A SaaS business relies on recurring revenue to survive and grow. Retention is one of the key metrics to track, as without a consistent flow of new customers, a company can quickly spiral into financial trouble. While retention isn’t a silver bullet, it’s the closest thing to it in terms of keeping your

Strong retention indicates that customers are not only interested in, but also benefitting from using your product. This is a strong indication that you have found a product-market fit and are solving a real problem for your customers.

Retention is critical to any company’s growth. Those with the best retention rates grow at least 1.5x – 3x faster than their competitors. By ensuring that your employees are happy and valuable, you can ensure a loyal workforce that will help accelerate your company’s growth

A high retention rate is important for businesses running in the SaaS market. Facing stiff competition, acquiring new customers can be expensive. For SaaS companies, losing a customer can be even more costly as sales and marketing expenses make up a large majority of their overall spending.

According to a recent study from The Boston Consulting Group, companies that can retain more of their revenue tend to be worth more. This finding is not surprising, given all the factors that go into determining a company’s value – but it does underscore the importance of retaining as much revenue as possible. Companies with high net revenue retention typically command higher valuations than those who struggle to keep profits and earnings intact. This isn’t

Businesses that are not retaining their employees may be experiencing a decrease in profits and an increase in employee turnover. In order to ensure that their retention rate is adequate, businesses need to take into consideration a variety of factors, such as salaries and benefits, company culture and values, training opportunities, development opportunities and more. Furthermore, companies should analyze the reasons why employees are leaving in order to devise solutions or create policies that will help keep those employees around.

Lead retention is critical for SaaS businesses, as it determines the sustainability of a company’s++ growth. ChartMogul found that businesses with higher lead retention rates reported significantly more favorable financial performance than their counterparts; this was true both in terms of total revenue and customer churn rate. Additionally, ChartMogul found that companies with high lead retention rates were also more likely to be well-funded. In other words, investors value these companies highly not only because they are successful products but also because they have a robust lead-retention strategy in place.

