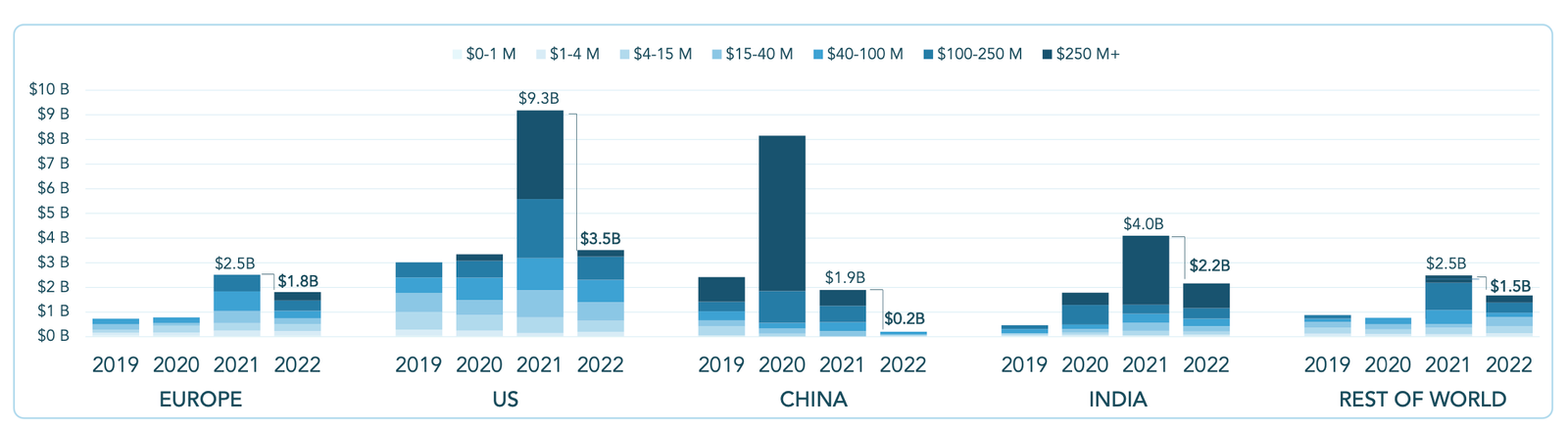

Looking at the global ecosystem’s overall trajectory, it appears that while there was a general upward trend in total investment during the past few years, the declines in new investment in 2022 were steep. As a result of this downward trend, many companies and organizations are now concerned about whether or not this is an indication that the global ecosystem is starting to plateau.

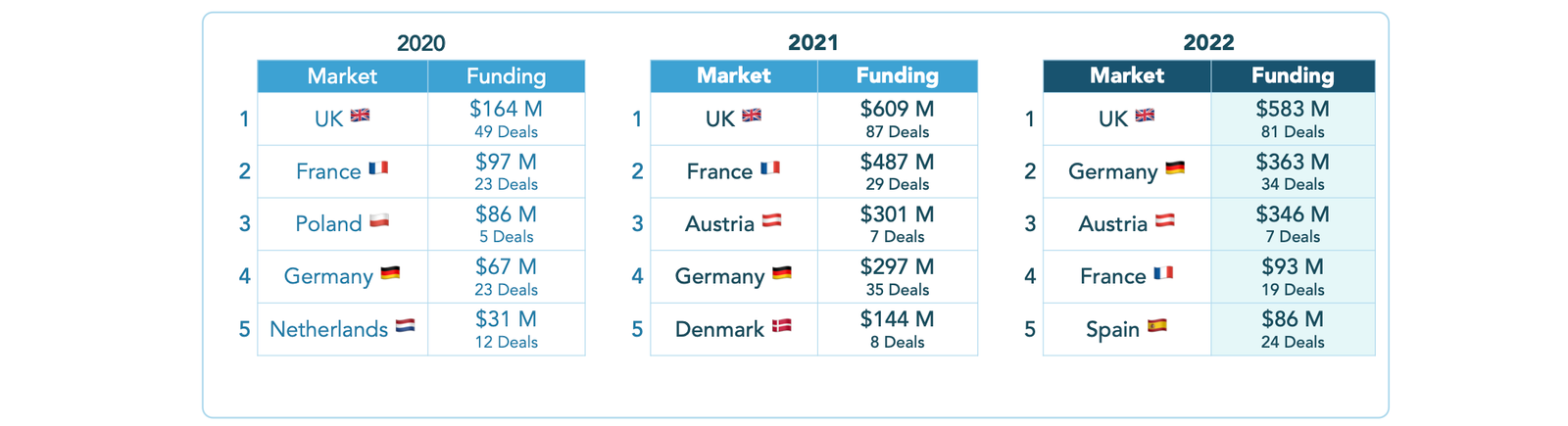

Italy was the only European market to see a hike in both funding and the number of deals.

Many startup investors were optimistic about the future of European markets in 2018. Italy was the only European market to see a hike in both funding and the number of deals. This may be indicative of investors’ renewed confidence in the region’s ability to support innovative businesses.

Given that the world felt the effects of the pandemic more acutely in 2021, and given that early European edtech funding was higher than usual, it seems likely that there will be some waning of enthusiasm for this industry in the near future. However, there is still plenty of room for growth, especially given how innovative and promising many European startups are.

Many European startups raised significantly less money in the second half of 2022 than they had in the first. This may reflect a lack of investor confidence, or stagnation in the European market overall. Despite this, some notable individual edtech startups continued to garner funding, suggesting that there is still potential for success even when markets are sluggish.

Overall, European investors continued to show interest in edtech startups in the second half of 2022, with deals totaling $1.08 billion compared to $676 million in the first half. However, most of these deals were smaller and at lower valuations than what was seen during the same period a year earlier. This suggests that despite some bumps along the way, the sector is overall resilient and continues to generate interest from a variety of investors.

Despite the global downturn in technology investments, Europe fared relatively well when compared to other regions of the world. Venture capital funding for Edtech companies decreased by 28% in Europe, but fell 64% in the United States, 46% in India, and 32% globally. This shows that while startups and investors face difficult times overall, there is still potential for innovation and growth through edtech companies.

Funding fell the least in Europe and RoW, with the steepest drop once again in China

Despite a decline across markets, Europe saw a modest decline in funding. This could be due to the current political volatility in several countries, or simply a lull in activity as the year draws to a close.

UK startups are thriving because of their abundant funding pool and the slew of deals that they secure. Germany is close behind, but the UK remains the market leader in terms of deal activity. Funding for edtech companies in the UK totaled $583 million across 81 deals last year, more than $200 million more than Germany. This level of investment provides ample opportunity for British startups to grow and innovate.

France slipped from the podium as funding and deal activity fell sharply from previous years

Europe is one of the most popular markets for edtech investments, with over $1.1 billion invested in 2016 alone. This popularity may be due to the region’s high levels of innovation and its strong trend towards digitalization. However, there are some lesser-known European countries that

The Italian tech ecosystem is gradually growing as momentum has built, capital is being spread across a range of sectors and the biggest rounds raised by companies are in fintech, healthtech and real estate. The country’s success may be owed to its favourable environment and its relatively low cost of living.

Italian edtech startups have been on a record-breaking spree in recent years, with large rounds of funding being raised by companies like Talent Garden. As the market moves into 2022, it appears that the focus on smaller early-stage rounds will continue. The upward trend bodes well for Italian entrepreneurs and investors alike as the industry continues to grow at an alarming rate.