The loss from the investment vehicles of SoftBank Group is a sign that the Japanese tech investor is continuing its bleeding through the market downturn, pared back its investments in new businesses, and is now seeking to recoup some of its losses.

The losses reported by SoftBank Group may call into question the fundamental thesis of the company, which has deployed more capital in the tech markets globally than anyone else in the past decade. While it is possible that this loss was a result of bad luck, there are also questions about whether SoftBank’s investments in private companies have paid off.

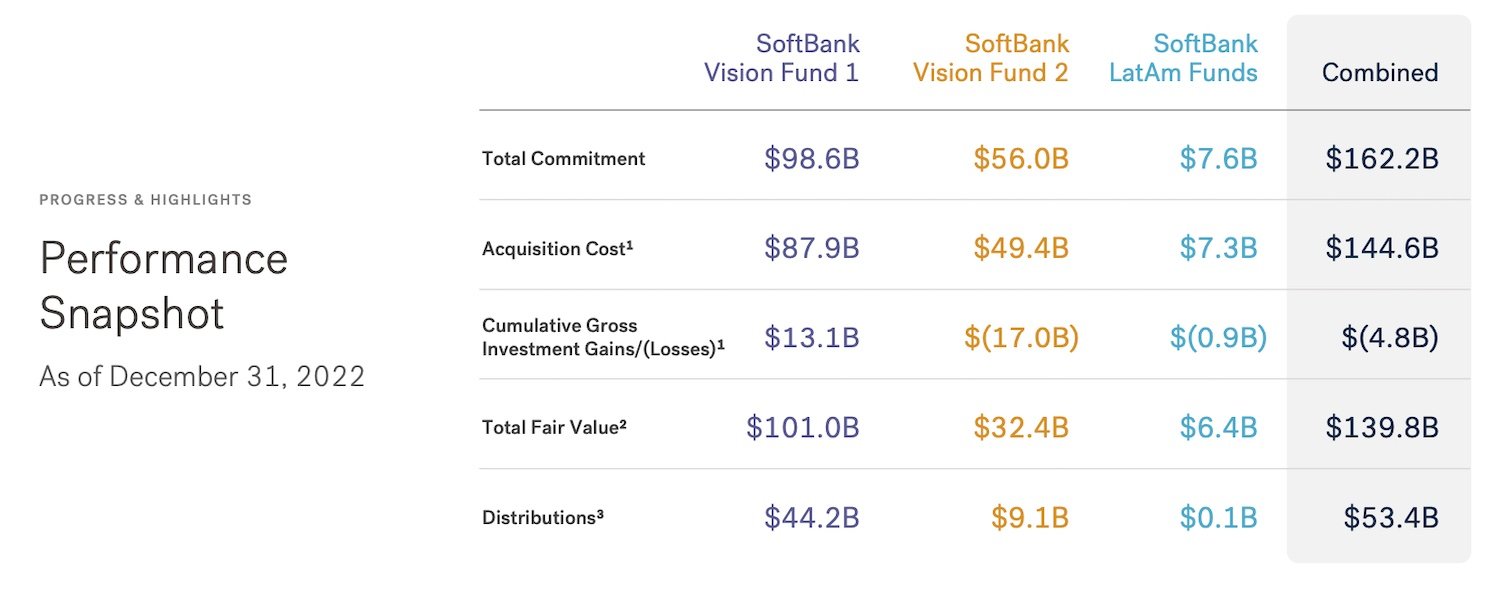

SoftBank chief executive Masayoshi Son has repeatedly called for his company to transform into a technology and internet conglomerate, but its performance in the first three months of this year shows that the group is still struggling to turn a profit. At $5.8 billion, the quarterly loss suffered by Vision funds and Latin America fund falls well short of SoftBank’s total net losses over last year

The late-stage portfolio of the company represents some of the most promising technology innovations on the market, and its worth is estimated to be over $37 billion. This wealth of potential presents major opportunities for future growth, as the company looks to capitalize on this valuable asset by expanding its reach and continuing to invest in innovative new products.

In the wake of the market crash of 2019, many prominent investors took a much different tact in their investments knowing that large deals were harder to come by. SoftBank was one such company that slashed checks worth over $20 billion in just one quarter as many investors scrambled to capitalize on what was once an open window for investment. After briefly regaining dominance in late 2020, this strategy proved much harder to maintain when the market reversed early last year with most large deals now out of reach.

