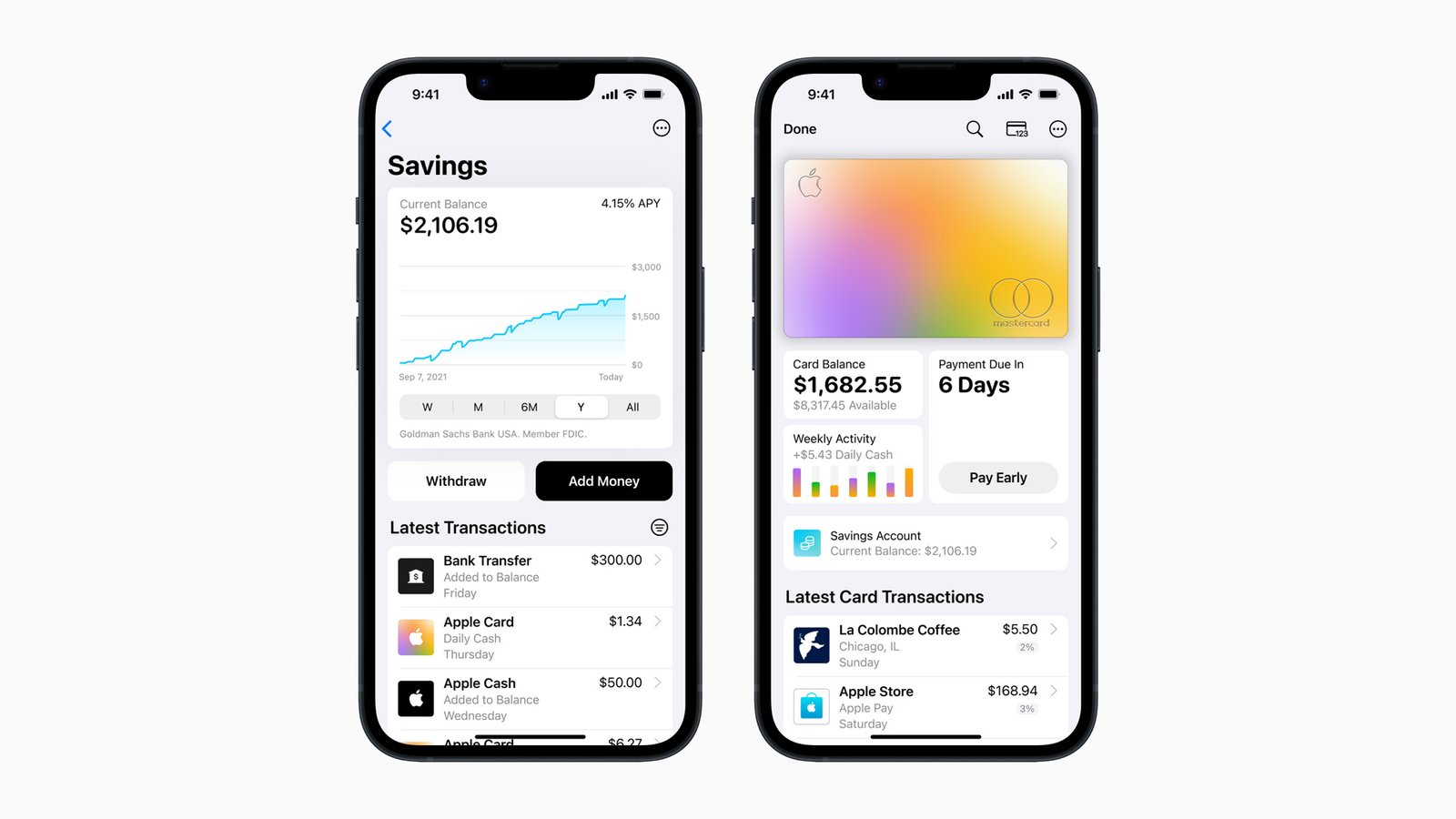

Apple has been offering a savings account with high interest rates to its customers in the United States since October. This accounts is now available to all Apple Card users, regardless of their credit score. Because rates are constantly changing, Apple can’t share what the rate will be now, but it promises that it will always be higher than traditional bank savings accounts.

Brand-name banks have been offering competitive rates on savings accounts for years now. This has driven the demand for these products, leading to a rise in competition among banks. However, if you’re looking for an account that provides guaranteed interest rates and stability over time, Apple’s 4.15% APY may be the ideal option for you.

Apple has been partnering with Goldman Sachs for the banking feature on the iPhone because they are a trusted provider and have a history of providing reliable service. This partnership means that people can store their money securely and have access to helpful resources should they need it.

Purchasing items with your Apple Card earns you rewards, which can be put toward future purchases or cashed out. This high-yield savings account is perfect for Apple Card holders, as they earn larger rewards on all purchases made with their card. By default, funds in this account give you 1% cash back on all spending and 2% when paying with Apple Pay. For select merchants, 3% in rewards are available when making a purchase using the App Store or embedded links from Safari.

Customers who regularly use their Apple Pay cards to make transactions get rewarded with tokens each day that can be used in the same way as checking account money. These tokens can be used to pay for goods and services using Apple Pay, transferred to a regular bank account, or spent on anything that normally costs money. Users can also gift these tokens to others via the Messages app.

As Apple Card users start depositing their rewards into savings accounts, they may be tempted to neglect their spending commitments. However, participating in a Savings Challenge can help members save money without feeling guilty. This challenge encourages users to set aside predetermined amounts of money each day towards savings goals. By participating in the challenge, cardholders can develop healthy spending habits and reach financial stability faster.

If you’re interested in keeping your money safe and also earning some decent interest, a savings account is a great option. You can access your account from the Wallet app, see your balance, current rate and recent transactions. You can also add or withdraw money manually if you need to.

According to Apple, their new Savings feature will help users save money every day by integrating it into their Apple Card in Wallet. By saving, users will have more money to spend on other things and can also easily send and receive cash payments. This is a great addition to the Apple Card benefit system as it helps people stay financially healthy and better manage their finances overall.

Many people prefer to save money in an Apple Savings account because there are no fees associated with the account. This means that you can keep as much money as you like without worrying about added charges. The account also has a maximum balance limit of $250,000, which is enough for most people.

Perhaps no other company has used consumer demand to drive innovation as much as Apple. The company’s focus on customer satisfaction has compelled it