The company said the new funding will be used to expand Acceldata’s product offerings, increase its customer base, and improve its analytics capabilities. Acceldata also plans to use the funding to develop new products that can help businesses better understand their data.

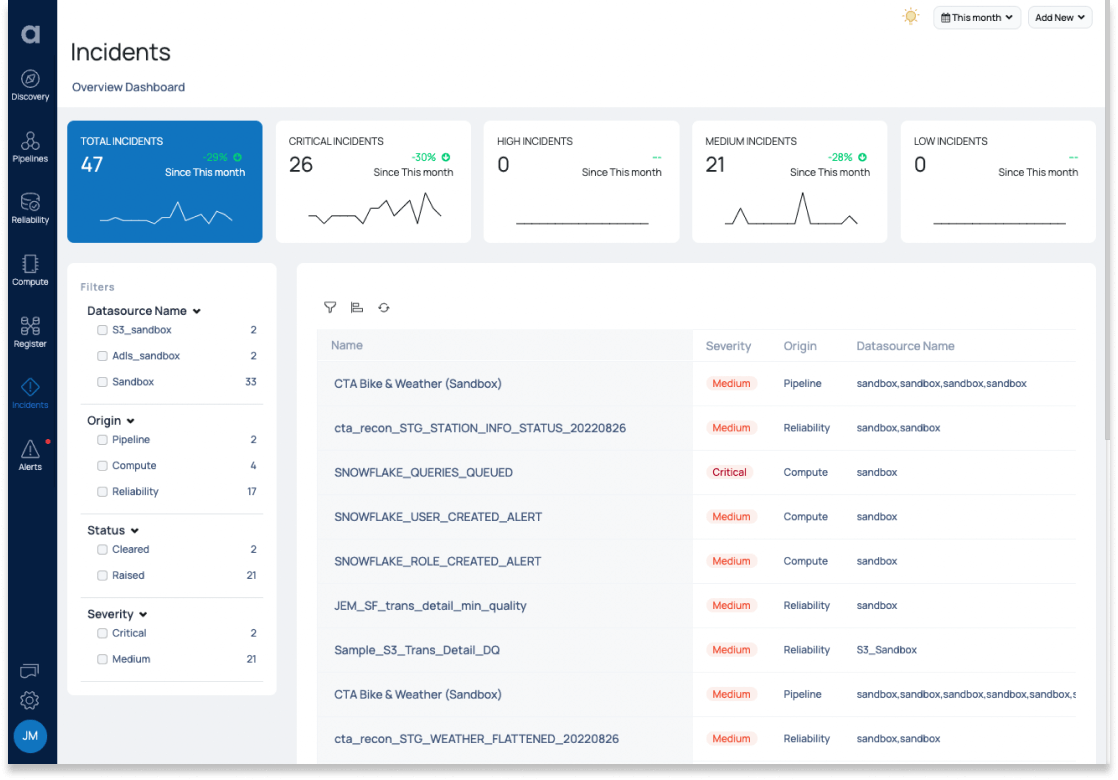

Acceldata offers an enterprise data health solution that helps organizations identify and solve issues with data across all platforms and applications. The product combines artificial intelligence, big-data analytics, and machine learning to offer a comprehensive view of data health, pinpointing any problems that may exist.

Given the sheer volume of data being generated by enterprises today, it is essential that companies have robust data pipelines in place to ensure that their information is properly transported and stored. Acceldata can help organizations assess the quality of their data in transit or at rest, while also revealing insights into the infrastructure underpinning their data pipelines.

A data pipeline is a critical tool for ensuring trustworthy data. It helps to efficiently move data between different sources, so that it can be used for analytics and governance purposes. This helps to ensure that the data used for these purposes is suitable and meets its desired goals.

Acceldata is a new startup focused on helping small businesses improve their data management. Acceldata offers a suite of tools that make it easy for businesses to collect, organize, and use data to improve

Recession-proof?

Could the growing observability vertical be a boom industry heading into the next recession? Sure, there have been a slew of tech companies collapsing in value and layoffs impacting the industry as of late, but it seems that investors are still bullish on observability as a potential solution to some of the world’s biggest issues. In just over five short weeks this year, we’ve seen two fledgling observability startups announce significant seed funding rounds – Metaplane with $8.4 million and Chaos Genius with $3.3 million – which could bode well for the industry as a whole going into 2024.

Traditional application observability metrics such as CPU, memory, and network usage can be useful indicators of an application’s health. However, depending on the layer of the software stack an observability company specializes in, different metrics may be more indicative of success or failure. For Acceldata, this means that the company covers a full gamut of layers across data infrastructure, quality, pipelines and users – supporting more use-cases including “spend intelligence” which allows its customers to manage and predict their data processing costs as well as giving them insights on data reliability – meaning bad data can cost companies a lot money in computing costs.

One of the main reasons Acceldata has been so successful in raising money is that data observability is increasingly seen as a top priority for data-driven companies. Choudhary said the fresh cash injection will help the company double down on its efforts to spread awareness about how necessary it is for businesses to implement effective data management practices.

According to Choudhary, the industry is growing quickly and there is a need for education around what data observability is. Acceldata will be providing this education through thought leadership, market education, and product innovation. This funding will help Acceldata continue to serve customers well.

Given that data-focused software companies are well-positioned to weather the current economic headwinds, it seems likely that the number of such companies will continue to grow in coming years. This is good news for employees who can expect better opportunities and higher wages in this sector.

As the world increasingly becomes data-driven, businesses and organizations are forced to adapt and adopt new ways of working. One solution is the development of a data platform, which can help with the management and analysis of data across different systems.

March Capital, Insight Partners, Industry Ventures and Sanabil Investments are all experienced investors in the digital space. All of these companies have a great deal of experience with data handling and analysis. This will add an extra layer of expertise to Acceldata’s operations, which is sure to improve the company’s performance.