Rule aims to keep customer assets segregated appropriately to protect users

I always knew that I could be a great writer, but I never imagined it would feel so rewarding. Compiling my thoughts and experiences into a story has been an incredibly cathartic experience and one

The proposed rule from the U.S. Securities and Exchange Commission could back further investment into crypto companies, as regulators continue to crack down on the space. This would create a situation in which regulatory uncertainty could discourage future investors, potentially leaving these businesses vulnerable to closure.

Digital assets have been growing in popularity, with more people looking to invest their money in this new technology. However, this is not without risk, as there is no central authority to back up these investments. This proposal from the SEC would direct registered investment advisers (RIAs) to store digital assets with qualified custodians like a bank, broker-dealer or trust company. This will help protect customers’ money and securities from being lost or stolen.

This proposal will help protect customer assets from being impacted by an adviser or custodian’s bankruptcy or insolvency. If implemented, this policy would ensure that the customers’ assets are appropriately kept separate from the adviser’s and custodian’s assets. This could prevent large losses for investors who may have placed their trust in these firms, and maintain confidence in the industry as a whole.

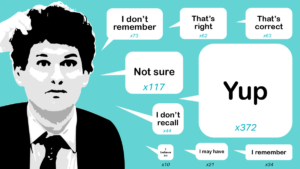

The collapse of the FTX exchange and its assets raises important questions about how digital asset investors should store their assets. Mike Belshe from BitGo suggests that investors should store their assets with qualified, regulated and insured custodians in order to ensure that they have a check and balance against any exchange’s control.