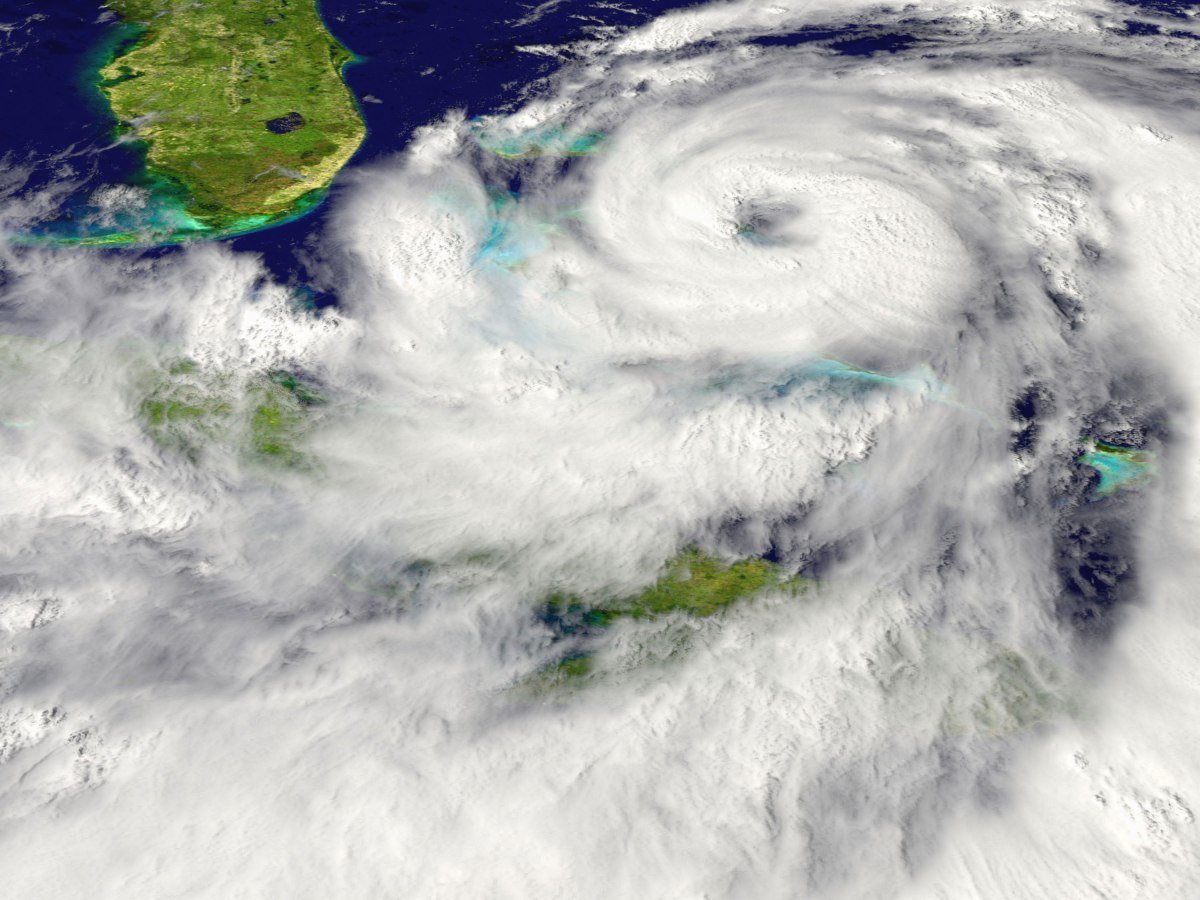

The insurance industry has remained largely unchanged for the past few decades, with people suffering losses as a direct result of something going south and getting paid by their insurer. In many cases, insurers are able to offer lower premiums to maintain a steady stream of customers, but this can also pose a risk if events occur that cause widespread loss across the industry. For example, Hurricane Sandy caused widespread damage to coastal areas in 2012 and was followed by several large wildfires in California later that year. These events resulted in significant loss claims paid out by insurers and raised concerns that premiums would need to be raised to cover future risks.

It would make sense for a construction company to be relatively immune to hurricanes, as these storms generally cause minimal destruction. However, even the most experienced professionals can’t always cope with powerful storms and may find it difficult to get crews to work. This is particularly true in regions regularly affected by hurricanes, where disruptions can last for weeks or even months after the storm has passed.

Traditional insurance policies often provide indemnity payments for losses not covered by the policy. For example, if a homeowner owns a policy that covers $500,000 in damages from a tornado, but the damage exceeds $1 million because of follow-on costs, the homeowner might receive an indemnity payment from their insurance company. The difference between what is paid out as damages and what is received as an indemnity payment leaves many companies feeling short-changed when claims arise outside of normal coverage. Creating catch-all clauses in policies that specifically list expenses such as lost wages due to illness or damage caused by weather events can address this issue.

Parametric insurance is an innovative alternative to traditional insurance that offers customers the security of knowing they can win regardless of the magnitude of losses. This type of contract guarantees payout based on a pre-determined event or conditions, such as a Category 4 hurricane hitting an area or wind speeds reaching a certain threshold. This gives customers more assurance that they will be able to recoup costs in case something unexpected happens, such as severe weather interfering with construction projects.

Insurtech startups are revolutionizing the methods used to insure risky investments. These companies are using artificial intelligence, big data and other analytics to help insurers distinguish between high- and low-quality risks. This has the potential to reduce premiums for clients while improving accuracy and consistency of coverage.

“Parametric insurance (as opposed to traditional indemnity insurance) is an insurance type that pre-specifies the amount of payout based on concrete ‘trigger’ events. For example, the payout could be linked to a certain weather event, such as the height of a river above the flood point.”

Though parametric insurance dates back centuries, it has only become increasingly popular in recent years due to its customizable and pre-determined payout features. In fact, many insurers now offer this type of policy as a way to target specific riskier customers or regions. As a result, parametric insurance is seen as being more cost-effective than traditional indemnity insurance because it enables carriers to reduce the amount paid out in the event of a claim without having to individually assess each claim.

One reason why index-based insurance is growing in popularity is because it provides a more streamlined process for all involved. For example, the insurer can rely on automated data to determine whether a trigger event has occurred, thus minimizing clerical tasks and speeding up the overall process. In addition, this type of insurance can be more affordable than traditional coverage as premiums are based on indexed data instead of actual claims experiences.

Parametric insurance is a type of insurance that uses data to create models of losses that can then be insured against. This method is extremely efficient because it allows for faster payouts and greater flexibility in coverage.

Many startups are building parametric solutions for weather-related insurance, where quick access to funds is crucial. The fast payouts that this model facilitates make it particularly useful for this space.