SoftBank Vision Fund is boldly investing in startups with big revenue potential and it appears to be paying dividends. Between Q2 and Q3 of 2022, the firm invested a total of $300 million into 39 companies with revenues totaling over $1 billion. Out of these, more than half have surpassed even SoftBank’s own expectations – meaning this investment may very well be worth its weight in gold.

“We are excited to partner with SoftBank Group and invest in their transformative vision for the future of technology,” remarked Apple CEO Tim Cook. “We believe in

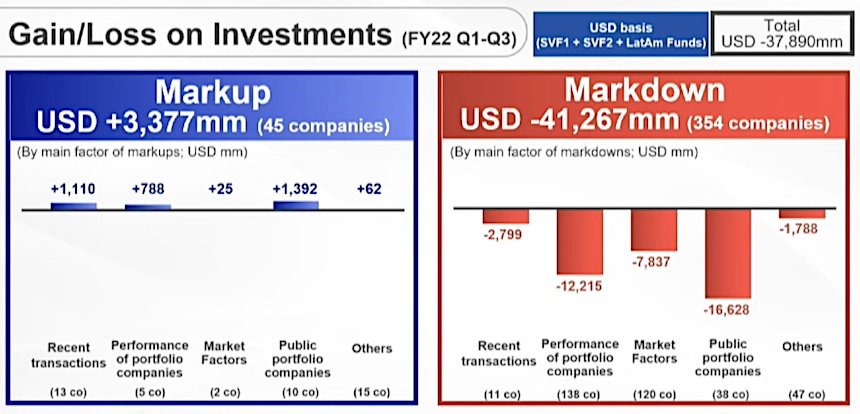

SoftBank’s public investments have not fared well in comparison to its private investments. In the past two years alone, SoftBank’s stocks have lost nearly 43 percent of their value compared to its gains in the public market. This lack of success has earned SoftBank some negative press, and it may be facing further headwinds as it tries to invest more in AI and other cutting-edge technologies.

SoftBank Vision Fund 1 is a giant investment fund controlled by the Japanese conglomerate SoftBank. The fund has invested in a number of publicly-listed companies, but its largest holdings are in London-based ARM Holdings, which makes semiconductors for smartphones and other devices, and US tech firm Nvidia. Compared to investments made through the Vision Fund 2 – which poured $48.3 billion across firms – SoftBank’s overall holdings have seen smaller returns though it is still facing a loss of $17.6 billion.

Amidst SoftBank’s massive losses in their investment in Chinese ride-sharing company Didi and coworking company WeWork, shareholders continue to reap the benefits. For example, Coupang, a subsidiary of SoftBank that owns a significant stake in both companies, saw its stock prices rise by over $4.2 billion since the investments were made. In total, SoftBank has lost over $9 billion on these two ventures – although they have still profited overall thanks to their shareholdings in other profitable businesses like Sprint and Takata

SoftBank is preparing for a market recovery, or stumble through until early 2024. In the event of a market recovery, they anticipate seeing growth in their businesses by second half of this year or early 2024. However, should the market take a stumble, SoftBank is prepared to remain in defence mode and focus on their core businesses.

There has been a recent push by SoftBank to bring more discipline across its portfolio firms, as raising money became exceedingly difficult in the past one year. Masayoshi Son, founder and chief executive of SoftBank Group, cautioned that the funding winter for startups may continue for longer because some unicorn founders are unwilling to accept lower valuations in fresh funding deliberations. Son skipped the earnings call Tuesday, suggesting that there might be some trouble ahead for the startup community.

Despite its reluctance to invest in digital currencies, the huge financial conglomerate SoftBank is one of the biggest investors in blockchain technology. The company has made 26 investments in this area so far, with a current value of $1 billion. Notably, its most recent investment was made in the collapsed cryptocurrency exchange FTX, which saw it lose $97 million overall. Despite these setbacks, SoftBank remains bullish on the potential of blockchain technology and sees it as a key way to spur innovation and improveefficiency in various industries.

One of the largest investors in artificial intelligence (AI) is Japanese tech giant, SoftBank. SoftBank has a long history of investing in cutting edge technologies and believes that AI is one of the key areas where this investment will pay off. The company maintains a “