In a major boost to its mission and capabilities, B2B financial solutions startup Simetrik has announced a massive $55 million influx of Series B funding. This comes nearly two years after the company first secured $20 million in Series A capital.

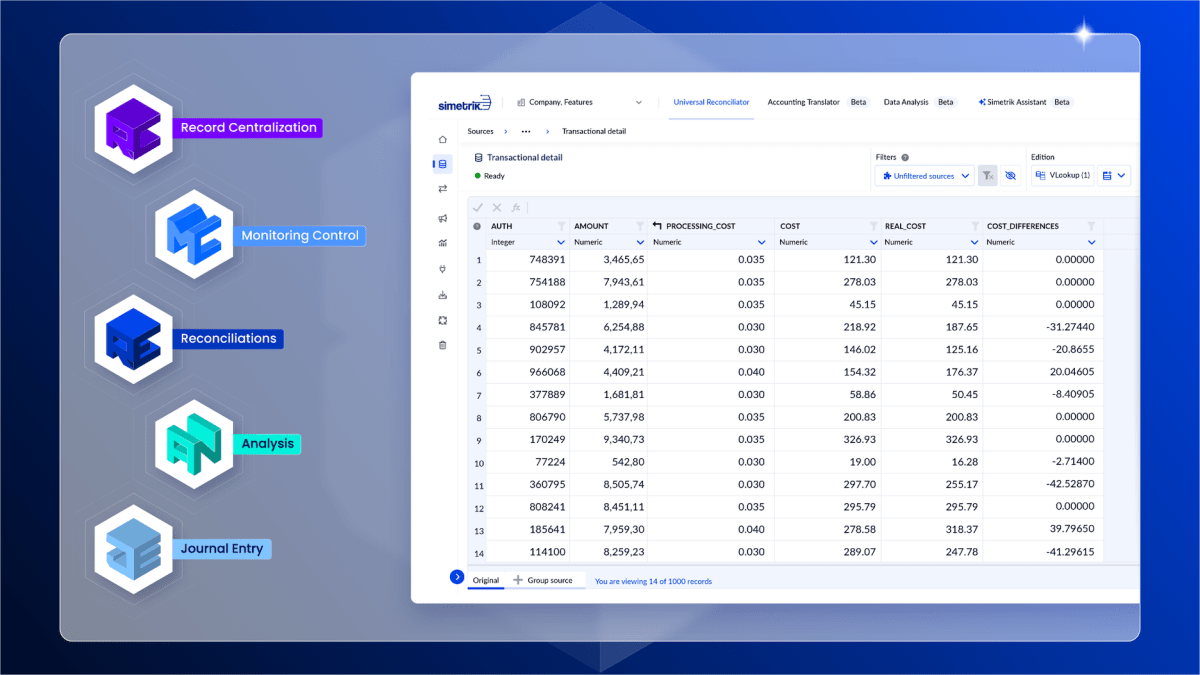

Based in Colombia, Simetrik is revolutionizing financial automation through its cutting-edge technology centered around record centralization, reconciliations, controls, reporting, and accounting. What sets it apart is its innovative Simetrik Building Blocks, or SBBs, which utilize no-code development and generative AI technologies to offer scalability and flexibility.

“There are a number of controls and automations that need to be done in the CFO’s office, including financial flows, and many others that are currently run manually,” explained Santiago Gómez , co-founder and COO of Simetrik. “Never before has there been this approach. We had an orchestration platform, which we left behind, and are now dedicated to software for CFOs.”

The sizable investment was led by Goldman Sachs Asset Management, with participation from FinTech Collective and seed investor Cometa. Other notable investors include Falabella Ventures, Endeavor Catalyst, Actyus, Moore Strategic Ventures, Mercado Libre Fund and the co-founders of Vtex.

This new influx of funding brings the total venture-backed investment for Simetrik to an impressive over $85 million . Notably, this Series B round is an “up round,” indicating significant progress and potential for the company. However, co-founders Alejandro Casas and Santiago Gómez declined to disclose exact figures.

Since being profiled in 2022, Simetrik has experienced substantial growth, expanding its global presence with clients in over 35 countries . The company currently monitors a staggering 200 million records each day, a significant increase from the previous 70 million records recorded daily. Additionally, Simetrik has witnessed a four-fold increase in revenue since the Series A round.

The company has built a strong presence in the Latin American market, collaborating with major players such as Rappi, Mercado Libre, Nubank, Oxxo, and PayU. Furthermore, it has formed strategic partnerships with firms like PagSeguro, Falabella, and Itaú, along with a global expansion into Asia, with a footprint in India and Singapore.

The bulk of the new investment will reportedly be allocated towards the development of Simetrik’s Building Blocks, strengthening its AI capabilities, and further expanding its presence in the international market. With the ever-growing presence of fintech products and services, co-founder and CEO Alejandro Casas believes Simetrik’s unique offering will continue to have a strong market hold: “They have more reports and larger volumes of records, yet are still using manual processes. They need a new approach, and that is where our building blocks have a strong product market piece.”