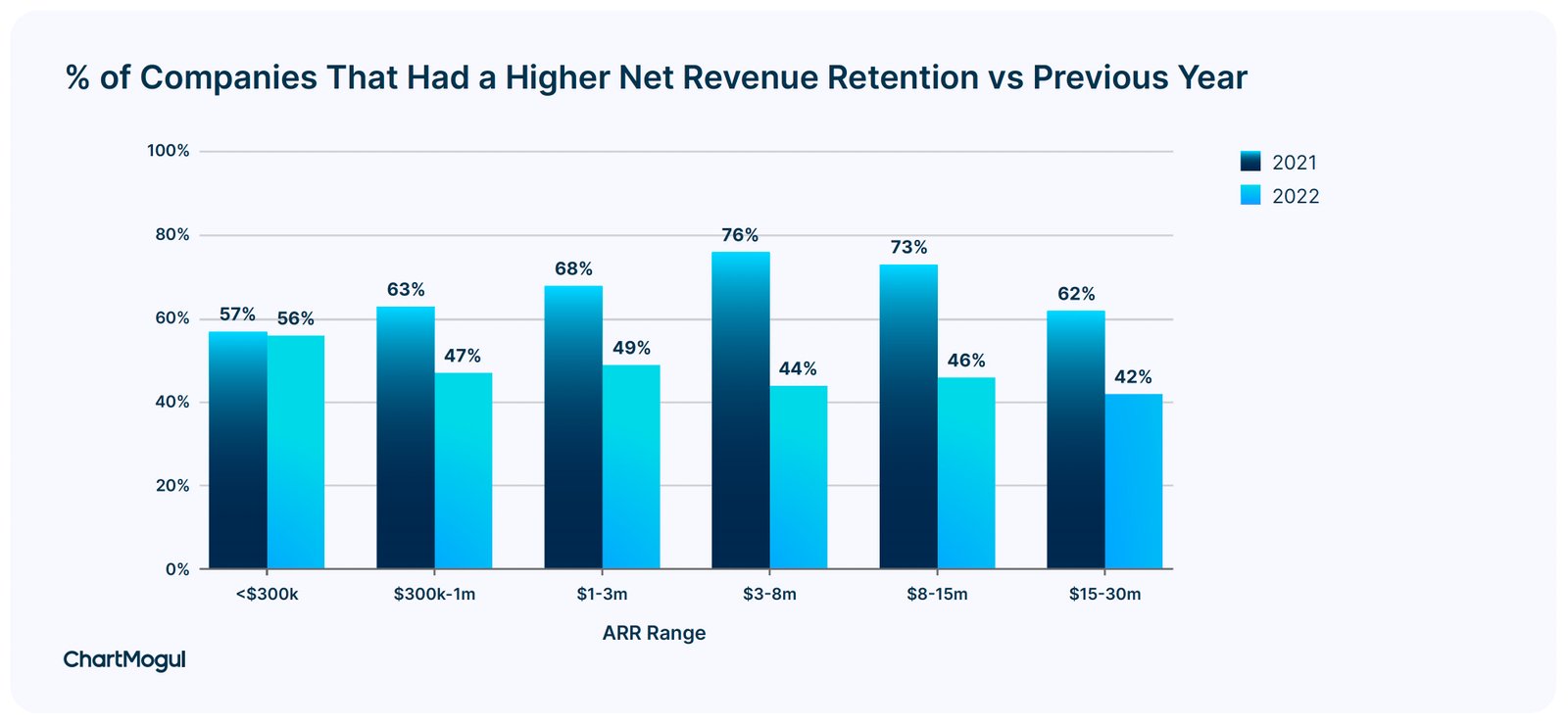

Retention in 2022 was harder than ever

According to the report, almost half of SaaS businesses had a lower retention rate in 2022 when compared to 2021. This is likely due to the current challenging macroeconomic environment, which meant that subscribers reassessed their spending and reduced their SaaS spend. However, this was in sharp contrast to 2021, where nearly 70% of businesses had a higher retention rate. This suggests that despite the challenges posed by the economy, businesses are continuing to invest in SaaS technology and see benefits such as increased customer engagement and profitability.

When looking at which companies are retaining more money, it’s clear that those who are thriving are those who have a robust financial stability policy in place. Many of the largest firms retain over ninety percent of their revenue, while many smaller businesses only retain around fifty percent. This indicates that the firms with a stronger financial stability policy can weather any storms and keep more money flowing into their coffers.

One possible explanation for the trend of retention decreasing in 2022 is that customers are starting to feel burned by SaaS offerings. This could be due to a number of reasons, such as companies not keeping their promises or constant changes made to products.

SaaS businesses over $3m in ARR should target a net retention rate of over 100%

When it comes to network retention, the “good” number for any business can differ depending on its stage. In early stages of a startup, for example, an efficacy rate of 50% or more is often seen as a positive. After hitting certain milestones (such as raised capital or an acquisition), however, higher retention rates may

For many startups, the pre-product-market-fit stage is one of the most difficult in their journey to becoming successful. During this phase, net retention is usually poor because companies are still trying to find their target market and figure out how to address it. As companies grow and find product-market fit, net retention usually improves; however, as they become category leaders, net retention can often be over 100%. This indicates that even top performing startups have room for growth. Ultimately, retaining talented employees is one of the key factors that will help a startup succeed.

A business’s retention rate is one important detail to keep in mind when benchmarking different businesses. ARR stands for annual revenue and, as the name implies, is a good gauge of how profitable a company is. For businesses with ARR below $1 million, the net retention rate can be quite low; however, as ARR increases so does the net retention rate. So far this year (as of October 2018), the top quartile has retained 94% of its revenue while those in the $3 million-$15 million range have retained 99%. Over 105% of revenue has been retained by companies with ARR totals above $15 million.

Retention rates display the success of a company in retaining revenues. The chart shows that companies with an ARR range of $100 million to $1 billion have a retention rate of 78%. This demonstrates that these companies are able to effectively manage their revenue and keep customers around. Businesses with

Customer retention rates are an important indicator of a company’s success. A high customer retention rate indicates that the company is able to keep customers happy and committed, which can lead to increased revenue and growth. If your customer retention rate is low, it may be indicating that your product or service isn’t meeting the needs of your customers or that you aren’t succeeding in converting them into long-term subscribers. In either case, it’s essential to take steps to improve your retention rate as soon as possible in order to maintain sustainability and growth in your business.

Some businesses are able to keep customer base high by offering flagship products that remain relevant and innovative. Other companies have a more difficult time keeping customers because they offer low-cost solutions or services with limited added value. Still, even these businesses can be successful if they focus on retaining their most valuable customers.

Net revenue retention leaders are businesses that maintain high ARRs (average revenue) over an extended period of time. These businesses have a proven ability to generate consistent, high-value revenue from their customers. Their success depends on replicating this success in the future, which can be difficult given