In recent years, the fintech movement has experienced enormous success. Thanks to innovative technological tools and solutions, consumers have seen dramatic improvements in their financial experiences. This movement has ushered in a new era of financial innovation, and it looks like it isn’t going to stop anytime soon.

Smart fintech startups are often hailed as the future of financial innovation. However, it is important to note that not all these ventures will be successful. In fact, some may even fail outright. This is something to bear in mind when evaluating any potential investment in a fintech company – whether this be through direct investment, sponsorship or simply exposure.

Some fintech ideas have had a lot of initial hype and momentum, but ultimately did not live up to their promise. One example is the idea of using blockchain technology to help with financial transactions. This idea has been around for a while now, but has yet to become mainstream. There are many reasons why this might be the case, including the complexity of understanding how it works and its potential security risks. It remains to be seen whether or not blockchain will play a major role in reshaping financial services in the future, but for now it seems like it is only going to have a limited impact.

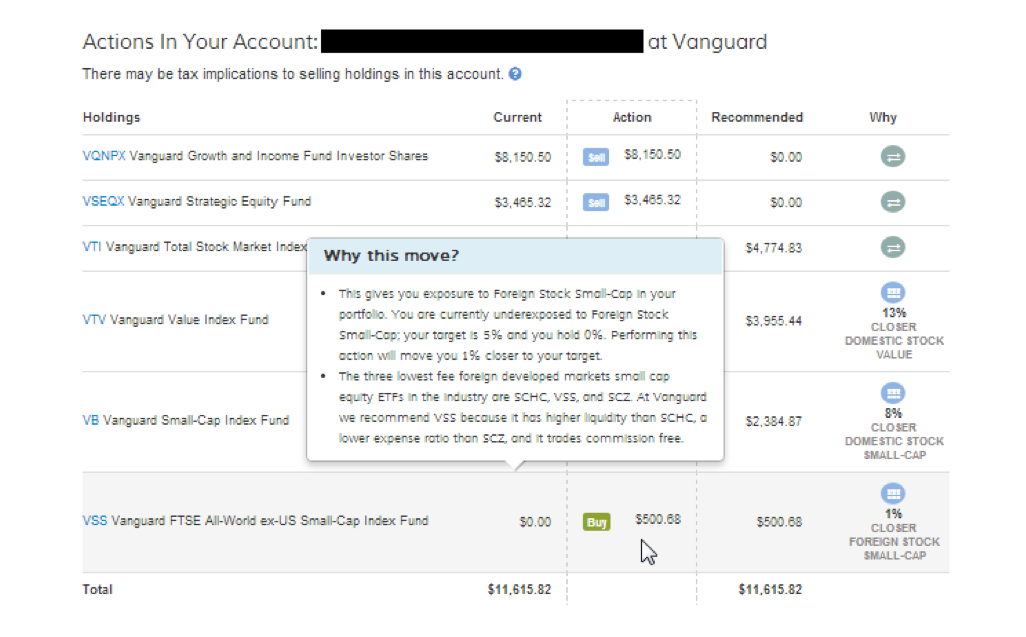

Algorithm-based buy/sell/hold advice for investment portfolios

Fintech must remember that the average consumer doesn’t like thinking about money and often wants someone else to take care of it.

As the world becomes increasingly digitized, people are increasingly turning to technology to manage their finances. Fintech companies must remember that the average consumer doesn’t like thinking about money and often wants someone else to take care of it. Fintech companies must also make sure they are constantly innovating and expanding their services in order to keep up with the competition.

The first robo advisors were born out of the boom in fintech, as companies that offered algorithm-based buy, sell and hold advice for a user’s investment portfolio. These services would give holistic and specific advice for every single holding (e.g., sell this stock and buy this ETF instead), which was seen as a revolutionary approach to investing. However, while these services were very popular in their early days, they eventually lost ground to more traditional investopedia sites and services that offer more generic advice across all holdings.

The technology would allow users to see a graphical representation of their entire investment portfolio, consolidating all of their accounts with different institutions into one place. This would provide investors with an easy way to see where they are positioned across all of their investments and make more informed decisions about where to allocate their money.

In 2013, FutureAdvisor recommended buying stocks in a number of companies including Amazon.com (AMZN), Apple Inc. (AAPL), and Google Inc. (GOOGL). While the stock recommendations may have changed since then, the platform continues to offer useful advice on how to invest for the long term.

The failure of these firms may be due to the high cost of acquiring wealthy customers and successfully trading their portfolios. Interestingly, this seems to be a common trend for startups that pursue this technology – they eventually pivot to a different business model. This suggests that even with impressive technology, it may not be feasible for a startup to become mainstream in this space.

Some in the financial services industry believed that allowing customers direct access to the technology would lead to large amounts of money being directed away from the firms. They feared that people would begin to use it as a way to trade their funds without following advice from their investment professionals, which could lead to portfolio mistakes and even loss of capital. This was a major reason why many of the large players were resistant to this technology’s development.

Online investment tools have come a long way in the last decade, but they still fall short of the quality and variety of services that were available 10 years ago. For example, current online tools are missing features that were common in earlier versions, such as detailed portfolio tracking and comprehensive analysis. Furthermore, some older tools are no longer supported or can only be used with certain browser plug-ins. As a result, many people

Peer-to-peer (P2P) lending and insurance

Many people were enticed by the idea of P2P lending and insurance startups because they promised a better experience than receiving loans or insurance policies from faceless corporations. The companies that created these business models targeted those who were looking for a more personalized experience and made it clear that they would not be bound by the same rules as traditional lenders or insurers. This appealed to many people, who saw these startups as offering unique opportunities unavailable from other sources.